[Asia Economy Reporter Minji Lee] Amid intensifying competition in the OTT (online video service) market, there is a forecast that the stock prices of domestic content companies will rise further. With expectations of benefits from the easing of the Hanhanryeong (Korean content ban) in the Chinese market, the investment appeal is also expected to increase.

According to NH Investment & Securities and related industries on the 11th, following aggressive investments by overseas OTT companies, domestic OTT companies such as TVING, Coupang Play, and Wavve are expanding their investment scale, so the benefits to domestic content companies are expected to continue. Currently, the combined market capitalization average of content producers has grown from 4.1 trillion KRW in the second half of last year to 6.2 trillion KRW recently.

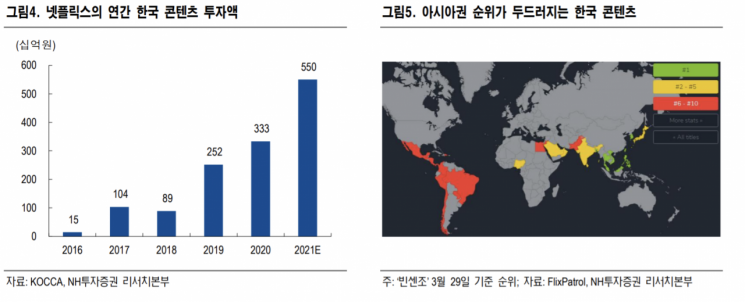

Overseas companies like Netflix, Disney+, and Apple TV view Korean content as offering maximum efficiency at a low cost. This is because the production costs are noticeably cheaper compared to similar-scale content in Western countries, providing a strong price advantage. For example, the per-episode production cost of Netflix original "Bridgerton" Season 1 is 8 billion KRW, whereas the domestic sci-fi drama "Sweet Home" costs 3 billion KRW per episode. Considering the minimum guaranteed revenue that domestic content can generate, the investment scale of overseas OTT companies is expected to increase further.

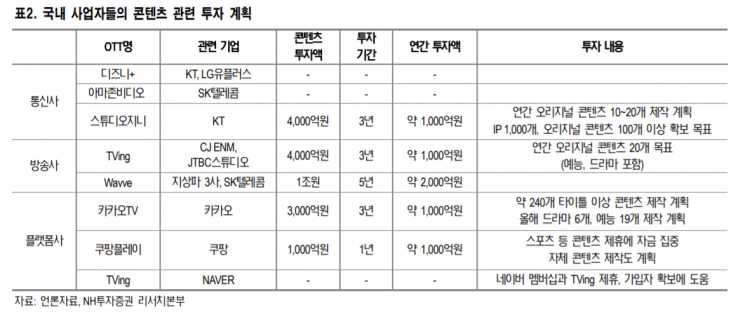

Domestic OTT companies are also joining in. TVING plans to invest around 400 billion KRW over the next three years, and Wavve plans to invest about 1 trillion KRW over the next five years. As a result, the total investment scale in Korean content this year is expected to reach 2.8 trillion KRW, with the possibility of OTT companies increasing their investment budgets.

Since the demand growth for domestic content outpaces the supply expansion speed of content producers, both sales volume and sales prices are expected to increase. Researcher Hwajung Lee of NH Investment & Securities stated, "The sales price increase of companies with rich global OTT hit references such as Studio Dragon, Ace Story, and J Contentree will be prominent," adding, "In fact, not only tentpole dramas but also general dramas are seeing a rising trend in prices."

Expectations for a positive wind from China are also rising. The Hanhanryeong, which began in early 2017, is expected to naturally lift content broadcasting as Korea-China exchanges become more active, even without an official lifting declaration. Recently, exchanges with China have increased, and in the second half of last year, Studio Dragon reported revenue recognition from sales to China. At the end of last year, Tencent made a 100 billion KRW equity investment in JTBC Studio. At the end of February, a broadcasting industry cooperation MOU was signed between China Central Television and Korea's KBS.

Considering these positive factors, the securities industry views the stock price of the top producer Studio Dragon as highly likely to rise. From the 5th to the 9th, it rose nearly 6% over a week, showing a significant upward trend. This is analyzed to have driven the media sector's rise, reflecting expectations for solid first-quarter earnings, sales of work copyrights, and supply of original content to China. The securities industry estimates Studio Dragon's first-quarter expected sales and operating profit at 126.1 billion KRW and 14.4 billion KRW, respectively, projecting growth of 5% and 24% compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.