Faster-than-Expected Recovery in the US... Continued Easing Policies

China Already in Stabilization Phase... Policies Also Passive

"If US and China Diverge, Negative Impact on Domestic Stock Market... Must Watch After Q2"

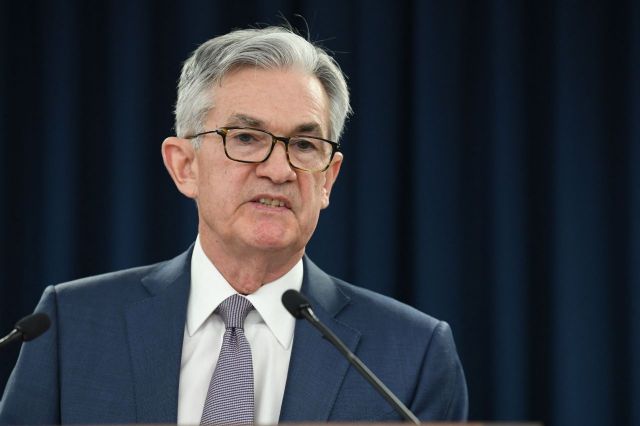

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), acknowledged on the 17th (local time) that some assets are overvalued but drew the line by saying it is not the time to discuss tightening policies. Chairman Powell holds a press conference after unexpectedly announcing a rate cut on March 3 last year. [Image source=Yonhap News]

Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), acknowledged on the 17th (local time) that some assets are overvalued but drew the line by saying it is not the time to discuss tightening policies. Chairman Powell holds a press conference after unexpectedly announcing a rate cut on March 3 last year. [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] An analysis suggests that the contrasting economic recovery drivers of the U.S. and China could pose a burden on the domestic stock market. While the U.S. is expected to experience a rapid economic recovery, China’s recovery is anticipated to stabilize downward due to COVID-19 base effects and policy stances. Concerns are emerging that the strength of the Korean stock market’s rise may weaken, caught in between.

U.S.: Strong Growth Expectations Overcoming Interest Rate Rise Concerns

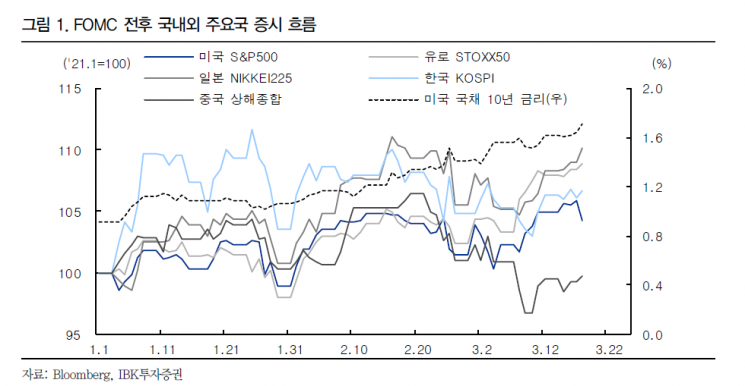

On the 20th, IBK Investment & Securities analyzed the future outlook of the domestic stock market influenced by the U.S. and China in this way. In the U.S. stock market, the mood was positive following the Federal Open Market Committee (FOMC) meeting held on the 17th-18th (local time). At that time, the U.S. Federal Reserve (Fed) raised its growth forecast for this year from 4.2% to 6.5% and also increased the expected personal consumption expenditure (PCE) inflation rate to 2.4%, up from the previous 1.8%. However, it announced it would maintain an accommodative monetary policy for the time being, including holding the policy rate steady at 0.00?0.25%, continuing asset purchases, and raising the daily transaction limits for reverse repurchase agreements (Reverse RP) by institutions. Fed Chair Jerome Powell also drew a line on tapering discussions, stating it was not the time to talk about reducing asset purchases, thus avoiding tightening debates. Following this, U.S. stock indices rose collectively, and Asian and European markets also generally increased.

Researcher Soeun Ahn of IBK Investment & Securities diagnosed that there was virtually no significant change in the Fed’s monetary policy stance. Rather, there were no additional measures to control the interest rate rise that some had expected, and uncertainty remains regarding the extension of the supplementary leverage ratio (SLR) regulation easing, which could increase interest rate volatility, so the burden of rising rates has not been alleviated. In fact, immediately after the FOMC, on the 18th, the U.S. 10-year Treasury yield rose to the 1.7% range. Researcher Ahn explained, “Nevertheless, the stock market seems to have primarily reflected the reconfirmation of high expectations for economic recovery through the Fed’s economic outlook and the belief that there will be no policy change risk from the Fed until the economic recovery becomes visible.”

Expectations for U.S. economic recovery are also growing. The 6.5% U.S. economic growth rate projected by the Fed this year significantly exceeds Bloomberg’s financial market consensus median forecast of 5.6%. Although employment has not yet returned to pre-COVID-19 levels, consumption is recovering rapidly due to government income support policies. Additionally, further cash payments are underway, and the COVID-19 spread is continuing to subside domestically, which is positive.

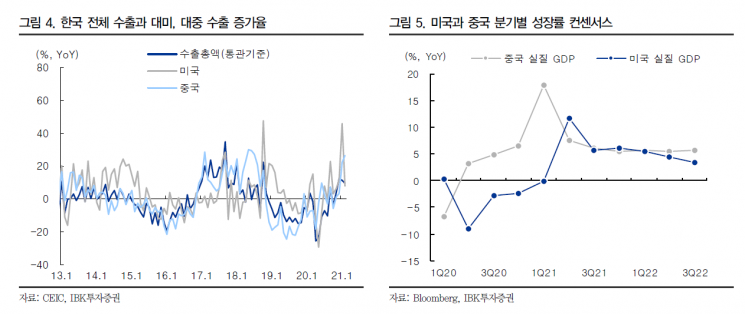

Due to COVID-19 Time Lag... Passive Chinese Authorities

The Organisation for Economic Co-operation and Development (OECD) recently adjusted its economic outlook, reflecting the effects of the U.S.’s large-scale stimulus measures in the upward revision of growth forecasts for major trading partners. One of the key pillars of South Korea’s exports is U.S. demand, which is also important for corporate profits. However, it is uncertain whether the recovery effect in the U.S. will directly translate into the domestic economy. This is because the economic momentum of China, a significant demand pillar, may be weaker compared to the U.S.

Researcher Ahn analyzed that the difference in economic trends between China and the U.S. this year fundamentally started from the timing difference of the COVID-19 shock. Due to the COVID-19 base effect, China’s economy is expected to form a peak in the first quarter of this year and then gradually stabilize downward, whereas the U.S. economy is expected to peak in the second quarter and then decline.

This economic trend difference has led to policy differences between the two countries. The U.S. government is preparing to implement policies centered on large-scale infrastructure investment following the passage of a $1.9 trillion stimulus package. The focus is on economic recovery rather than fiscal soundness risks. In contrast, the Chinese government has already shifted from stimulus to normalization. Researcher Ahn diagnosed, “Looking at the recent open market operations of the People’s Bank of China, the net liquidity supply is frequently zero or negative,” adding, “Under the pretext of preventing asset bubbles, it is effectively taking a tightening stance.” At this month’s National People’s Congress (NPC), China’s largest political event, the fiscal deficit target relative to GDP was lowered to around 3.2%, down from over 3.6% last year.

U.S. and China’s Divergent Economic Recoveries May Cause Korean Stock Market to Falter

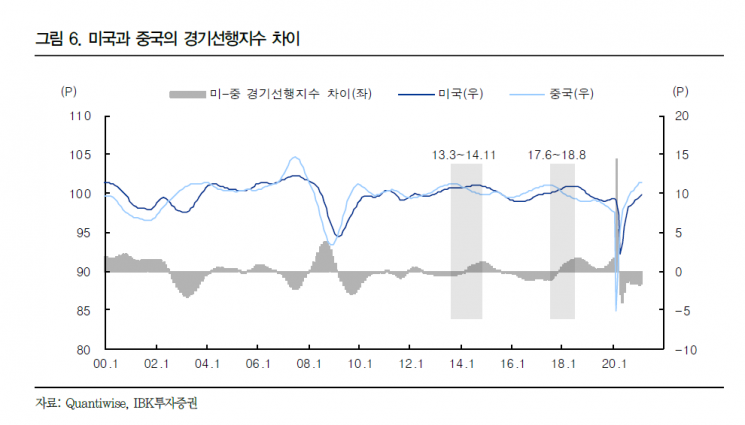

Researcher Ahn expressed concern that China’s economic trend this year could weaken the momentum of Korean corporate profits and stock market gains driven by the U.S. economic recovery. This impact has already been confirmed during past periods when China and the U.S. had divergent economic momentum.

The periods 2013?2014 and 2017?2018 are representative examples. During those times, the leading economic indicators of the U.S. and China diverged and reversed. In 2013?2014, the U.S. economic recovery became visible after the Fed’s third round of quantitative easing, with tapering discussions beginning, while China faced downward pressure on its economy due to strengthened shadow banking regulations. In 2017?2018, the U.S. domestic economy strengthened due to large-scale stimulus measures including former President Donald Trump’s tax cuts, whereas China’s economy weakened, centered on exports and manufacturing, due to the trade dispute.

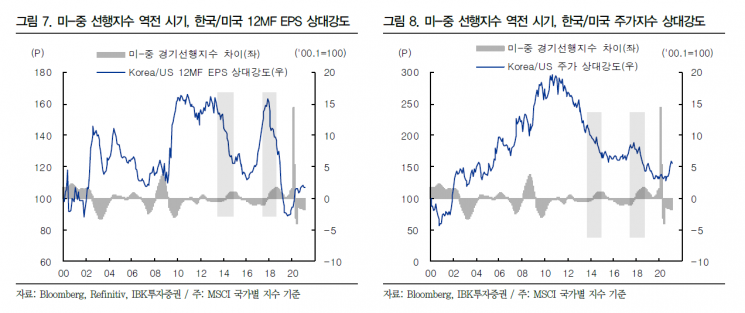

Although the reasons for the divergent economic directions of the U.S. and China at these two points differ, they commonly had mixed effects on Korean corporate profits and stock prices. Despite strong demand recovery in the U.S., the strength of Korean corporate profits and stock price recovery was lower. Researcher Ahn said, “Specifically, at both points, Korea’s 12-month forward earnings per share (EPS) and relative stock price strength compared to the U.S. both declined,” adding, “For similar reasons, the rebound strength of the Korean stock market compared to the U.S. may be weak in this phase as well, so it is necessary to closely monitor the economic directions of the U.S. and China and their differences after the second quarter.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.