[Asia Economy Reporter Lee Seon-ae] Korea Securities Depository announced on the 11th that it is accelerating the establishment of the venture investment support platform 'VentureNet' to support investment and securities-related tasks for startup and innovative venture companies.

Currently, small unlisted companies such as venture companies face practical limitations in using the electronic securities system, making it difficult to systematically manage stock affairs such as shareholder registry management, issuance and replacement of rights certificates, name transfer, and exercise of conversion and redemption rights. Most companies handle stock affairs management internally, exposing vulnerabilities in managing legal ledgers such as shareholding records. In particular, various data provision and reporting to investors are done via mail or email, resulting in weak security and lack of systematic management. Additionally, the back-office systems of venture capital firms that form investment associations such as small and medium business startup investment associations, Korea Venture Investment Associations, New Technology Business Investment Associations, and individual investment associations to invest in venture companies are outdated, necessitating infrastructure improvements.

To address these issues, the Depository is preparing a 'customized securities affairs management platform for unlisted companies' through VentureNet, enabling startup and innovative venture companies to easily use simplified and tailored securities affairs management services. VentureNet participating companies can conveniently handle securities affairs necessary for shareholder management by accessing the dedicated platform via the internet. They can create and manage shareholder registries online and issue or replace electronic certificates on the platform when investor shareholdings change.

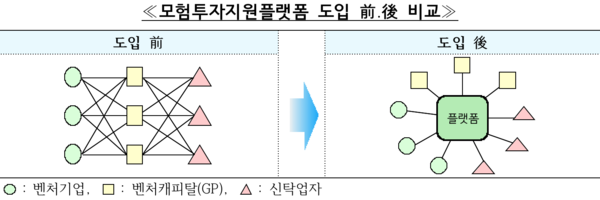

A 'venture capital specialized back-office support platform' will also be introduced. An automated platform will be established for transmitting and confirming various operational instructions among venture investment participants and managing daily balance details by fund. Venture capital firms can transmit operational instructions related to innovative company investments to trustees in real time, and trustees can verify these electronically. For unlisted companies, it will become easier to manage shareholder shareholding changes, improving the efficiency and transparency of securities affairs management.

Meanwhile, the Depository plans to launch the service at the end of September after completing the development and testing of the VentureNet system.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)