118 out of 135 Companies Announced Earnings... 17 Companies Excluded Due to Adverse Audit Opinions and Other Reasons

Manufacturing Sector Advances... Operating Profit Increased by 207.4% Year-on-Year Last Year

[Asia Economy Reporter Gong Byung-sun] Thanks to the advancement of the manufacturing industry, the performance of the KONEX market improved last year. The overall operating profit, which was in deficit in 2019, turned to a surplus last year.

On the 4th, the Korea Exchange announced the 2020 fiscal year KONEX market settlement results. The target was 118 companies out of 135 companies with December fiscal year-end, for which comparison with the previous year was possible.

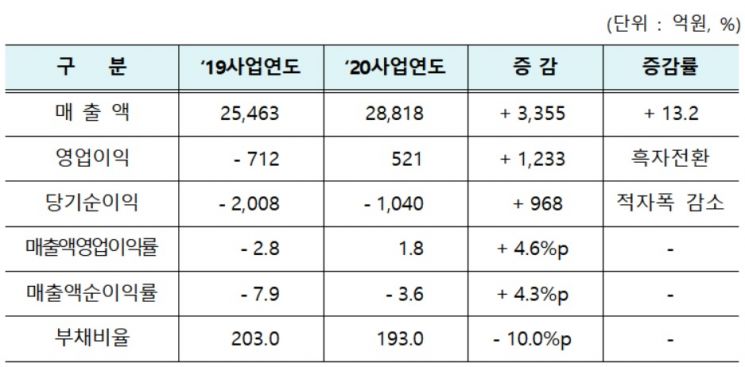

Last year, the overall performance of the KONEX market improved compared to 2019. Sales increased by 13.2% year-on-year to 2.8818 trillion KRW. The operating loss of 71.2 billion KRW in 2019 turned into an operating profit of 52.1 billion KRW. Net loss also significantly decreased from 200.8 billion KRW to 104 billion KRW. The debt ratio decreased by 10 percentage points from the previous year to 193%. Profitability indicators, such as operating profit margin and net profit margin based on sales, both rose compared to the previous year. The operating profit margin recorded 1.8%, up 4.6 percentage points year-on-year. The net profit margin increased by 4.3% compared to the previous year, showing -3.6%.

Among 34 companies with comparable data from the previous year, the consolidated performance of 31 companies also improved. Sales of these 31 companies increased by 14.8% compared to 2019, and the debt ratio decreased by 43.7 percentage points. Operating profit increased by 66.9 billion KRW, successfully turning to a surplus. Net loss also decreased from 57.1 billion KRW in 2019 to 2.7 billion KRW.

In the KONEX market, the improvement of the manufacturing industry, which accounts for the largest share at 32.2% of all companies, was notable. Last year, sales of 38 manufacturing companies rose by 26.4% year-on-year to 1.2728 trillion KRW. In particular, operating profit increased by 207.4% compared to the previous year to 113.5 billion KRW, and net profit also turned to a surplus. Last year, the manufacturing industry's net profit was 27.5 billion KRW. However, the debt ratio rose by 7 percentage points from the previous year to 209.2%.

Unlike manufacturing, the bio and IT-related sectors were sluggish. Although sales increased in both bio and IT-related sectors, operating losses and net losses both increased significantly. The bio sector recorded an operating loss of 77.5 billion KRW, continuing the deficit from 2019. Net loss also reached 101.6 billion KRW, nearly tripling compared to 2019. The IT-related sector recorded an operating loss of 9.5 billion KRW, continuing the deficit last year as well. Net loss was 46.4 billion KRW, marking a deficit for two consecutive years. However, the debt ratios of both bio and IT-related sectors decreased by 19.0 percentage points and 7.3 percentage points, respectively.

Regarding accounting standards, companies adopting Korean International Financial Reporting Standards (K-IFRS) showed better performance than those adopting Korean Generally Accepted Accounting Principles (K-GAAP). Among 69 companies adopting K-IFRS, sales were 1.9565 trillion KRW, operating profit was 68.8 billion KRW, and net loss was 39.8 billion KRW. Meanwhile, 49 companies adopting K-GAAP recorded sales of 925.2 billion KRW, operating loss of 16.7 billion KRW, and net loss of 64.2 billion KRW.

Seventeen companies were excluded from the settlement performance analysis due to reasons such as adverse audit opinions. Eleven companies, including Goose & Home, NaraSoft, and Miaebu, received adverse audit opinions such as disclaimers. Five companies, including Myeongjin Holdings, Huvecell, and Sunbio, did not submit audit reports. A-One R-Form was subject to delisting substantive review.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)