Proportion of active funds underperforming the S&P 500 index returns [Image source= Wall Street Journal]

Proportion of active funds underperforming the S&P 500 index returns [Image source= Wall Street Journal]

[Asia Economy Reporter Park Byung-hee] It has once again been proven that investing in index funds is better than relying on fund managers when choosing funds.

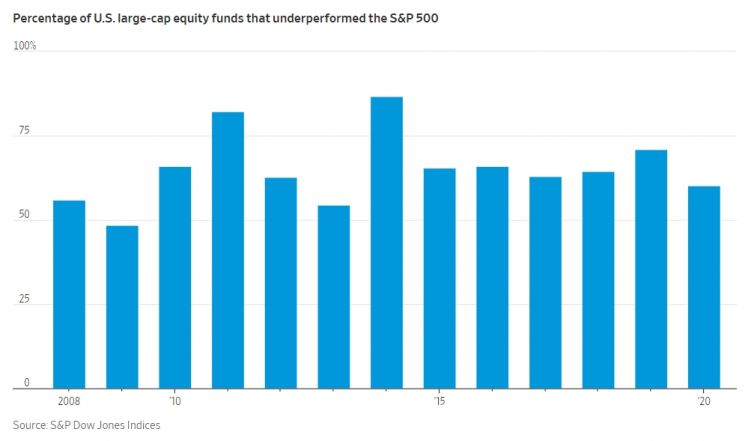

On the 11th (local time), the Wall Street Journal reported, citing statistics from financial information company S&P Dow Jones Indices, that 60% of active funds in the U.S. last year recorded returns below the S&P 500 index returns.

Active funds refer to funds where fund managers actively analyze and judge market conditions to replace investment stocks. The reason fund managers actively replace stocks is to generate returns exceeding market returns, but this active management has instead become a poison that erodes returns.

The proportion of active funds that performed poorly, falling below market returns, has continuously exceeded 50% since 2009. This means that for 11 years, there have been more fund managers generating returns below market returns than those exceeding them. In 2011 and 2014, the proportion of fund managers underperforming the market return exceeded 80%. In conclusion, this means fund managers cannot be trusted.

The S&P 500 index rose 16.3% last year. Due to the COVID-19 outbreak, it once plunged 32.2% year-over-year in March last year, falling to the 2100 level, but then sharply rebounded to close last year's trading at 3756.07. Apple and Amazon stock prices surged 81% and 76%, respectively, leading the rise in the S&P 500 index.

Fund managers failed to properly respond to such market fluctuations.

It has been confirmed that it is even more difficult for fund managers to generate returns exceeding market returns in the long term.

S&P Dow Jones Indices revealed that among funds operated for more than 20 years, only 6% achieved returns exceeding the S&P 500 index growth rate over the past 20 years.

Rather than trusting the fund managers' skills, it is better to invest in index funds.

Index funds operate by allocating fund assets according to the weight of the stocks that make up the index. For example, as of the end of last year, Apple accounted for 6.7% and Amazon 4.4% of the S&P 500 index, so the fund assets are also invested 6.7% in Apple and 4.4% in Amazon accordingly. Therefore, the analysis and judgment of fund managers are excluded.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.