As Direct Bio Investors Increase, SK Chemicals Left Out

SK Bioscience's IPO Expected to Keep Weakness for a While

[Asia Economy Reporter Lee Seon-ae] Investors holding SK Chemicals are trembling with anxiety. While SK Bioscience, which rewrote the history of initial public offerings (IPO), is creating a frenzy, the stock price of its parent company SK Chemicals is plummeting as if just watching from the sidelines. SK Chemicals gained attention last year as a bio stock, recognized for the value of SK Bioscience, but with the dual listing, more people are investing directly in the bio business, leading to a decline in investment interest in SK Chemicals. Given the harrowing experience of SK’s stock price plummeting during SK Biopharm’s IPO, there are forecasts that SK Chemicals’ stock price will inevitably fall further around the SK Bioscience listing date on the 18th.

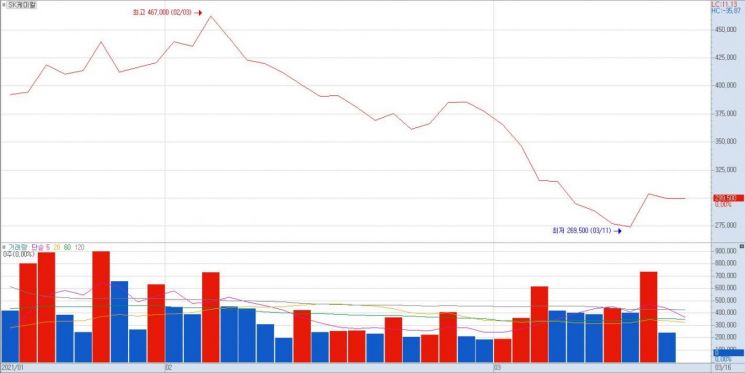

At 9:31 a.m. on the 16th, SK Chemicals traded at 292,000 KRW, down 2.50% from the previous day. Since reaching a high closing price of 462,500 KRW on the 3rd of last month, SK Chemicals’ stock price has been on a continuous downward trend, falling 35.2% compared to the previous day’s closing price.

SK Bioscience was spun off from SK Chemicals in July 2018. It manufactures influenza vaccines, shingles vaccines, and more. Last year, news that SK Bioscience would produce AstraZeneca’s COVID-19 vaccine material at its vaccine plant in Andong, Gyeongbuk, caused SK Chemicals’ stock price to surge, raising expectations for a 500,000 KRW price. However, as SK Bioscience proceeded with its own listing, SK Chemicals’ investment value diminished, weakening its stock price. After SK Bioscience’s listing, SK Chemicals’ stake will drop from 98% to 68.4%. SK Discovery, the holding company owning 33.5% of SK Chemicals, is also weakening accordingly. At 9:31 a.m., it traded down 1.28% at 61,900 KRW. Compared to the high closing price of 70,800 KRW on the 16th of last month, it has fallen 11.4% compared to the previous day’s close.

Although SK Chemicals and SK Discovery’s credit ratings are expected to be upgraded due to SK Bioscience’s IPO and other large-scale capital increases, their stock prices are likely to remain weak for the time being. When SK Biopharm, which was spun off from SK in 2011, was listed on July 2nd last year, it recorded a remarkable 342.9% return (compared to the IPO price) with five consecutive days of gains after listing. However, SK’s stock price fell for seven consecutive trading days, including a 6.2% drop on the listing day, resulting in a total decline of 19.0%.

The securities industry is cautious and reluctant to predict how SK Chemicals and SK Discovery’s stock prices will move. This year, almost no stock analysis reports have been issued. However, it is interpreted that investors are forming the perception that the price adjustment is a buying opportunity. For SK Chemicals, individuals have net bought 114.7 billion KRW and foreigners 139.3 billion KRW as of the 15th this year, while institutions have net sold 264.9 billion KRW. Similarly, for SK Discovery, individuals and foreigners have net bought 16.6 billion KRW and 6 billion KRW respectively during the same period, while institutions sold 23.5 billion KRW.

Meanwhile, in the domestic stock market, it is characteristic that when a parent company and its subsidiary are dual-listed, a discount on the parent company’s stock price is inevitable. Accordingly, concerns about a discount on LG Chem’s stock price are emerging due to the upcoming listing of LG Energy Solution. The judgment is that investors who expect growth in batteries would prefer to invest directly in LG Energy Solution. LG Energy Solution was spun off from LG Chem last year and selected KB Securities and Morgan Stanley as its listing underwriters in January.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.