Government's Real Estate Policy to Catch Multi-Homeowners and Speculators

Repeated Failures Lead to Sharp Rise in Housing Prices...High Tax Burden Extends to Single-Homeowners

Various Taxes and Quasi-Taxes Linked to Officially Announced Prices Also Increase

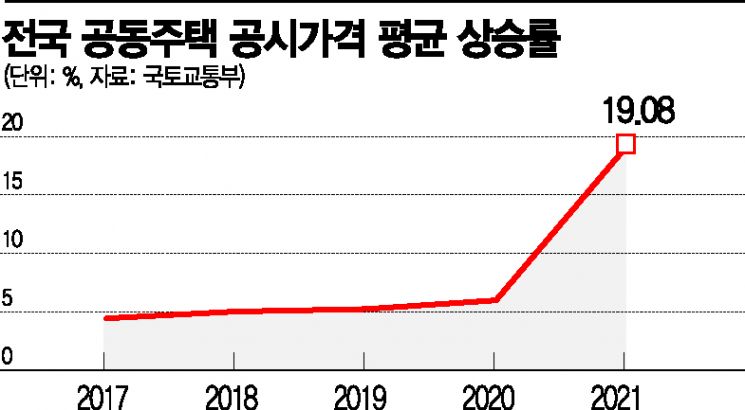

The official prices of apartments and other multi-family housing nationwide will increase by more than 19% compared to last year.

The official prices of apartments and other multi-family housing nationwide will increase by more than 19% compared to last year. The Ministry of Land, Infrastructure and Transport will begin public viewing of the "2021 Multi-family Housing Official Price Plan" starting on the 16th. According to the plan, the average increase rate of official prices for multi-family housing nationwide this year is 19.08%, with Seoul seeing a 19.91% rise, indicating that property tax burdens for multi-family housing owners are expected to increase.

The photo shows the area of Gongdeok-dong, Mapo-gu, Seoul, where multi-family housing is densely concentrated.

"House prices have all gone up, so I can't move anywhere. I end up paying my entire monthly salary to the government."

The government has issued real estate policies 25 times and has continued an unclear 'war against speculation' for nearly four years, but ultimately, the enormous burden resulting from policy failure has fallen on the people. This is because the official prices of apartments and other multi-family housing nationwide have surged by an average of 19.08% compared to last year, and it is expected that the pure property tax revenue, excluding comprehensive real estate tax, will increase by about 360 billion KRW.

According to the Ministry of Land, Infrastructure and Transport and industry sources on the 16th, the official price increase rate recorded 22%?the highest in 14 years since 2007?resulting in significant tax burdens not only for multi-homeowners but also for single-homeowners. According to a simulation analysis by the Ministry of Land, Infrastructure and Transport, the holding tax burden on high-priced apartments could increase by up to 50% compared to last year. A single-homeowner (excluding long-term holding and senior citizen deductions) owning an apartment with a current market price of 3.75 billion KRW (official price 3 billion KRW) will face a holding tax of 33.602 million KRW, an increase of 9.168 million KRW from last year. For an apartment with a market price of 1.71 billion KRW (official price 1.2 billion KRW), the owner must pay 4.325 million KRW, which is 1.302 million KRW more than last year. This is equivalent to giving up a mid-level manager's monthly salary at a small or medium-sized enterprise.

For multi-homeowners, the term 'tax bomb' has become a reality. From June, the comprehensive real estate tax for owners of three or more homes (two or more in regulated areas) will be raised from the current 0.6?3.2% to 1.2?6.0%, further increasing the burden. For example, a two-homeowner holding a 76㎡ unit in Eunma Apartment, Daechi-dong, Gangnam-gu, and a 114㎡ unit in Dogok Rexle, Dogok-dong, Gangnam-gu, will see their holding tax jump 2.4 times from 49.97 million KRW last year to 102.89 million KRW this year.

That morning, posts expressing bewilderment flooded real estate communities, such as "I might have to take out a credit loan just to pay taxes to the country," and "The government stirred up house prices every time they released real estate measures, so why should single-homeowners who were quiet face a tax bomb?"

This year's rise in official real estate prices is also expected to affect welfare systems overall. In South Korea, official prices are used as the basis for calculating over 60 quasi-taxes and charges, including comprehensive real estate tax, health insurance premiums, basic pension, Earned Income Tax Credit (EITC), basic livelihood security system, and support for elementary to high school education expenses.

Ultimately, if official prices rise and recognized income increases, not only will tax payments increase, but individuals may also be excluded from welfare benefits. Professor Hong Woo-hyung of Hansung University's Department of Economics stated, "For EITC and health insurance premiums, asset requirements are considered. If official prices rise, people may be excluded from welfare benefits or face increased health insurance premiums."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.