Semiconductor Supply Shortage Expected to Persist Until Year-End

Accelerating Localization of Related Parts to Prepare for Additional Shutdowns

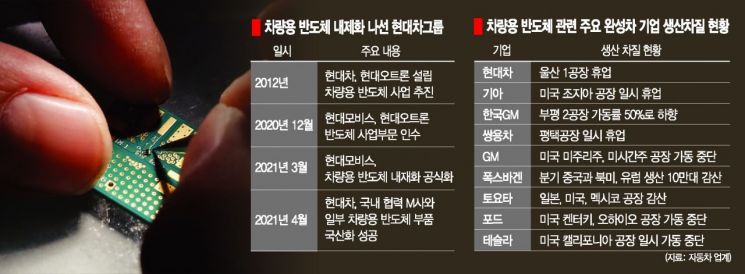

[Asia Economy reporters Changhwan Lee and Jehun Yoo] Hyundai Motor Group has directly embarked on domestic production of automotive semiconductors due to the global semiconductor shortage causing domino shutdowns (temporary halts in operation) to become a reality.

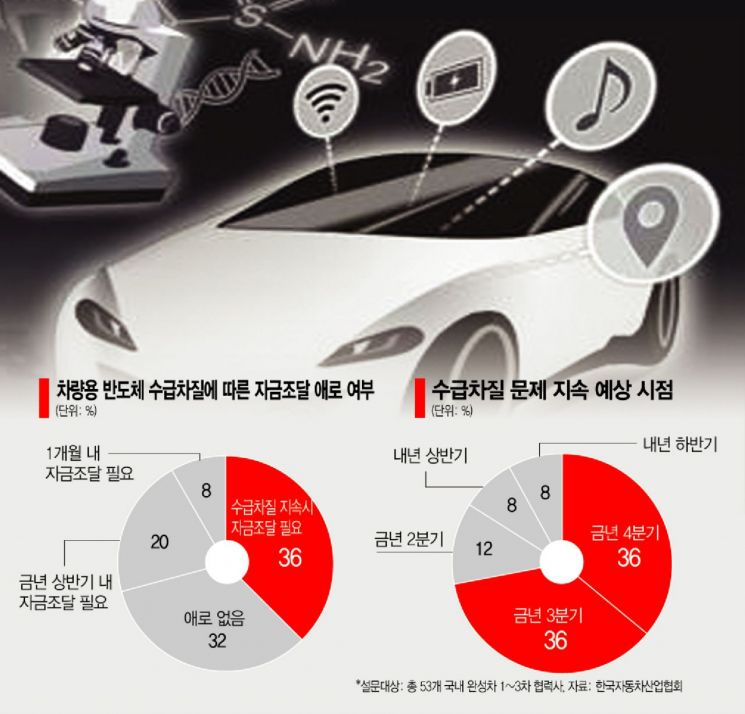

The automotive industry expects the shortage of automotive semiconductors to continue at least through the second half of this year. Hyundai Motor also anticipates increasing damage such as additional factory shutdowns and plans to accelerate parts development together with its affiliates and partners.

Semiconductor crisis spreading comprehensively... Prolonged shortage inevitable

Hyundai Motor dramatically avoided a shutdown of its 3rd plant by developing some substitute automotive semiconductors, but internally it is considered likely that such incidents could occur simultaneously in multiple places. Since hundreds of semiconductors are used in a single vehicle, ongoing shortages in automotive semiconductors could cause problems in other parts at any time.

The Asan plant, which currently produces Grandeur and Sonata models, is reportedly discussing a shutdown due to other semiconductor parts. Kia, an affiliate, is also facing a similar situation. Following the Hwaseong plant, the Gwangju plant canceled overtime work in April due to semiconductor shortages. Accordingly, Hyundai Motor is said to be continuing domestic production efforts for automotive semiconductor-related parts with various partner companies at the group level.

Partner companies are also actively pursuing domestic production of related parts. According to a survey conducted earlier this month by the Korea Automobile Industry Association (KAIA) targeting 53 first- to third-tier suppliers of domestic automakers, 72% of the surveyed parts companies stated that they would replace imported parts with domestic ones if performance standards are met. They emphasized the need to discover domestic companies and support commercialization for localization.

Jung Manki, chairman of KAIA, said, "A significant number of automotive parts companies have expressed willingness to replace imported parts with domestic ones if performance is sufficient," adding, "If this crisis is properly utilized, it could be an opportunity for our automotive semiconductor industry to leap forward."

Direct semiconductor design, aiming for internalization

Hyundai Motor Group plans to internalize automotive semiconductors in the long term, using this crisis as a turning point. A representative example is Hyundai Mobis recently announcing plans to pursue internalization of automotive semiconductors in the mid to long term. To this end, Hyundai Mobis acquired the semiconductor division from Hyundai Autron, a group affiliate, for approximately 133.2 billion KRW at the end of last year.

Hyundai Autron was established by Hyundai Motor in 2012 to achieve independence in automotive semiconductors. Although the semiconductor business had been sluggish since its establishment, it is being reorganized following the acquisition by Hyundai Mobis. Currently, labor and management have formed a New Business Stabilization Promotion Committee to discuss power semiconductor packaging business.

The company explains that this is largely due to the increasing importance of building optimized platforms that integrate software, hardware, and semiconductors amid trends toward electrification and autonomous driving, as well as responding to the global semiconductor supply shortage.

Kim Young-kwang, executive director at Hyundai Mobis, said, "Since we need to realize economies of scale with semiconductors optimized for our software, we plan to internalize (semiconductors)," adding, "The acquisition of the semiconductor division from Hyundai Autron was not to simply buy and use semiconductors externally."

Accordingly, Hyundai Mobis is expected to reduce the proportion of externally procured semiconductors in the mid to long term and reorganize its supply chain by directly designing and developing semiconductors and outsourcing manufacturing to external manufacturers.

Experts say that while the internalization strategy is essential, it requires massive investment and expansion of specialized personnel, making ‘collaboration’ with the government and semiconductor industry indispensable. For example, as of 2018, the U.S. had nearly 250,000 personnel related to future vehicles, whereas South Korea had only about 50,000.

A representative from the Korea Semiconductor Industry Association said, "Internalization is absolutely necessary to establish a stable supply chain, but there are limits to automakers directly performing this," adding, "If they collaborate with the domestic system semiconductor industry, sensitive areas like engines and brakes may take time, but general automotive semiconductors can be internalized quickly."

Research fellow Lee Hang-gu of the Korea Automotive Technology Institute also stated, "Hyundai Motor Group is expanding its business in various fields such as Urban Air Mobility (UAM) and robotics, so there are limits to investment capacity, and it is not easy to secure specialized personnel domestically," adding, "It seems necessary to cooperate more actively with the semiconductor industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.