Too Low Supply

Closed Exchange Only Accepting KRW

Last Investment Destination After Real Estate and Stock Market Booms

Aggressive Investment Tendency

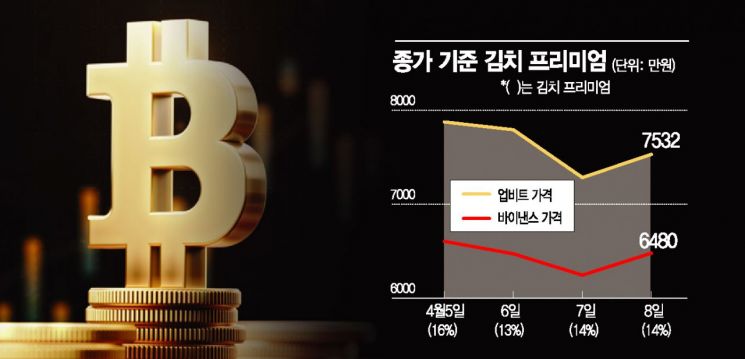

[Asia Economy Reporter Gong Byung-sun] On the morning of the 6th at 9:40 AM, Bitcoin on the domestic virtual currency (cryptocurrency) exchange Upbit traded at 79.5 million KRW, setting an all-time high. At the same time, Bitcoin was trading at 62.82 million KRW on the US virtual currency exchange Binance. The Bitcoin price on the domestic exchange was a whopping 15.98 million KRW, more than 20% higher than overseas prices, a so-called "Kimchi Premium."

As Bitcoin's upward trend continued, the Kimchi Premium also began to grow. The Kimchi Premium refers to the price difference between Bitcoin traded on domestic virtual currency exchanges and the global Bitcoin price. Although Bitcoin was created with the goal of decentralization, slight price differences can occur due to differences in the number of users, nationalities, and circumstances across exchanges. However, foreign media have shown interest in the Kimchi Premium because Bitcoin is often sold at a higher price in Korea. Why does this particularly prominent Kimchi Premium occur?

Low Supply Itself Creates a Bubble-Prone Structure

First, the supply of Bitcoin circulating domestically is low. Currently, a small number of miners hold 90% of all Bitcoins, and only a very small portion of these Bitcoins circulate in the domestic market. Lee Byung-wook, CEO of Kras Lab, said, "If the supply is large, the possibility of price fluctuations or bubbles decreases," adding, "Given the current structure of the domestic virtual currency market, even a slight surge in buying demand can easily create a bubble." In fact, as of 8:30 AM on the 9th, Upbit is the second-largest exchange in the world by trading volume, but its 24-hour Bitcoin trading value is 663.9 billion KRW, which is only about 1.1% of the total."

Closed Domestic Virtual Currency Exchanges

Additionally, domestic virtual currency exchanges have contributed to creating a closed market. Domestic investors find it difficult to invest in overseas exchanges and thus remain only on domestic exchanges. Unlike overseas exchanges, domestic exchanges block stablecoin trading linked to fiat currencies such as Tether and only allow Korean won transactions. Domestic investors, accustomed to won transactions, find it daunting to invest on overseas exchanges. Moreover, domestic virtual currency investors find it difficult to purchase large amounts of dollars or transfer funds overseas. Professor Hong Ki-hoon of Hongik University’s Business Administration Department said, "Domestic exchanges have no economic incentive to expand overseas or form partnerships, so the virtual currency market tends to be more closed."

Real Estate and Stock Market Booms... Only Virtual Currency Remains

From the demand side, this coincides with Korea's unique situation. Recently, asset prices have soared due to booms in real estate and the stock market. Currently, the high prices make it burdensome to challenge real estate, and there are concerns that stocks may be at a peak. As a result, many flock to the virtual currency market to increase asset value. According to big data analytics firm IGAWorks, as of February, 59% of the 3.12 million virtual currency app users are in their 20s and 30s, who find it difficult to hold assets.

Compatibility with Aggressive Domestic Investors

There is also analysis that the virtual currency market suits the aggressive nature of domestic investors. Investors who have shown aggressive tendencies in the stock market prefer the virtual currency market, which has no market closing times and no limits on price fluctuations. On domestic virtual currency exchanges, it is common to see investors flocking to altcoins that surge over 50%, while major coins like Bitcoin or Ethereum are pushed to the background. CEO Lee said, "Uniquely, the domestic virtual currency market is dominated not by Bitcoin but by altcoins."

Kimchi Premium as a Harbinger of a Crash... Investors Should Be Cautious

There is also advice to be cautious because the Kimchi Premium signals a potential crash. Investors perceive the Kimchi Premium as a bubble, so the higher it rises, the more unstable the market becomes and the stronger the selling pressure. In fact, during the cryptocurrency frenzy of 2017-2018, the Kimchi Premium rose to 54.48%, and shortly after, in January 2018, Bitcoin fell about 60% from its peak. Hwang Se-woon, a researcher at the Capital Market Research Institute, said, "The higher the Kimchi Premium, the greater the possibility of a correction," adding, "Since the Kimchi Premium has not yet been fully resolved, another correction may occur."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)