[Asia Economy Reporter Minji Lee] Adidas is expected to improve its performance this year with the reopening of stores. However, since the sales rebound speed in the Chinese market, which accounts for a large portion of sales, is slower compared to competitors, confirming competitiveness will be necessary.

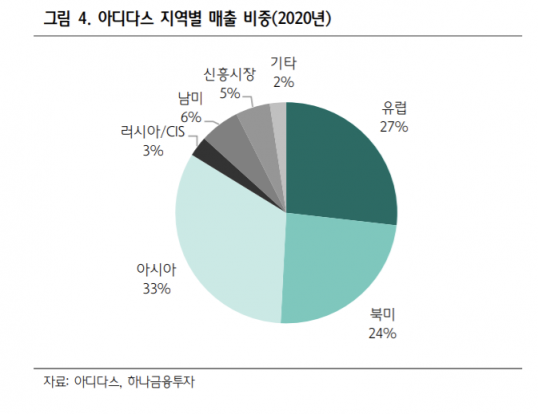

According to the financial investment industry on the 13th, Adidas' sales in the fourth quarter of last year slightly exceeded market expectations at 5.5 billion euros, down 5% from the previous year. While it showed solid performance in China and other regions, sales were affected as the proportion of store closures increased again in North America and Europe due to the rise in COVID-19 cases since November last year.

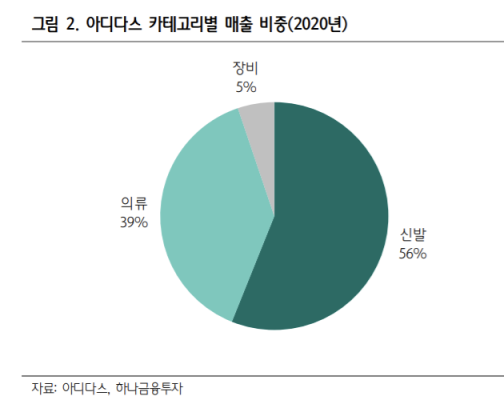

Operating profit was 230 million euros, down 8% from the previous year but exceeding market expectations (200 million euros). E-commerce sales increased by 43%, and on an annual basis last year, they grew by about 53%, raising the sales proportion to 21%. Compared to other competitors, focusing on strengthening the apparel sector resulted in shoe sales in the fourth quarter of last year decreasing by 4% compared to a year earlier, while apparel sales increased by 9%.

This year, with the store reopening rate expanded to 95%, a full-fledged rebound is expected. The company's projected sales growth forecast for this year is 15-19%, which aligns with the market forecast (7%). Growth of 20-30% is expected in the Asian market centered on China and in South America. Researcher Jaerim Kim stated, “The company plans to focus on expanding the Chinese market and manage it as a separate individual market from Asia starting this year.”

Adidas has set a sales growth rate of 8-10% annually and an operating profit margin of 12-14% by 2025. Profitability will be improved by expanding the proportion of direct sales to 50%. The expansion of digital sales capabilities and strengths in sports apparel sectors such as athleisure are expected to further accelerate Adidas' performance rebound in the future.

Although costs will increase due to the sale of the Reebok division, considering the scale of shareholder returns, it is expected not to have a significant negative impact on the stock price. Researcher Eunhye Lim from Samsung Securities explained, “After the sale of Reebok, Adidas will solidify its growth strategy centered on the Adidas brand,” adding, “The dividend payout ratio will be maintained at 30-50%, and 3-4% of sales will be reinvested.”

However, the slower sales rebound speed of the Chinese business unit compared to competitors is a concern. Researcher Jaerim Kim explained, “Compared to Nike, it has not shown significant prominence in the sales of sneakers, including basketball shoes,” and added, “Its relative investment attractiveness is lower compared to Nike.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.