[Asia Economy Reporter Jeong Hyunjin] As major countries around the world, including the United States, China, and Europe, are expanding support to grow the semiconductor industry, a warning has been issued that Korea must cooperate between the public and private sectors to make efforts for a leap forward amid a sense of crisis. There is a view that while preserving the strength in memory semiconductor technology, Korea must foster system semiconductors and enhance foundry competitiveness.

The Federation of Korean Industries (FKI) held a seminar titled "The Semiconductor Industry is Shaking: Semiconductor Industry Paradigm and Future" at the FKI Conference Center at 2 p.m. on the 30th. The FKI explained that this seminar was urgently held to review response strategies as the global semiconductor market landscape is rapidly changing, with the semiconductor supply situation worsening mainly in the automotive industry and Intel declaring its re-entry into the foundry (semiconductor contract manufacturing) business.

Kwon Tae-shin, Vice Chairman of the FKI, said in his opening remarks, "This year, the global semiconductor market is expected to be about 530 trillion won, comparable to Korea's national budget of 558 trillion won. This will clearly be an opportunity for our companies." He added, "However, as the competition to foster the semiconductor industry among global powers such as the United States and China intensifies, we must not be complacent with past successes," and "The semiconductor industry’s success or failure will depend on large-scale investment, timing, and talent."

Jin Dae-je, CEO of Skylake Investment and former President of Samsung Electronics and Minister of Information and Communication, emphasized in his keynote speech, "A policy environment that fosters semiconductor technology talent and motivates leading companies is necessary to dominate semiconductor hegemony," and "Although China declared its semiconductor rise in 2015 and is investing hundreds of trillions of won to catch up with Korean semiconductors, due to strong U.S. sanctions and the limitations of low technological self-sufficiency, it will take time, so we must not miss the opportunity."

At the seminar, Roh Geun-chang, Head of the Research Center at Hyundai Motor Securities, who gave a presentation titled "Semiconductor Industry Trends and Development Directions," said, "Recently, new risks have emerged due to intensified competition and disasters in the foundry sector, where Korean semiconductor companies are concentrating their investment resources," and "We must pay attention to the moves by major governments to foster their domestic semiconductor industries."

The United States is expected to reorganize its semiconductor industry structure, which has been concentrated on fabless (semiconductor design), in the mid-to-long term, induce investment in domestic production facilities, and strengthen manufacturing competitiveness. To foster its domestic semiconductor industry, it plans to provide a tax credit of about 40% of investment costs by 2024 and support semiconductor infrastructure and research and development (R&D) with $22.8 billion (about 25.8 trillion won). Despite U.S. sanctions, China is attempting large-scale mergers and acquisitions (M&A) and expanding semiconductor localization. China announced "Made in China 2025" in 2015 and set a goal to achieve a 70% semiconductor self-sufficiency rate by 2025, continuing its investments.

European countries have also agreed to invest up to 50 billion euros (about 66.6 trillion won) to reduce dependence on Asian foundry companies, with Germany, France, Italy, and the Netherlands joining forces. It is known that 20-40% of the investment amount for semiconductor companies will be provided as subsidies.

Roh predicted that the automotive semiconductor supply shortage will ease after around July this year as Taiwanese foundry companies such as TSMC increase automotive semiconductor production lines in response to requests from various governments.

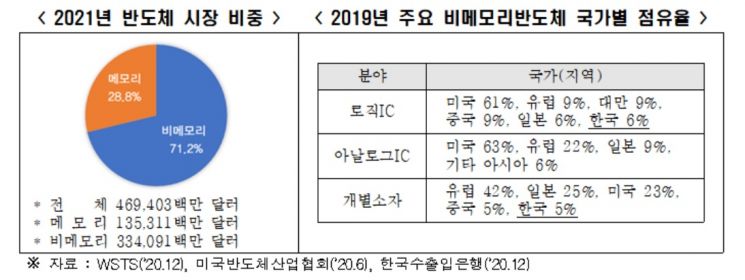

In the comprehensive discussion chaired by Kang Sung-chul, Senior Research Fellow at the Korea Semiconductor Display Technology Society, discussions continued on "Response Measures for the Future of Korea's Semiconductor Industry." Semiconductor experts agreed that although Korea possesses the world's best memory semiconductor technology, its competitiveness in the non-memory sector is weak, and it must overcome complacency stemming from the success of memory semiconductors.

Ahn Ki-hyun, Executive Director of the Korea Semiconductor Industry Association, said, "Due to the recent semiconductor shortage, major countries are establishing various incentive programs to attract semiconductor manufacturing facilities," and "The United States, Europe, and Japan are promoting supply chain stabilization by expanding domestic manufacturing facilities, China is aiming for semiconductor rise through large-scale investments, and Taiwan is enhancing its international status through the world's best system semiconductor manufacturing technology." He added, "If Korea also quickly and well establishes semiconductor manufacturing facilities and the public and private sectors cooperate to expand the role of system semiconductors in the electronics industry supply chain, good results will follow."

Hong Dae-soon, Director of the Global Strategy Policy Institute, said, "The United States launched the semiconductor manufacturing technology research consortium 'Sematech' in 1987, and thanks to investments by the government and large companies like Intel, Qualcomm was born today. Taiwan also grew global companies such as TSMC and UMC through support from the Industrial Technology Research Institute (ITRI) established in 1973," and emphasized, "Since the semiconductor industry faces competition not only among companies but also among countries, governments and companies must stake their lives on it."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.