[Asia Economy Reporter Minji Lee] Despite Nike reporting earnings below market expectations, there are opinions that it will benefit from economic stimulus effects due to vaccination and inventory normalization in the North American region. The digital sector and direct-to-consumer channel growth are also expected to continue.

According to the financial investment industry and Nike on the 20th, Nike's Q3 revenue from December to February was $10.4 billion, up 3% year-on-year. Due to delayed inventory in North America and re-lockdowns in Europe, revenue fell about 6% short of market expectations. Earnings per share (EPS) rose 70% to $0.90 during the same period, exceeding market expectations by 18%. Cost reductions centered on labor expenses led to a pre-tax profit margin increase of 7.1 percentage points to 15.8%.

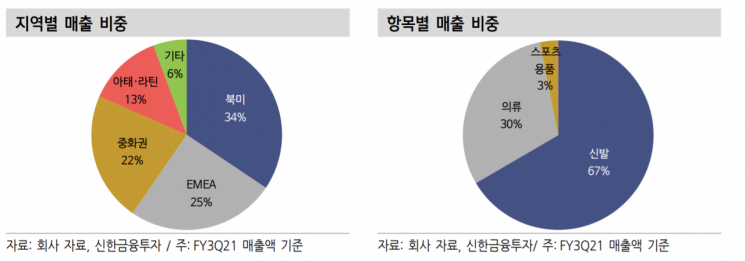

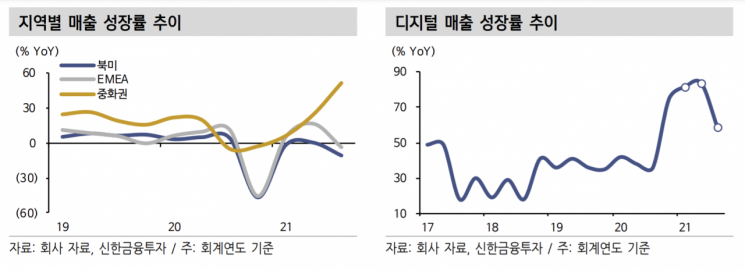

By region, China showed strong performance. Revenue in North America was $3.6 billion, down about 10%, Europe, Middle East, and Africa (EMEA) was $2.6 billion, down 4%, while the Greater China region recorded $2.3 billion, up about 51%. The Asia-Pacific and Latin America regions were $1.3 billion, down 7%. China’s revenue exceeded $2 billion, and the pre-tax profit ratio expanded to 60%. Hyunji Lee, a researcher at Shinhan Financial Investment, explained, “North American sales were sluggish due to maritime logistics disruptions, and 45% of European direct stores were closed due to the resurgence of COVID-19, making a performance hit in the EMEA region inevitable. However, sales growth was sustained by increased shopping demand during the Chinese Lunar New Year, and the activation effects of digital platforms such as live streaming and SNS.”

Growth in the digital sector and direct-to-consumer channels also continued. Digital sales grew 59% year-on-year, and direct sales increased by 20%. Eunhye Lim, a researcher at Samsung Securities, said, “This offset COVID-19 issues in some regions and inventory issues in the U.S. Digital and direct sales will become core elements of Nike’s brand strategy.”

Q4 expected revenue and EPS are projected at $10.7 billion, a 69% increase, and $0.53, respectively, indicating a return to profitability. With North American inventory normalization and benefits from global reopening, estimates are expected to be revised upward in the future. Researcher Lim said, “The strength of the strategically emphasized digital sales sector and the brand momentum in the key region of China will continue this year. The recovery of economic activities due to vaccination will also act as a favorable factor for the company’s operating environment.”

However, concerns about short-term volatility remain as adjustments centered on tech stocks continue. Lim said, “Recently, the company has succeeded in evolving into a tech platform and is attracting attention as a growth stock. Given the price burden compared to competitors, a simultaneous adjustment centered on tech stocks due to rising interest rates is inevitable.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.