Market Size Expected to Reach 2 Trillion Won This Year

Expansion of Consumption Among General Consumers

Popularity Growing with the Rise of Ready-to-Eat Meals

[Asia Economy Reporter Lim Hye-seon] Riding the wave of home-cooked meal trends, sauces from around the world are infiltrating the sauce market, which has been centered on ketchup and mayonnaise. Due to the impact of COVID-19, more people are enjoying cooking at home and are seeking a variety of sauces to accompany their dishes.

2 Trillion Won Scale Sauce Market

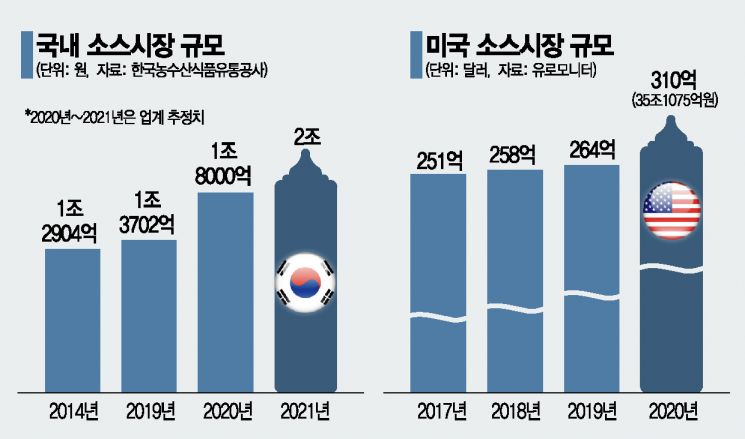

According to the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 30th, the sauce market size last year was about 1.8 trillion won, a 40% increase compared to six years ago (2014). As the ‘home meal’ culture has settled, both B2B (business-to-business) and B2C (business-to-consumer) markets are growing. This year, the market size is expected to exceed 2 trillion won.

An interesting point is that the sauce market targeting general consumers is rapidly growing. According to market trend data from the Korea Agro-Fisheries & Food Trade Corporation, until 2018, about 80% of sauces were sold in the B2B sector. Last year, with the increase in B2C, the ratio shifted to 70 to 30 between B2B and B2C. The sauce market is gaining popularity with the growth of the home meal replacement (HMR) market, where dishes can be completed by just adding sauce. Versatile sauces mixing various ingredients have been released, moving beyond the traditional one-dimensional sauces like soy sauce, gochujang, and general seasonings. Interest in Chinese and Southeast Asian sauces such as Sriracha, La Jiaojiang, and Mala is also on the rise.

Leading Pasta Sauce

Companies actively entering the sauce market include Daesang, Dongwon Home Food, Ottogi, CJ CheilJedang, and SPC Samlip. Daesang’s sales of sauces and dressings last year increased by 31% compared to the previous year. Pasta sauce grew by about 50%. Sales of ‘single pouch pasta sauce’ surged by approximately 150%, taking the lead. Cream spaghetti sauce also recorded a growth rate of about 100%. Daesang’s Cheongjeongwon holds about 40% market share in the pasta sauce market by preserving authentic recipes and ingredients from various regions of Italy, ranking first. Oyster sauce, used in various home-cooked dishes such as stir-fries and fried rice, saw sales grow by 39% compared to the previous year.

With overseas travel restricted, products that offer exotic flavors have also gained popularity. Sales of peanut Vietnamese spring roll sauce and traditional Vietnamese spring roll sauce increased by 36% and 33% respectively compared to the previous year, and steak sauce sales rose by 47%. Sales of retort curry and jjajang (black bean sauce) also increased significantly last year, showing growth rates of about 43% and 26%. Powdered versions of jjamppong (spicy seafood noodle soup) and jjajang, the original delivery foods, also received positive responses with growth rates of 41% and 24% respectively.

Dongwon Home Food expects the sauce market to grow as the HMR market expands and has increased production capacity. The company plans to expand sauce sales from 190 billion won in 2019 to 300 billion won by 2023. Ottogi is strengthening existing products while launching various sauce products to target the market.

Gochujang and Ssamjang Popular in the U.S.

According to Euromonitor, the sauce market size in the U.S., a representative food market, grew from $25.8 billion in 2018 to $31 billion last year. Among domestic sauce products, gochujang and ssamjang have recently attracted the most attention. The chili sauce market in the U.S., including gochujang, recorded $769.3 million in 2018 and $973.3 million last year.

The U.S. burger brand Shake Shack introduced new menu items this year featuring gochujang sauce: a chicken breast burger with gochujang sauce, gochujang chicken nuggets, and French fries. The gochujang chicken breast burger is served with ‘kimchi slaw,’ and the nuggets and fries come with gochujang mayonnaise sauce.

CJ CheilJedang and Daesang, which produce and sell gochujang, are actively targeting the U.S. market this year, considering sauces as one of their new growth engines. CJ CheilJedang has toned down the spiciness of gochujang and ssamjang sauces to suit local tastes, while Daesang has adjusted the texture of gochujang to be more like a table sauce that can be poured. According to market research firm IHS Markit’s U.S. sauce import trends, the import value of Korean sauces grew from $26.98 million in 2018 to $35.93 million last year. KOTRA explained, “As consumers increasingly want to enjoy popular Korean dishes such as bibimbap, Korean-style fried seasoned chicken, and bulgogi at home, sales of ssamjang, gochujang, soy sauce, and bulgogi sauce have increased.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)