[Asia Economy Reporter Suyeon Woo] Recently, as the price gap between LCD (Liquid Crystal Display) and OLED (Organic Light Emitting Diode) in the display market has narrowed, global TV brands are expected to accelerate their transition to OLED business. Over the past year, large LCD panel prices have risen by more than 70%, losing their price competitiveness, which strengthens the prediction that the popularization of next-generation displays, OLED, will speed up.

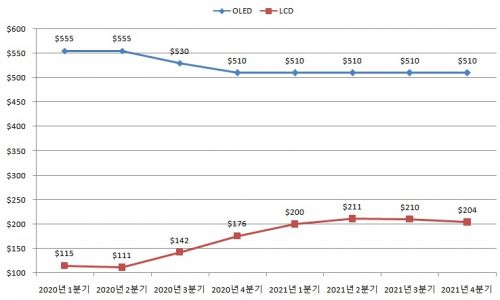

According to market research firm Omdia on the 27th, the price of a 55-inch 4K LCD panel in the first quarter of this year was $200, up about 74% from $115 in the same period last year. Meanwhile, the price of an equivalent OLED panel during the same period was $510, down about 8% from the previous year.

The price difference between equivalent LCD and OLED panels was $440 as of the first quarter, but this year it has narrowed to around $310. The industry expects that this price gap between the two panels will continue to shrink for some time due to the combination of LCD supply shortages and expanded OLED production capacity.

The recent sharp rise in LCD TV panel prices is due to natural disasters such as power outages and fires at factories that play a crucial role in the global production supply chain. Additionally, the overall supply situation has become tighter as sales of home appliances have continued to increase due to the rise in non-face-to-face demand after COVID-19.

Kim Yangjae, a researcher at KTB Investment & Securities, said, "A power outage at the Japanese NEG factory caused problems in procuring glass substrates for panel companies worldwide, and a shortage of foundry supply made it difficult to secure driver ICs, resulting in continuous production disruptions of LCD panels since the second quarter of last year."

He added, "Furthermore, the fire at LCD material company Tacoma Technology in March compounded the situation, and LCD production is estimated to fall short of initial expectations."

On the other hand, OLED TV panels, regarded as next-generation displays, have recently entered a downward price trend supported by stable production volumes. LG Display, the sole supplier of OLED TV panels to global TV set manufacturers, started operating its Guangzhou plant in China in July last year, doubling its production capacity of the main product, 8.5-generation OLED panels, from about 80,000 units per month to about 140,000 units per month.

Market research firm TrendForce expects OLED TV shipments this year to reach 6.76 million units, a 72% increase compared to the previous year. TrendForce stated, "This year, OLED products have emerged as the top priority for TV brands in the high-end TV market, accelerating their OLED TV strategies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.