Household Loan Growth Maintains 3 to 4 Trillion Won Range for 4 Consecutive Months

Demand Deposits of Investment-Ready Funds Increase by 47 Trillion Won in February-March

[Asia Economy Reporters Sunmi Park, Kiho Sung] Credit loans, which surged last year, are showing signs of stabilization as financial authorities strengthen household loan management and market interest rates rise. Additionally, as the stock market, which had been active last year, takes a breather after the KOSPI settled around 3000, liquidity without investment destinations is accumulating in bank accounts, clearly indicating changes in the flow of market funds.

According to the financial sector on the 2nd, the total household loan balance of the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?stood at 681.6357 trillion KRW as of the end of March, an increase of 3.4652 trillion KRW from 678.1705 trillion KRW in the previous month. The increase, which was in the 7 trillion KRW range in October and 9 trillion KRW in November last year, has maintained a range of 3 to 4 trillion KRW for four consecutive months from December last year to March this year.

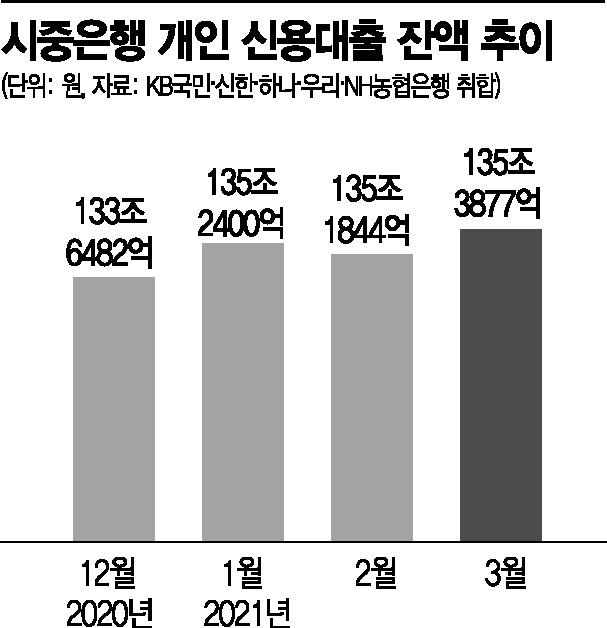

In particular, credit loans increased by only 203.3 billion KRW to 135.3877 trillion KRW as of the end of March compared to the previous month. The credit loan balance showed signs of stabilization after increasing by 4.8495 trillion KRW in November last year compared to the previous month, with changes of -43.3 billion KRW in December, 1.5918 trillion KRW in January, and -55.6 billion KRW in February.

However, housing-related loans are on the rise. The balance of mortgage loans (including jeonse deposit loans) was 483.1682 trillion KRW as of the end of March, an increase of 3.0424 trillion KRW from the previous month. This marks more than 3 trillion KRW increase for two consecutive months following February’s 3.7579 trillion KRW rise.

An official from a bank explained, "With the atmosphere of strengthened household loan management, loan interest rates have risen and loan limits have been reduced, clearly putting the brakes on the increase in credit loans." They analyzed, "The increase in mortgage loans is due to the recent rise in jeonse prices and the coincidence with the moving season in March." In fact, looking only at jeonse deposit loans, the balance was 110.8381 trillion KRW as of the end of March, showing an increase of 2.0714 trillion KRW from 108.7667 trillion KRW at the end of February, marking a two-month consecutive increase in the 2 trillion KRW range.

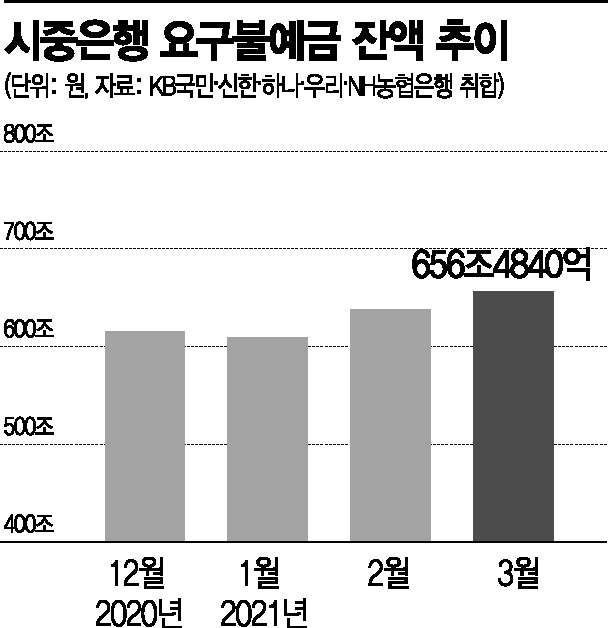

Demand Deposits Increase by 18 Trillion KRW in March... 47 Trillion KRW Rise Over February and March

On the other hand, 18 trillion KRW of "money with nowhere to go" flowed into bank demand deposits last month. Parking accounts, which rarely earn interest due to their on-demand withdrawal nature, are swelling again as they fail to find suitable investment destinations.

The balance of demand deposits at the five major banks reached 656.484 trillion KRW in March, up 2.9% from 638.2397 trillion KRW in February. Following an increase of 28.9529 trillion KRW in February, demand deposits rose by 18.2443 trillion KRW last month, accumulating about 47 trillion KRW over two months.

This is interpreted as liquidity without investment destinations piling up in investment-ready accounts within banks, due to the fourth round of disaster relief funds?the Small Business Support Fund Plus?being distributed and the stock market’s upward momentum slowing down. The influx of subscription funds for SK Bioscience’s IPO also had an impact.

Last year, the KOSPI’s rise rate was 30.8%, topping the US (16.3%) and Japan (16%), and even surpassed the 3200 mark during the early year trading session, but it has since failed to break the previous high for over two months, hovering between 3000 and 3100.

According to the Korea Exchange, the average daily trading value of the domestic stock market (KOSPI + KOSDAQ) was 26.2202 trillion KRW in March. This is 37.7% lower than January’s 42.0965 trillion KRW and 19% lower than February’s 32.3692 trillion KRW. Compared to December (52.4865 trillion KRW) and November (42.5828 trillion KRW) last year, it decreased by 50% and 38.4%, respectively. On the 15th of last month, the KOSPI’s daily trading value was 12.5809 trillion KRW, the lowest so far this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)