Impact of Power Outage at US Austin Plant Slows Growth

1Q Semiconductor Operating Profit Estimated at 3.5 Trillion Won

Semiconductor Price Increase to Take Full Effect from 2Q

Recent Semiconductor Supply Shortage Remains a Variable

[Asia Economy Reporter Suyeon Woo] Samsung Electronics' first-quarter earnings this year exceeded market expectations thanks to stronger-than-expected sales of sets (finished products) such as smartphones, TVs, and home appliances. From the second quarter, the Austin plant in the U.S., which had halted operations due to a sudden cold wave, is resuming full operation, and supported by rising memory semiconductor prices, the 'traditional breadwinner' semiconductor division is expected to lead strong performance.

◆ Steady COVID-19 demand... The power of set sales= The main contributor to this 'surprise earnings' was the set division, not semiconductors. Amid steady non-face-to-face demand due to the COVID-19 special situation, the launch of new products such as the Galaxy S21 and Bespoke refrigerators acted as short-term momentum.

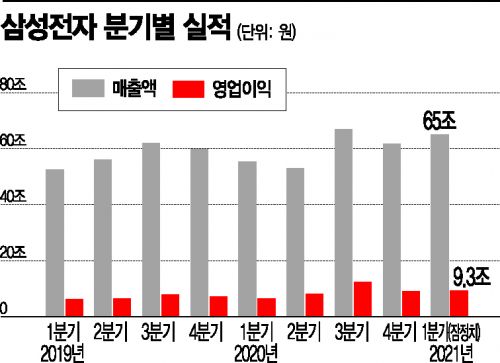

The consensus forecast by securities firms was sales of 61 trillion won and operating profit of 8.9 trillion won, but Samsung Electronics' preliminary first-quarter figures revealed sales of 65 trillion won and operating profit of 9.3 trillion won, exceeding expectations. Operating profits by division are estimated at 3.5 trillion won for semiconductors, 4.5 trillion won for IT & Mobile (IM), 1 trillion won for Consumer Electronics (CE), and 300 billion won for displays.

The IM division improved profitability as smartphone shipments in the first quarter increased significantly due to the Galaxy S21, and the average selling price (ASP) also rose. The CE division also achieved operating profits surpassing the fourth quarter of last year (800 billion won) as consumer sentiment revived mainly in advanced markets such as the U.S. and Europe, with both TVs and home appliances showing favorable performance.

This year, Samsung Electronics plans to expand the Bespoke lineup to various product categories such as air conditioners, dishwashers, and air purifiers, and lead the premium home appliance market by broadening product usage experiences linked with artificial intelligence (AI) technology.

◆ Semiconductor division, bottomed out in 1Q and leading 2Q performance= The semiconductor division is estimated to have recorded operating profit of about 3.5 trillion won, slightly down from 3.8 trillion won in the fourth quarter of last year, partly reflecting losses from the power outage at the Austin plant in the U.S. From the second quarter, it is expected to gradually recover losses and enter the full-fledged 'supercycle' phase, supported by rising memory semiconductor prices. Recently, DRAM prices have sharply increased starting from the spot market, and NAND flash price outlook is also positive.

Since the beginning of this year, the spot market price for PC DRAM (DDR4 8Gb) was around $3.46 in early January but rose sharply by about 30% to $4.5 by mid-March in just over two months. The industry expects overall DRAM prices to rise by mid-teens percentage compared to the previous quarter from the second quarter, driven by a surge in server DRAM demand. NAND flash prices are also expected to rebound by more than 5% thanks to strong SSD and NAND wafer demand.

Dongwon Kim, a researcher at KB Securities, said, "Due to increased demand for servers, PCs, and communication equipment, fixed semiconductor prices will start rising from April and increase significantly in the second quarter," adding, "Samsung Electronics' semiconductor division operating profit is expected to confirm the bottom in the first quarter and reach the 5 trillion won level in the second quarter."

However, concerns remain that the recent global semiconductor supply shortage could lead to production disruptions in sets, posing a variable for future overall performance forecasts. The industry believes that Samsung Electronics, which directly produces semiconductors and uses them in its products, will have limited impact from supply shortages.

Yangjae Kim, a researcher at KTB Investment & Securities, analyzed, "Samsung Electronics has a high component internalization rate and diverse suppliers," adding, "Compared to competitors, the impact of production disruptions is limited, and there is even a possibility of expanding market share."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.