Focus on Growth Stocks with Improved Performance Without Base Effects and Stocks Expected to Continue Surprises

Also Check the Sales of Growth Stocks

[Asia Economy Reporter Song Hwajeong] As the first quarter earnings season approaches, interest in corporate performance is growing. Especially in the first quarter of this year, most companies are expected to show significant earnings improvements due to the base effect caused by the impact of COVID-19, making stock selection important.

KB Securities identified growth stocks with earnings improvements even without the base effect and stocks expected to continue delivering earnings surprises as short-term preferred stocks for the first quarter earnings season. They also emphasized the need to check the sales of growth stocks from a mid-to-late year perspective.

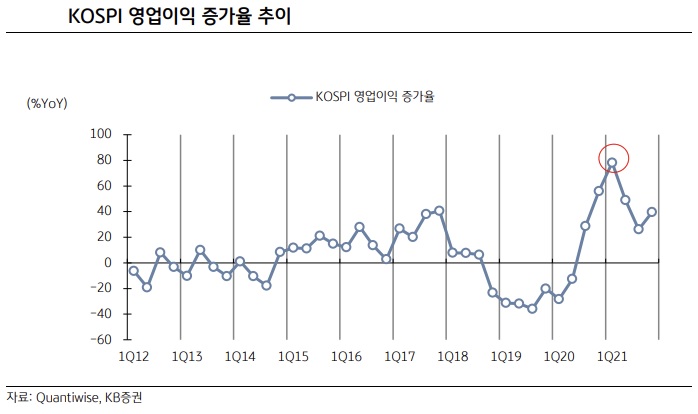

Kim Mingyu, a researcher at KB Securities, said, "The first quarter earnings season is the 'mid-recovery' phase where the base effect peaks," adding, "The recent experience of the financial crisis supports a rotation into sectors with less base effect." The operating profit of the KOSPI in the first quarter is expected to increase by 78% year-on-year, heading toward the peak of recovery. Excluding sectors that posted operating losses in the first quarter last year, an increase of 47% is anticipated.

Looking back at the recent economic downturn experience of the financial crisis, a similar period to now was the first quarter earnings season of 2010. At that time, earnings declines continued until the second quarter of 2009, then recovery began from the third quarter of 2009. After the first quarter of 2010, the base effect gradually faded during the mid-recovery phase, and after the third quarter of 2010, the base effect disappeared during the late recovery phase. Researcher Kim analyzed, "The short-term changes that occurred in the second quarter of 2010 were industries with earnings growth without the base effect ranking high in returns," and explained, "As the recovery from the recession reached the mid-phase, earnings improvements were confirmed in most sectors. In a situation where everyone’s earnings improved, sectors that had consistently performed well were more attractive than those that just improved."

KB Securities pointed out eco-friendly stocks such as Hanwha Solutions and CS Wind, healthcare companies like Samsung Biologics, and semiconductor materials and equipment companies such as Wonik IPS, TES, and Hansol Chemical as stocks with earnings improvements without the base effect.

Next, attention should be paid to sectors where surprises are expected to continue. Although the first quarter earnings surprises may not be as large as those in the second or third quarters of last year, the surprises themselves are expected to persist. Researcher Kim said, "In the second and third quarters of last year, when the consensus forecast turned from downward to upward, the speed at which the consensus was reflected was slower, resulting in larger surprise margins," adding, "Since first quarter earnings estimates are also being revised upward, the possibility of surprises is high, but because the upward revision period has been long, the surprise margin is likely to be smaller than in the second or third quarters of last year." KB Securities suggested chemical companies like Kumho Petrochemical and Hyosung TNC, machinery companies such as Doosan Bobcat, transportation companies like HMM, as well as SK Hynix, LG Electronics, and Meritz Fire & Marine Insurance as stocks expected to deliver surprises. Kim explained, "These are companies whose fourth quarter 2020 earnings at least met expectations and whose first quarter 2021 earnings forecasts are being revised upward."

There is also an opinion that the sales of stocks to hold for a long time should be checked and then moved on. Researcher Kim said, "Companies with sales growth in the first quarter are highly likely to continue sales growth in the second to fourth quarters," adding, "To identify future growth stocks, it means starting with companies that currently have strong sales." Most stocks with both first quarter and annual sales growth are growth stocks, but given the concerns about U.S. monetary tightening that emerged early this year and the fact that interest rate hikes have not completely ended, it is unlikely that rebounding growth stocks will maintain dominance throughout the first half of the year. Kim said, "From a fundamental perspective, growth stocks still have many opportunities to win, so these risks can be buying opportunities from a long-term investment viewpoint," emphasizing, "Therefore, the first quarter earnings season is a time to respond short-term by looking at the two factors mentioned earlier while confirming the sales of growth stocks to hold long-term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.