SBI, OK, Welcome, etc. cut interest rates by 0.1~0.7 percentage points

Deposit rates fall, 0% range savings products emerge

Industry says "If loans decrease despite sufficient deposits, negative margin occurs"

[Asia Economy Reporter Song Seung-seop] As a massive amount of funds poured into the savings bank industry due to COVID-19, they have been consecutively lowering deposit interest rates. It is analyzed that concerns arose that if loans decrease due to the authorities' tightening of lending policies, 'negative spreads' could occur.

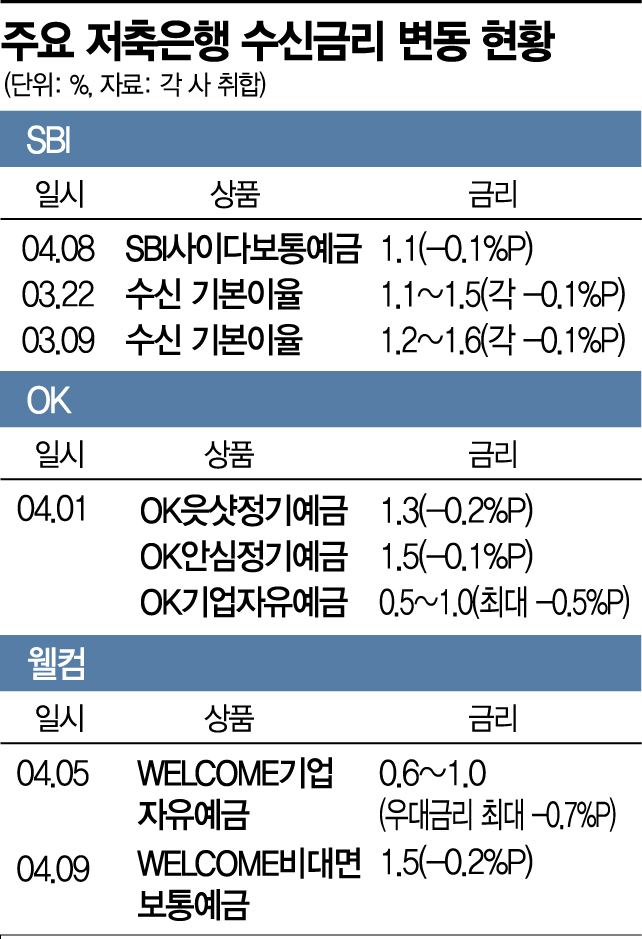

According to the industry on the 9th, Welcome Savings Bank lowered the interest rate on the 'Welcome Non-face-to-face Regular Deposit' starting today. The applied interest rate for balances of 30 million KRW or less will be reduced from 1.5% per annum to 1.3%. On the 4th, they adjusted the preferential interest rates for corporate free deposits. The preferential rates, which were previously granted at 0.6% to 1.2% depending on the balance, were drastically lowered to 0.1% to 0.5%.

SBI Savings Bank also lowered the base interest rate of the 'SBI Cider Regular Deposit' from 1.2% to 1.1% the day before. This adjustment came about 20 days after lowering the basic deposit rate on the 9th of last month. This is the fifth time this year that SBI Savings Bank has reduced deposit interest rates.

As of December 31 last year, SBI Savings Bank had announced an increase in the basic interest rate for 12 to 36-month fixed deposits from 1.9% to 2.0%. However, about ten days later, they lowered it by 0.1 percentage points, starting the downward trend. Since last month, the 1 to 12-month fixed deposit rates, which had been maintained at 1.3% to 1.5%, were also lowered, bringing the minimum interest rate down to 1.1% to 1.3%.

In the case of OK Savings Bank, they announced the reduction of deposit product interest rates through their official website on the 1st. The 6-month product 'OK Eutshot Fixed Deposit' was lowered from 1.5% to 1.3%, and the 'OK Anshim Fixed Deposit' (3 years, variable rate) was reduced from 1.6% to 1.5%. The products with the largest rate cuts were the 'OK Corporate Free Deposit' (less than 7 days) and the ISA fixed deposit (3 months), both reduced by 0.5 percentage points at once.

Loan Decline Feared... Savings Banks Also Launch Deposit Products with 0% Interest Rates

After nine rounds of deposit rate cuts, deposit products with 0% interest rates have also appeared. Currently, the 'OK Fixed Deposit' has a base interest rate of 0.8% for 1 to 3-month products, down by 0.2 percentage points.

This indicates a complete change in business methods compared to the second half of last year when savings banks attracted customers with relatively higher interest rates than commercial banks. At that time, savings banks competed in deposit interest rates to attract excess liquidity in response to surging loan demand. 'Parking accounts' that pay interest even for one day and special promotions for deposits and savings were also introduced.

Looking at the Bank of Korea's Economic Statistics System, the newly accepted deposit interest rate of savings banks, which bottomed out at 1.67% in August, rose to 2.04% in December. However, it has fallen by about 0.1 percentage points each month, dropping to 1.87% as of February.

There is an analysis that the savings bank industry is concerned about 'negative spreads' due to a future decrease in loan growth. The deposit balance of mutual savings banks, which was 65.8425 trillion KRW at the beginning of last year, surged to 80.9705 trillion KRW in one year. If the government's household debt management plan to be announced next month includes strengthened regulations on the secondary financial sector, including savings banks, the interest paid on deposits could exceed loan interest.

A savings bank official explained, "From the bank's perspective, deposits are a kind of liability," adding, "If loans decrease after securing sufficient funds, it could lead to negative spreads."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.