$156 Billion in 15 Months for US-Listed Stocks

Meme Investment Culture Fuels Market Boom

Moves to Strengthen Regulations on Concept Investment Risks

[Asia Economy Reporter Yujin Cho] "The end is approaching." On the 8th (local time), Bloomberg News warned of a SPAC (Special Purpose Acquisition Company) bubble, mentioning the tulip mania that occurred over 400 years ago, the dot-com bubble of the 2000s, and the subprime mortgage crisis.

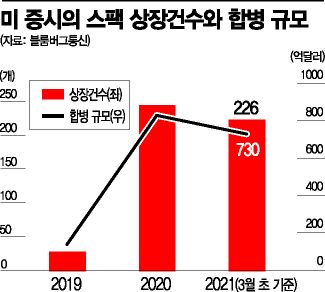

◆ "Even rappers have jumped in" = According to Bloomberg News, as of early this month, the number of SPAC listings on the U.S. stock market over the past 15 months reached 474, with the total SPAC merger size amounting to $156 billion. The number of SPAC listings surged from 59 in 2019 to 248 last year, and already 226 have been created this year alone. During the same period, the size of SPAC mergers also skyrocketed from $13.6 billion to $83 billion and $73 billion.

A SPAC raises funds through a public offering and lists on the stock market, then merges with an unlisted company within a set deadline (2 years). For unlisted companies, listing through a SPAC offers the advantage of reducing the listing procedures compared to a formal initial public offering (IPO). Last year, due to increased volatility caused by the COVID-19 pandemic, the number of companies seeking rapid fundraising increased, fueling the SPAC listing craze.

SPACs, which have gained attention through participation by global billionaires, financiers, and celebrities, have created a market boom combined with the culture of 'meme' investing. A meme is a neologism referring to content or culture shared like a trend on the internet. Following the GameStop stock surge incident, meme investing has had a tremendous impact on the financial investment market.

‘Dr. SPAC,’ who has 28,000 followers, is one of the social media accounts leading the SPAC boom. He posts SPAC-related information on his Twitter feed called ‘For Entertainment,’ attracting SPAC investors. In addition to Dr. SPAC, accounts like ‘SPAC Tiger,’ ‘SPAC Guru,’ and ‘SPACjilia’ have joined in, fueling the SPAC boom. Hip-hop artist Cassius Cube also released a rap called ‘SPAC Dream’ praising SPAC investment. He has invested $500,000 divided among 40 to 50 SPACs.

◆ Valuation soared 23,650% in one year = The hottest SPAC company these days is Archer Aviation, an air taxi developer. Supported by a SPAC backed by U.S. billionaire investor Ken Moelis, the company was valued at $3.8 billion and recently entered the New York Stock Exchange where Boeing and Airbus are traded. Considering that its corporate value was evaluated at $16 million during the seed funding round in April last year, its valuation surged 23,650% in less than a year.

Archer Aviation has announced plans to release 500 air taxis by 2026, but its transportation performance is zero. An investment advisor who consulted for Archer Aviation, which was struggling with funding before merging with the SPAC, said, "When they approached us for funding last year, we refused the investment request without even holding a meeting," adding, "The business plan he proposed was closer to a science project than a business."

◆ ‘No substance’ but only ‘concept’... SEC tightens regulations = Besides Archer Aviation, many companies with only ‘concepts’ and no ‘substance’ are rushing to debut on the stock market through SPACs, raising bubble warnings. Unlike normal IPOs based on financial evaluations, SPACs rely solely on expectations, making it highly likely that valuations are significantly inflated beyond reality.

Experts consistently warn that SPAC investment is betting on ‘concepts’ rather than ‘future profits.’ According to Bain & Company, among companies listed through SPAC mergers from 2016 to last year, 60% had stock prices below the S&P 500 index after the merger, and as of January this year, 40% were trading below the S&P 500 index.

The U.S. Securities and Exchange Commission (SEC) is showing signs of strengthening regulations related to SPACs. After warning of potential risks of SPACs in September last year, the SEC is preparing new guidelines regarding SPAC regulations. An SEC official said, "The increase in SPAC volume signifies a significant change," adding, "We are closely examining the structural issues surrounding SPACs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.