Coupang's listing on the New York Stock Exchange has served as a turning point for domestically listed or pre-listed companies as well. With Coupang achieving a market capitalization of 100 trillion KRW on its first day of listing, it has prompted a reevaluation of domestic companies and sparked interest in the possibility of overseas stock listings. Recently, unicorns such as Market Kurly, Ridibooks, and Dunamu, along with other general companies, have shown movements toward considering overseas listings. There have also been frequent reports of jackpot gains by venture capitalists (VCs) who invested early in these companies. Interest has grown in VCs holding stakes in companies pursuing overseas listings and the portfolios of companies these VCs have invested in. Asia Economy took a closer look at the situation and investment portfolios of VC firms 'Woori Technology Investment' and 'DSC Investment,' which hold shares in Dunamu, a company that has announced plans to list in New York.

[Asia Economy Reporter Jang Hyowon] Woori Technology Investment, a first-generation venture capital firm, has recently attracted market attention as it is known to hold shares in the cryptocurrency exchange 'Upbit.' News that Dunamu, the operator of Upbit, is preparing for a U.S. stock market listing has highlighted the value of Woori Technology Investment's stake in Dunamu.

In fact, Woori Technology Investment has realized a sixfold valuation gain from its investment in Dunamu. Additionally, in February, it sold shares in a U.S. gaming company, generating a profit of 48 billion KRW. This is why there is growing interest in the direction of companies held by Woori Technology Investment.

Rising Expectations for Upbit's U.S. Listing

Woori Technology Investment was established in 1996 as a venture capital company funded by domestic semiconductor equipment manufacturers and individuals to support the startup of small and venture businesses.

The company's operating revenue (sales) mostly comes from new technology investments. Woori Technology Investment primarily earns income through equity investments in small and medium-sized enterprises and startups, with the equity value reaching 92.9 billion KRW last year. Another business segment, credit finance, is minimal at about 750 million KRW.

Woori Technology Investment's performance increased significantly last year. Its standalone operating revenue was 43.6 billion KRW, a 107.6% growth compared to 21 billion KRW the previous year. Operating profit and net income also rose by 182.7% and 175.5%, reaching 35.9 billion KRW and 28.1 billion KRW, respectively. Return on equity (ROE) doubled from the previous year to 30.4%.

Of the total operating revenue, 91% came from financial asset valuation gains. Last year, the fair value measurement gains on financial assets recognized in profit or loss amounted to 39.7 billion KRW. This means the equity value of companies invested in by Woori Technology Investment increased by 39.7 billion KRW last year.

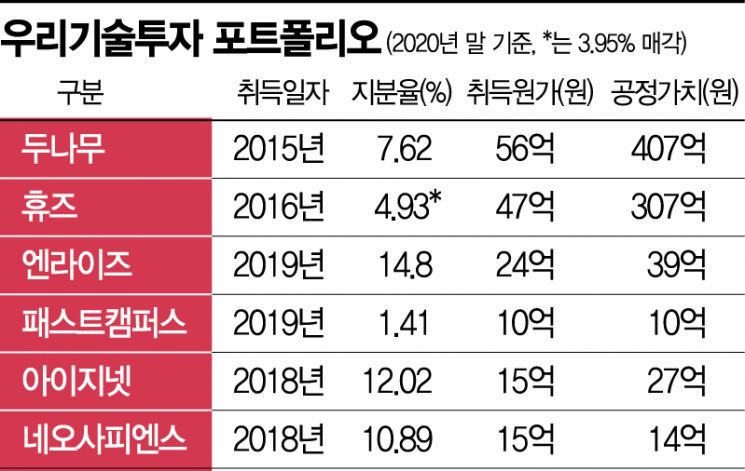

The stock with the largest increase in valuation gains was Dunamu. At the end of last year, Woori Technology Investment held 2,565,000 shares (7.62%) of Dunamu. The fair value of this stake was assessed at 40.7 billion KRW, a 115.3% increase from 18.9 billion KRW the previous year.

Woori Technology Investment acquired its stake in Dunamu starting in 2015 for about 5.6 billion KRW. By the end of last year, it had realized an approximate 526.8% valuation gain. Dunamu, as the operator of Upbit, the largest cryptocurrency exchange in Korea, has attracted market attention amid recent U.S. stock listing rumors.

If Coinbase, the No. 1 cryptocurrency exchange in the U.S., achieves a market capitalization of 100 trillion KRW after its listing on the 14th, Upbit, which surpasses Coinbase in trading volume, is expected to be valued at a minimum of 10 trillion KRW. In this case, Woori Technology Investment would realize a profit of about 760 billion KRW.

480 Billion KRW Recovered from ‘Huuuge’ Exit

Besides Dunamu, Woori Technology Investment has invested in many other companies. According to last year's business report, it invested in 18 companies with its own capital. It is also known to have invested in about 11 companies through funds such as partnerships. Companies like Fast Campus, LendingHome, and Zigbang are also part of Woori Technology Investment's portfolio.

The company with the second-highest valuation gain after Dunamu is the U.S. gaming company ‘Huuuge Inc.’ Woori Technology Investment acquired 800,000 convertible preferred shares of Huuuge in 2016, investing 4.7 billion KRW. As of the end of last year, the fair value of this stake reached 30.7 billion KRW. In February, when Huuuge was listed on the Warsaw Stock Exchange in Poland, 80% of these shares were sold as secondary shares, cashing out 48 billion KRW and recovering more than ten times the initial investment.

Among Woori Technology Investment's portfolio, the company attracting market expectations is the craft beer company ‘Jeju Beer.’ Jeju Beer passed the preliminary review for listing on the Korea Exchange in February and has begun preparations for listing on KOSDAQ. The expected public offering price per share is between 2,600 and 2,900 KRW, and if the upper limit is set as the offering price, the market capitalization is estimated to reach 160 billion KRW.

However, it is analyzed that the profit Woori Technology Investment will gain from Jeju Beer's listing will not be significant. Woori Technology Investment holds a 3.06% stake in Jeju Beer through the ‘Woori Growth New Technology Investment Partnership No.16’ it manages. As the general partner (GP) of the Woori Growth Partnership, Woori Technology Investment itself holds only 1% of the partnership's stake.

Even if the Woori Growth Partnership cashes out 4.8 billion KRW from Jeju Beer's listing, the profit distributed to Woori Technology Investment based on its stake would be about 48 million KRW. Adding management and performance fees, it is unlikely to generate substantial profits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.