Outstanding Balance Exceeds 10 Trillion Won for the First Time in 4 Years

Interest Rate Cut to Manage Loan-to-Deposit Ratio

[Asia Economy Reporter Kiho Sung] K-Bank has surpassed 10 trillion KRW in deposit balances, growing to a scale comparable to regional banks. This achievement comes four years after its launch in April 2017 as Korea's first internet-only bank. It is analyzed that securing competitiveness in interest rates and the partnership effect with the cryptocurrency exchange Upbit have influenced this growth.

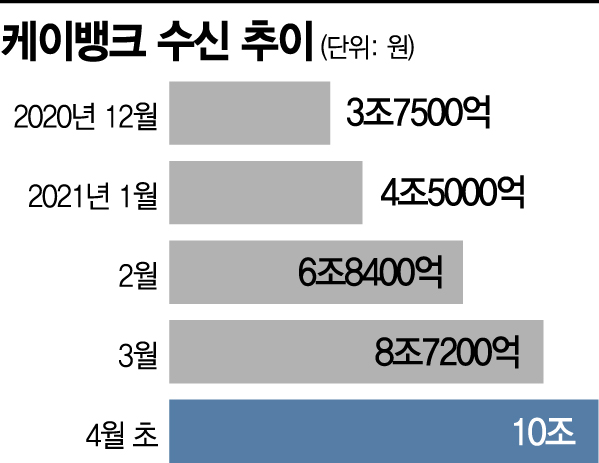

According to the financial sector on the 7th, K-Bank's deposit balance, which was 8.72 trillion KRW at the end of last month, recently exceeded 10 trillion KRW. As of the end of June last year, just before resuming operations, the deposit balance was only about 1.85 trillion KRW, but it increased more than fivefold in nine months. This is twice the total deposits of Jeju Bank (about 5.4 trillion KRW) as of the end of last year, and somewhat less than the total deposits of Jeonbuk Bank (about 15.6 trillion KRW).

The deposit growth rate is also remarkable. Looking at the deposit growth rate from the end of 2019 to the end of 2020 among 12 banks including the four major commercial banks (KB Kookmin, Shinhan, Hana, Woori), six regional banks (Gyeongnam, Gwangju, Daegu, Busan, Jeonbuk, Jeju), and two internet-only banks (Kakao Bank, K-Bank), only four banks?Shinhan Bank, Gwangju Bank, Kakao Bank, and K-Bank?recorded double-digit growth.

K-Bank's growth is even more outstanding. As of the end of last year, K-Bank recorded an annual deposit growth rate of 63.9% (total deposits of 2.2845 trillion KRW at the end of 2019, 3.7453 trillion KRW at the end of 2020). The other three banks showed growth rates in the 10% range.

This rapid deposit growth is interpreted as being greatly influenced by competitive interest rates at the level of commercial banks and the partnership effect with Upbit, a cryptocurrency exchange. Additionally, new products such as the parking account 'Plus Box,' which provides interest even for a single day deposit, and 100% non-face-to-face apartment mortgage loans are also gaining attention.

Amid the steep growth, K-Bank is taking a breather. Starting today, K-Bank has lowered interest rates by 0.1 percentage points on four deposit products: the parking account 'Plus Box,' the Dual K checking account, the Code K time deposit, and the main transaction preferential time deposit.

The interest rate on the parking account Plus Box has been lowered by 0.1 percentage points to an annual 0.5%. The Dual K checking account's preferential interest rate was reduced by 0.1 percentage points, lowering the maximum interest rate from 0.6% to 0.5%. The basic interest rate on the Code K time deposit is also reduced by 0.1 percentage points. Furthermore, starting in May, the sale of new 'main transaction preferential time deposit' products will end, and the basic interest rate on existing products will be lowered by 0.1 percentage points. The main transaction preferential time deposit offers up to a 0.4 percentage point preferential interest rate when using a K-Bank account as the main bank account.

K-Bank's decision to lower deposit product interest rates appears to be aimed at managing the loan-to-deposit ratio. Although deposits have surged recently, loan amounts have only slightly increased, worsening the profit structure and triggering alarms in soundness indicators. As of the end of last month, K-Bank's loan balance was 3.83 trillion KRW, with deposits increasing by 1.88 trillion KRW last month, but loans only increasing by 280 billion KRW. The loan-to-deposit ratio at the end of last month was only 44%, a significant decrease compared to 73% at the end of last year. In other words, the interest paid to customers has increased more than the interest income earned. In contrast, Kakao Bank, another internet-only bank, maintains a loan-to-deposit ratio in the high 80% range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.