Outdoor Activities Surge in Spring Weather Boost Offline Spending

Expansion of High-Value Purchases Like Department Stores and Automobiles

Vaccination and Base Effects Contribute

[Asia Economy Reporter Ki Ha-young] Office worker Jeong Su-hwa (32) plans to visit The Hyundai Seoul, which opened in Yeouido, this weekend. With the weather warming up and the place becoming a must-visit shopping spot on social networking services (SNS), she intends to browse and possibly buy a spring suit. Jeong said, "Because of COVID-19, I mostly shopped online from home, but as the weather has warmed up, I have been visiting department stores more frequently since last month and stopping by luxury brand stores as well. Getting vaccinated also gives me some peace of mind."

Signs that suppressed consumer sentiment due to COVID-19 is reviving have been confirmed through card payments. In particular, high-value spending such as department store purchases and car buying has significantly increased. This is interpreted as pent-up consumer demand manifesting as 'revenge spending.'

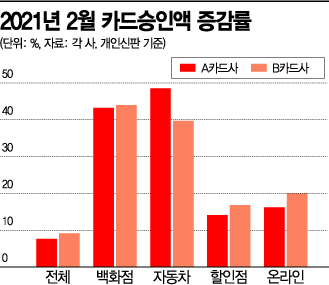

According to the card industry on the 12th, last month, the automobile card usage approval amount for Card Company A surged 48.5% compared to the same period last year. During the same period, spending at department stores also jumped 43.2%. Discount stores such as large marts increased by 14.1%, and personal credit sales rose by 7.6% on a provisional basis.

High-value spending was also notable at Card Company B. This company saw a 44.0% increase in card usage at department stores compared to the same period last year, and automobile spending rose by 39.5%. Personal credit sales increased by 9.1%. Card Company C estimates that last month’s card approval amount rose about 10% compared to the same period last year.

The card industry views that card spending, which had been concentrated online due to refraining from going out during COVID-19, is noticeably expanding offline as well. An industry insider said, "While the online sector, which replaced offline consumption after COVID-19, maintained a growth rate close to 20%, offline sectors such as department stores and discount stores also saw increased performance. The adjustment of social distancing levels from mid-February and expectations for the COVID-19 vaccine effects have combined to release consumer demand that had been suppressed for a year."

The Consumer Confidence Index (CCSI) is also on an upward trend. According to the Bank of Korea, the consumer confidence index was 91.2 in December last year, rose to 95.4 in January, and increased further to 97.4 in February.

However, some analyses suggest that the signs of consumption recovery do not indicate a return to pre-COVID-19 consumption levels. Another industry insider said, "Personal credit sales also increased by more than 10% in the first week of March, continuing the recovery trend. However, since this could be a temporary phenomenon, we need to observe the trend through March and April to consider it a complete consumption rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)