On the 8th, when Seoul Mayor Oh Se-hoon began his term, an election banner was hung on the exterior wall of an apartment in Eunpyeong-gu, Seoul. On the same day, Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, stated, "Housing supply cannot be carried out solely by the central government, metropolitan governments, or local governments in a series of administrative procedures such as candidate site selection, district designation, and review and approval." This is interpreted as a message indicating that even if Mayor Oh Se-hoon starts his term, it is difficult to expect that campaign promises such as easing reconstruction regulations will be immediately realized.

On the 8th, when Seoul Mayor Oh Se-hoon began his term, an election banner was hung on the exterior wall of an apartment in Eunpyeong-gu, Seoul. On the same day, Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, stated, "Housing supply cannot be carried out solely by the central government, metropolitan governments, or local governments in a series of administrative procedures such as candidate site selection, district designation, and review and approval." This is interpreted as a message indicating that even if Mayor Oh Se-hoon starts his term, it is difficult to expect that campaign promises such as easing reconstruction regulations will be immediately realized. Due to the easing of reconstruction regulations, which was the first policy announced by Seoul Mayor Oh Se-hoon upon taking office, major complexes in Seoul that were pursuing remodeling are now facing dilemmas. Since reconstruction and remodeling projects are substitutes, if the conditions for reconstruction projects improve due to regulatory easing, the momentum for remodeling projects may weaken.

According to the real estate industry on the 9th, amid rapidly growing market interest in remodeling this year, aging apartment complexes and construction companies are closely monitoring the variable of reconstruction regulation easing. This is because Mayor Oh, who promised to supply 360,000 housing units over the next five years, declared that he would "ease or lift redevelopment and reconstruction-related regulations such as the 35-floor rule and floor area ratio limits, the price ceiling system for sale prices, and the reconstruction excess profit recovery system."

In the housing market, reconstruction and remodeling are substitute options. Complexes with excessively high existing floor area ratios that reduce profitability or those that do not meet aging or duration criteria choose remodeling as an alternative. Lim Byung-chul, Senior Research Fellow at Real Estate 114, explained, "There are practically only reconstruction and remodeling methods to change aging housing complexes. Remodeling has a shorter construction period and faster project speed but lower profitability, while reconstruction takes longer but tends to be more profitable."

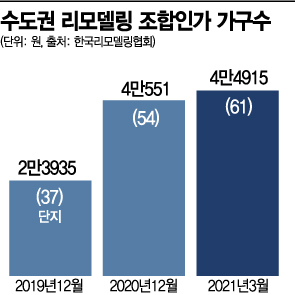

As the government strengthened reconstruction regulations, the remodeling market has recently enjoyed a relative boom. According to the Korea Remodeling Association, as of the end of March, 61 apartment complexes (44,915 households) in the metropolitan area have completed establishing associations for remodeling projects. This is a 65% increase compared to the end of 2019. The recent approval of the remodeling project for Hansol 5 Complex in Jeongja-dong, Bundang, the first in the first-generation new towns, was expected to signal the dawn of the remodeling era.

The construction industry is also anticipating a boom and actively entering the remodeling market. Construction companies with remodeling construction experience such as POSCO Engineering & Construction, Ssangyong Engineering & Construction, and Hyundai Engineering & Construction, as well as those that have not previously participated in the remodeling market, are showing interest. Daewoo Engineering & Construction established a dedicated remodeling organization for the first time in 12 years and set a goal to secure remodeling project orders worth 300 billion to 500 billion KRW annually.

Is it a remodeling association in the metropolitan area?

Is it a remodeling association in the metropolitan area?

However, the easing of reconstruction regulations has emerged as a variable. Ko Joon-seok, Adjunct Professor at Dongguk University Law School, said, "When directly comparing reconstruction and remodeling, reconstruction is advantageous in many ways from the association's perspective," adding, "Even looking at house price appreciation rates, reconstruction is better, and since regulations are being eased, there is no incentive to pursue remodeling." He also believed that Mayor Oh, who emphasizes supply expansion, is more likely to focus on reconstruction rather than remodeling. Professor Ko said, "There are clear limits to additional supply secured through remodeling," and "From the city's perspective, which needs to expand supply, reconstruction is judged to be more advantageous than remodeling."

However, the possibility that complexes pursuing remodeling will suddenly shift their project direction to reconstruction is currently considered low. Although Mayor Oh has advocated regulatory easing, its realization remains uncertain. Most key reconstruction regulations, such as safety inspections, fall under the jurisdiction of the central government, and these matters are stipulated by laws and notices, so there are no regulations that Seoul City can unilaterally ease. The reconstruction excess profit recovery system, which affects reconstruction profitability, is also beyond the city's authority.

Seo Jin-hyung, Professor at Gyeongin Women's University and President of the Korean Real Estate Society, said, "If the possibility of regulatory easing becomes prominent, complexes pursuing remodeling are likely to hope for floor area ratio relaxation while observing regulatory decisions and market trends." Senior Research Fellow Lim also predicted, "There are not many remodeling projects that have progressed deeply and concretely, and even if reconstruction regulations are eased, the remodeling market will not shrink immediately."

Meanwhile, according to the Korea Real Estate Board, in the first week of April (as of the 5th), the weekly apartment sale prices in Seoul rose by 0.05%, with Songpa-gu (0.10%), Nowon-gu (0.09%), Gangnam and Seocho-gu (0.08%), and Yangcheon-gu (0.07%) ranking among the top in price increases. All these areas have reconstruction-related positive factors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)