Statistics Korea's StatPlus Publishes 'Changes in Housing Policy and Housing Prices Seen Through Actual Transaction Prices'

Need to Change the State Where Asking Prices Compete with Actual Transaction Prices... Accurate Data and Statistics Required

[Sejong=Asia Economy Reporter Kim Hyunjung] It has been analyzed that changes in housing prices are more significantly influenced by macroeconomic indicators than by government housing policies, and that the supply effects of redevelopment and reconstruction?often mentioned as part of countermeasures?are not substantial. Furthermore, it was explained that analysis, investigation, and research based on actual transaction prices should be strengthened and linked with other administrative data to enhance their utilization.

According to "Housing Policy and Housing Price Changes Seen Through Actual Transaction Prices," published on the 30th in Statistics Korea's 'KOSTAT Statistics Plus (Spring Issue)' by Choi Eunyoung, Director of the Korea Urban Research Institute, and Professor Gu Hyungmo of the University of Seoul, domestic housing sale prices are more affected by macroeconomic indicators such as the base interest rate and the composite stock price index than by government real estate policies.

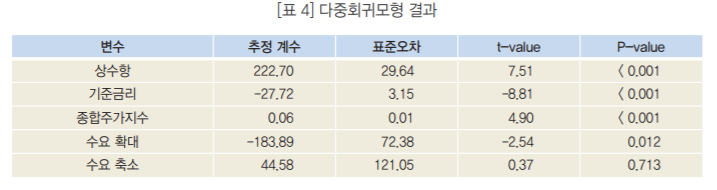

Director Choi Eunyoung and Professor Gu Hyungmo applied a multiple linear regression model to examine the relationship between various variables and housing sale prices. They selected the monthly average housing sale price as the dependent variable and the base interest rate and composite stock price index as macroeconomic indicators. Housing policies were utilized as dummy variables for 'demand expansion' and 'demand reduction' policies. Regarding the analysis results, they explained, "The estimation results show that sale prices have statistically significant relationships with both economic indicators?interest rates and stock prices?while both demand expansion and demand reduction policies showed statistically insignificant correlations at a 99% confidence level." They further stated, "When the base interest rate falls by 1%, the average housing sale price per unit area increases by approximately 277,000 KRW, and when the composite stock price index rises by 100 points, the average housing sale price per unit area increases by 60,000 KRW."

They also examined the historical governments’ view of redevelopment and reconstruction regulations as part of overall housing supply control and diagnosed that the supply effects of such maintenance projects are practically minimal. They evaluated, "During the Lee Myung-bak and Park Geun-hye administrations, deregulation was implemented through reducing the supply ratio of public rental housing, deferring burden charges via excess profit recovery from reconstruction, and allowing resale of pre-sale rights, whereas the Roh Moo-hyun and Moon Jae-in administrations strengthened regulations." They added, "The net housing supply in Seoul from 2016 to 2019 through redevelopment and reconstruction was only 13,902 units (8.6%), supporting the existing claim (Chae Sangwook, 2020) that revitalizing redevelopment and reconstruction is a demand stimulation policy rather than a supply responsibility." They explained, "In particular, redevelopment resulted in a small difference between existing and supplied housing units, providing only 473 units over four years." Regarding reconstruction, they emphasized, "Net housing supply through reconstruction increased recently with 4,713 units in 2018 and 5,457 units in 2019. Although higher than redevelopment, the four-year net supply (13,429 units) accounts for only 8.4% of the total net housing supply."

Regarding the previous analysis, Director Choi Eunyoung stated, "Government policies do not change the trend of housing price changes driven by macroeconomic indicators, but they do have some influence on housing prices." She argued, "Redevelopment and reconstruction not only have limited housing supply effects but also their impact on surrounding market prices varies over time, confirming that they are not effective policy tools for stabilizing housing prices."

She also emphasized the importance of developing statistics based on actual transaction prices. Director Choi said, "For productive discussions based on social consensus to solve problems, it is essential first to change the current state where the 'asking price' competes with actual transaction prices." She added, "The importance of facts created through accurate data, statistics, analysis, research, and discussion is greater than ever."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.