[Asia Economy Reporter Ji Yeon-jin] There is a forecast that domestic semiconductor-related stocks could benefit from the global tax increase issue. Following the announcement by the Biden administration in the United States to raise the current corporate tax rate from 21% to 28%, the push for a global minimum corporate tax rate is gaining momentum, especially in the US and Europe. It is expected that the massive revenue collected from tax increases will be poured into the semiconductor sector, which has recently been experiencing supply shortages.

On the 10th, KB Securities predicted that the period when the introduction of digital taxes and corporate tax hikes being discussed in Europe would negatively impact the stock market will likely be after June. They emphasized that April and May should focus more on where the government will allocate the revenue secured through tax increases.

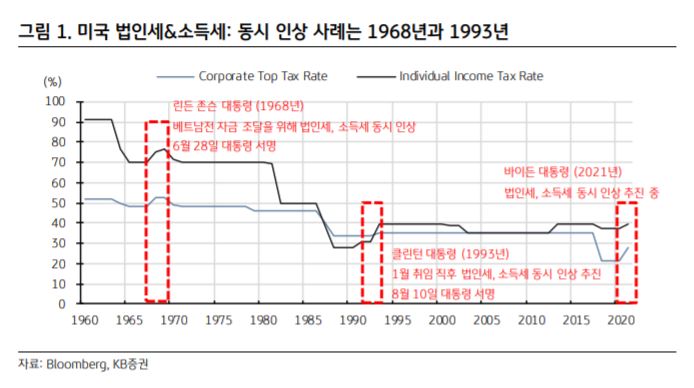

KB Securities compared 1993, when corporate taxes were raised, with this year and found that 1993 was an era of ‘small government,’ and the tax increase did not lead to government-led investment. Looking at government spending after raising corporate and income taxes, expenditures related to welfare increased.

However, this year is different. KB Securities researcher Ha In-hwan said, "Currently, we are moving toward a ‘big government’ era, so the tax increase is unlikely to be limited to welfare expansion

as it was in 1993. From this perspective, the infrastructure investment policy announced on March 31 signals that this change is beginning."

The infrastructure investment policy announced on the 31st of last month included support for semiconductors. Support for the semiconductor industry is expected to continue beyond the infrastructure investment policy. Investment is being promoted under the leadership of the US government, semiconductor supply shortages are worsening, and there is a technological hegemony conflict with China.

The US has scheduled a meeting on the semiconductor shortage on the 12th (local time), and the market widely expects that investment to expand semiconductor supply will be included. Samsung Electronics is reported to have been invited to this meeting. Researcher Heo said, "It is known that the Democratic and Republican leaders in the US Senate are preparing bipartisan legislation to resolve the semiconductor shortage, and both the US administration and legislature are joining forces to support the semiconductor industry, with Samsung Electronics at the center," adding, "this increases the possibility of benefits for domestic semiconductor equipment stocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.