As COVID-19 vaccinations began domestically, interest in vaccine-related companies has also increased. These companies contribute to public health and quarantine efforts, from the development and production of effective vaccines to their safe distribution. The global vaccine market is growing at an annual average rate of over 8%, recording a higher growth rate than other pharmaceutical markets. However, the entry barriers to the vaccine market are relatively high. Not only foundational technology but also manufacturing facilities for large-scale production are required. Both technological capability and financial strength must be supported. It is considered an attractive industry in which global pharmaceutical companies continuously invest. Domestic companies are also aggressively expanding their vaccine-related businesses in line with the increased vaccine demand due to the spread of COVID-19. This article examines the growth strategies and financial status of companies that have seized new opportunities amid the high growth of the vaccine market, as well as their sustainability after the end of COVID-19.

[Asia Economy Reporter So-yeon Park] SK Bioscience is a leading domestic vaccine specialist company. Established in July 2018 as a spin-off from SK Chemicals, SK Bioscience has developed and sold vaccines for influenza, shingles, and chickenpox.

Recently, it has gained attention for developing and contract manufacturing COVID-19 vaccines and is preparing to enter the KOSPI market this month. The COVID-19 situation is a "double-edged sword" for SK Bioscience. While it may help the IPO's success, the post-COVID-19 period poses challenges. Sustained growth and strengthening technological competitiveness in the increasingly competitive vaccine market after COVID-19 remain tasks to be solved.

◇Rapid growth riding vaccine demand, sustainability concerns= SK Bioscience has signed contracts with AstraZeneca to produce the bulk substance and finished pharmaceutical products of COVID-19 vaccine candidates. It has also entered into antigen development, production, and global supply contracts with Novavax for COVID-19 vaccine candidates and is currently producing them. Its self-developed COVID-19 vaccine candidates, ‘NBP2001’ and ‘GBP510,’ have entered clinical trials.

The COVID-19 vaccine business, which is receiving the most attention, is broadly divided into two categories. First, it involves contract manufacturing of vaccines developed by other companies on a large scale. SK Bioscience is responsible for contract manufacturing of COVID-19 vaccines for AstraZeneca and Novavax. In particular, for the Novavax vaccine, SK Bioscience plans to take over the original technology and handle everything from production to supply directly.

These global vaccine developers seek companies capable of large-scale vaccine production, so SK Bioscience’s contract manufacturing capacity is expected to translate into immediate profitability. Another pillar of SK Bioscience’s vaccine business is its own vaccine development. It plans to enter phase 3 clinical trials in the third quarter of this year and aims to launch its own vaccine products in the market by the first half of next year. In this way, SK Bioscience is conducting business across the entire process from contract manufacturing and development to distribution of COVID-19 vaccines and plans to expand into contract manufacturing of pharmaceuticals such as anticancer drugs.

Rapid Growth Riding Vaccine Demand: The Challenge of Finding New Revenue Sources

The First Major IPO of the Year: 22 Million Shares Offered on the 9th-10th

◇The post-COVID-19 pandemic challenge= The vaccine market environment, SK Bioscience’s main market, has become more volatile before and after COVID-19, which is a concern. This is the case if the vaccine market growth slows down after the end or partial resolution of the COVID-19 pandemic. Although demand surged sharply after the outbreak of COVID-19, analyses suggest that an imbalance may occur in the future where supply exceeds demand. This means a sales gap could become a boomerang after the end of COVID-19.

The company stated in its investment prospectus, "If COVID-19 ends, growth may slow due to price declines caused by decreased demand for our main product, the influenza vaccine, and a reduction in the number of influenza patients."

The rapid increase in facility investments could also trigger an oversupply situation. Recently, SK Bioscience made large-scale facility investments for mass vaccine production. Competitors are doing the same. An industry insider warned, "There is a risk that the overall market production capacity will exceed market demand, causing an oversupply situation," adding, "Excessive competition in the market could expose companies to risks such as product price declines and deteriorating operating profits."

◇A promising IPO candidate this year: Will it succeed in the market?= Attention is focused on whether the IPO subscription frenzy seen with SK Biopharm last year will be repeated ahead of the offering. SK Bioscience plans to offer a total of 22.95 million shares, combining 15.3 million newly issued shares and 7.65 million existing shares. The expected offering price range is KRW 49,000 to KRW 65,000 per share, with a minimum offering amount between KRW 1.1245 trillion and KRW 1.4917 trillion. Based on this price range, the estimated market capitalization at listing is approximately KRW 3.7485 trillion to KRW 4.9725 trillion.

The largest shareholder, SK Chemicals, plans to sell 7.65 million of its 60 million shares as existing shares, converting them into cash worth KRW 374.9 billion to KRW 497.3 billion. General subscription will be accepted over two days, the 9th and 10th. SK Bioscience plans to use the raised funds for facility investments, securing platform technology, developing next-generation pneumococcal vaccines, and operating expenses. Approximately KRW 393.4 billion will be allocated for facility investments.

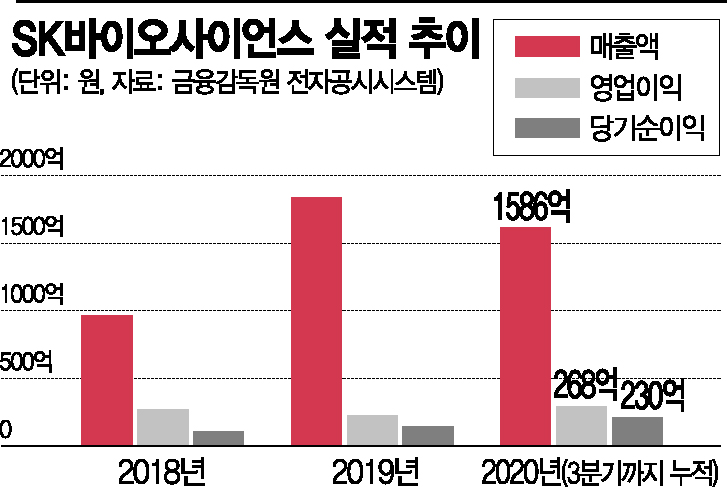

SK Bioscience’s sales have grown rapidly, with an average annual growth rate of 23.4% over three years since 2017. As of the third quarter of 2020, cumulative sales reached KRW 158.6 billion, and operating profit was KRW 26.8 billion, up 33.1% and 211.6% respectively compared to the same period last year. The operating profit margin and net profit margin as of Q3 2020 were 16.9% and 14.51%, respectively.

The debt ratio as of Q3 2020 was 107.5%, somewhat higher than the industry average. The current ratio (199%) and quick ratio (157.5%) were at healthy levels. As of the end of Q3 2020, cash and cash equivalents amounted to KRW 129.324 billion, and net borrowings were KRW 4.1 billion. As of the end of Q3 last year, SK Bioscience’s accounts receivable balance was KRW 69.845 billion, accounting for 13.2% of total assets. The allowance for doubtful accounts was KRW 360 million, about 0.52% of total accounts receivable.

Inventory assets have been increasing, from KRW 31.876 billion at the end of 2018 to KRW 36.378 billion at the end of 2019, and KRW 61.197 billion at the end of Q3 2020. Inventory at the end of Q3 2020 increased by 68.2% compared to the end of 2019. The company explained, "This is due to increased demand for influenza vaccines compared to the previous year because of COVID-19 and increased procurement of raw materials and storage items for contract development and manufacturing of pharmaceuticals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.