[Asia Economy Reporter Minji Lee] SJ Group is expected to record its highest quarterly performance due to normalization of consumption. On the 4th, Daishin Securities issued a buy rating and a target price of 28,000 KRW for SJ Group.

Daishin Securities forecasted that SJ Group will record sales of 32.2 billion KRW and operating profit of 5.9 billion KRW in the first quarter, representing increases of 29% and 72% respectively compared to the same period last year. Looking at sales by brand, Kangol is estimated to increase by 13% to 21.5 billion KRW, and Kangol Kids is expected to grow by 134% to 7.9 billion KRW. Helen Kaminski is projected to rise by 7% to 2.6 billion KRW.

Researcher Han Kyung-rae of Daishin Securities said, “From February, with the normalization of offline stores, the Kangol brand is expected to see a sharp increase in sales compared to last year and last month,” adding, “Strong sales of new semester backpack sets have driven performance, and after preparing 20,000 sets in the first quarter, inventory is rapidly being depleted.” The growth rate of Helen Kaminski’s existing offline stores increased by 20% compared to last year, and with five new stores opening, it is estimated to be showing solid growth.

The operating profit margin for the first quarter is expected to rise by 5 percentage points from the same period last year to 17.5%. If Kangol Kids exceeds monthly sales of 2 billion KRW at a fixed cost level, the operating profit margin is expected to be above 15%. The proportion of online sales is also continuously expanding, with 21% in 2019 and the high 30% range in the first quarter of this year, indicating efficiency improvements in sales commission rates, which is also positive.

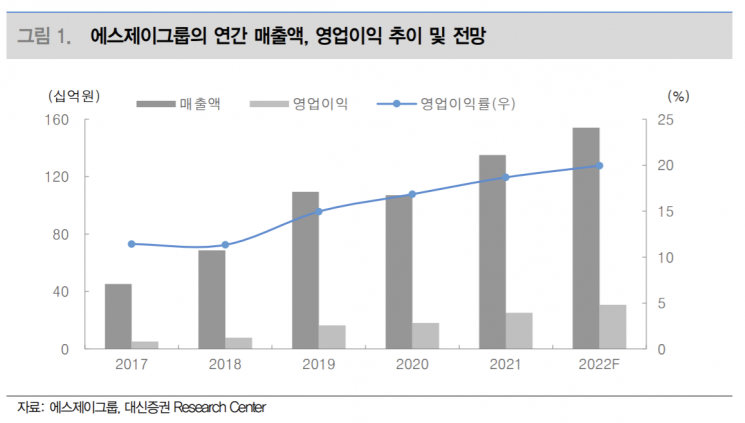

This year, sales are expected to increase by 26% to 135 billion KRW compared to last year. Operating profit is predicted to grow by 39% to 25.2 billion KRW. The researcher said, “First quarter results are expected to far exceed expectations,” adding, “The peak season for Helen Kaminski in the second quarter and the visible results of expansion into China in the second half of the year will expand.”

He continued, “Even just reflecting the normalization of domestic demand this year, the current valuation is undervalued, and additional upward revisions are possible when reflecting results from China,” explaining, “Since exports outside China are also expanding, maximum quarterly performance will be renewed every quarter.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.