6 Companies' RBC Ratios Decline

Fall Further When Interest Rates Rise

[Asia Economy Reporter Oh Hyung-gil] Red flags have been raised regarding the financial soundness of non-life insurance companies. Although they enjoyed a windfall from COVID-19 last year, the increase in managed assets led to a corresponding rise in required capital. Concerns are also emerging that financial soundness will further deteriorate as market interest rates rise this year.

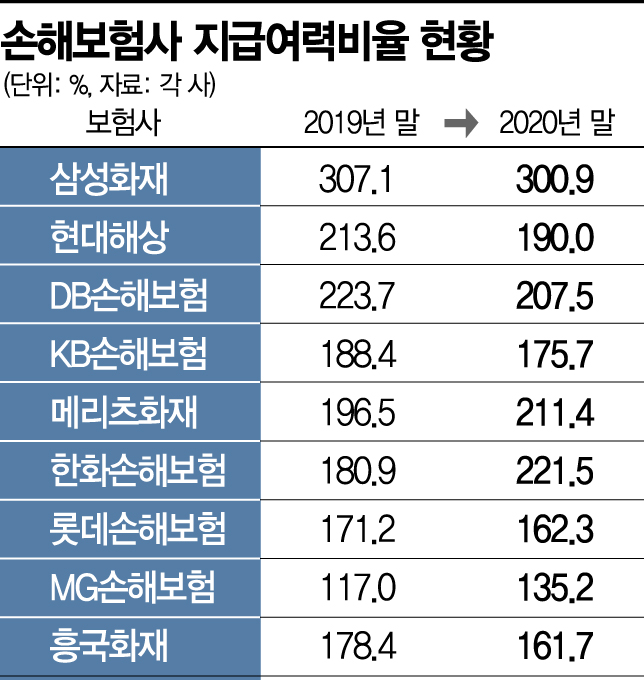

According to the insurance industry on the 9th, among the nine major non-life insurers at the end of last year, six companies saw a decline in their Risk-Based Capital (RBC) ratios.

The RBC ratio represents the amount an insurer can pay if all policyholders claim insurance benefits simultaneously, calculated by dividing available capital by required capital. The Insurance Business Act mandates maintaining this ratio above 100%, and financial authorities recommend keeping it above 150%.

Hyundai Marine & Fire Insurance's RBC ratio, which was 213.6% at the end of 2019, dropped by 23.6 percentage points to 190.0% at the end of last year. KB Insurance also decreased from 188.4% to 175.7% during the same period. DB Insurance recorded a double-digit decline from 223.7% to 207.5%.

Among non-life insurers, Samsung Fire & Marine Insurance, which has the healthiest RBC ratio, saw a decrease of 6.2 percentage points from 307.1% in 2019 to 300.9%.

For small and medium-sized companies, managing the RBC ratio is even more urgent. Lotte Insurance's RBC ratio fell to 162.3%, Heungkuk Fire & Marine Insurance to 161.7%, and MG Insurance increased to 135.2% compared to the previous year but remains at the lowest level in the non-life insurance industry.

A KB Insurance official explained, "The required capital increased by 227.9 billion KRW due to increased risk exposure and changes in retirement account-related regulations. Although available capital increased by 154.7 billion KRW compared to the previous year through net income realization, the RBC ratio decreased due to the required capital increasing more than available capital."

The problem is that with the introduction of the new International Financial Reporting Standards (IFRS 17) and the new solvency ratio (K-CIS) in 2023, the burden on reserve liabilities will increase, and risk calculation standards will be strengthened compared to the current ones, potentially causing the RBC ratio to decline further.

In recent years, non-life insurers have been selling real estate or expanding capital to reduce required capital, and this trend continues this year as well.

Meritz Fire & Marine Insurance conducted a 200 billion KRW subordinated bond subscription last week, and KB Insurance plans to issue subordinated bonds worth 800 billion KRW within the year. Lotte Insurance, which recently sold its Namchang-dong headquarters building to Capstone Asset Management for 224 billion KRW and signed a sale and leaseback contract, raised its RBC ratio by 8.6 percentage points. JC Partners, the major shareholder of MG Insurance, is also reportedly considering capital expansion.

In particular, concerns are growing that financial soundness will worsen further as market interest rates rise, leading to an even greater decline in RBC ratios. When interest rates rise, the valuation gains on bonds held by insurers decrease, reducing available capital. Hana Financial Investment forecasts that insurance companies' RBC ratios will drop by an average of 14% in the first quarter due to the impact of rising interest rates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.