If Passed, Financial Environment Drastic Changes Expected

Electronic Financial Transactions Act and Social Solidarity Fund Act, etc.

[Asia Economy Reporter Kiho Sung] As the March extraordinary session of the National Assembly begins, the National Assembly's Political Affairs Committee is in the final stages of coordinating bill reviews, putting the financial sector on high alert. In particular, each bill, such as the Electronic Financial Transactions Act amendment (Jeongeumbeop) and the Social Solidarity Fund Act, signals a drastic change in the financial environment, so the financial sector's attention is expected to remain fixed on the National Assembly for the time being.

According to political circles on the 8th, the Political Affairs Committee will hold the Bill Review Subcommittee starting from the 15th to begin full-scale bill examination. A staff member from the office of Kim Byung-wook, the ruling party's secretary of the Political Affairs Committee from the Democratic Party of Korea, said, "The first Bill Review Subcommittee is scheduled for the 15th, and the second Bill Review Subcommittee for the 16th," adding, "We are in the final stages of coordination between the ruling and opposition party secretaries to select the bills to be submitted."

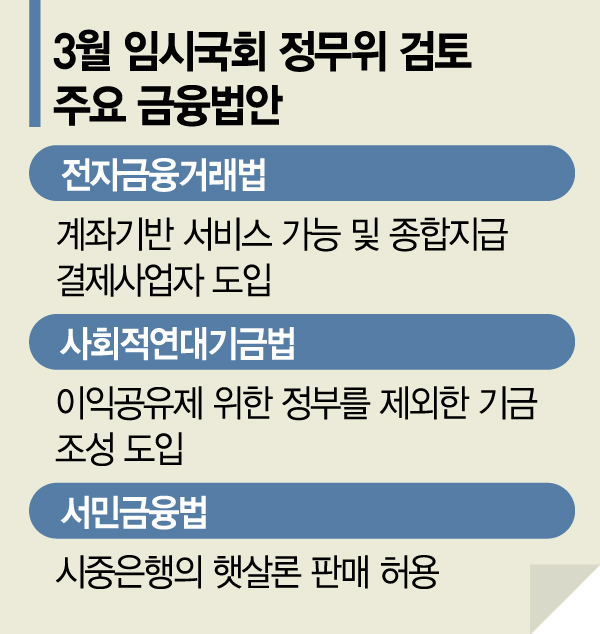

The financial sector's focus in this bill review is on the Jeongeumbeop, the Social Solidarity Fund Act, and the amendment to the Act on Support for Financial Life of the Underprivileged. Among these, the most notable bill is undoubtedly the Jeongeumbeop.

The core of the Jeongeumbeop amendment is the transition to a financial platform form of electronic financial business linked to bank accounts and the establishment of measures to protect digital financial users. This bill includes the introduction of new licenses for MyPayment and comprehensive payment settlement operators. If passed, big tech (large information and communication companies) and fintech firms based on data will become 'quasi-banks' capable of handling most banking operations except deposits and loans.

Specifically, it contains comprehensive reforms related to electronic finance, including △ introduction of payment instruction transmission business (MyPayment) and comprehensive payment settlement operators △ allowance of small postpaid payments △ integration of electronic financial business functions △ mandatory customer fund protection △ establishment of platform business regulations △ institutionalization of open banking △ institutionalization of digital payment transaction clearing △ reform of authentication systems.

The contentious issue lies in the conflict between the Financial Services Commission and the Bank of Korea. The Jeongeumbeop is sharply divided over the establishment of the 'electronic payment transaction clearing business' to ensure transparency in fintech and big tech financial transactions. The Financial Services Commission insists on mandatory external clearing to secure transaction transparency, but the Bank of Korea opposes this, arguing that the Financial Services Commission gaining supervisory authority over the Korea Financial Telecommunications & Clearings Institute would infringe on the central bank's payment and settlement management domain. With both sides firmly holding their positions, it is uncertain whether the Jeongeumbeop will pass the National Assembly.

The Social Solidarity Fund Act, which includes a profit-sharing system for the financial sector, is also expected to be reviewed by the Political Affairs Committee. This bill is one of the 'Lee Nak-yeon-type three coexistence solidarity laws' proposed to resolve inequality through solidarity and fund formation amid the prolonged COVID-19 pandemic. The core is to establish a social cooperation foundation with approval from the National Assembly Office to alleviate deepened inequality and polarization caused by national disasters, with the fund formed from cash, goods, or other assets contributed or donated by entities other than the government.

The financial sector is concerned, viewing it as legal preparation for participation in the profit-sharing system. However, the fact that such fund formats have been activated elsewhere adds to the financial sector's anxiety. The 'Large and Small Business Win-Win Cooperation Fund' started in 2013 with a contribution of 226 billion KRW but grew nearly fivefold to 1.3499 trillion KRW by 2021 in just eight years. Although it began under the name of 'voluntary donation,' most leading domestic companies, including Samsung and Hyundai Motor Company, now participate. Within the ruling party, there is a prevailing view that the opposition party will find it difficult to oppose the bill to provide relief for COVID-19 damages until the end.

The 'Cooperative Profit Sharing Act,' which shares profits between COVID-19 beneficiary and victim industries, is also controversial. Based on the 'Large and Small Business Win-Win Cooperation Promotion Act' proposed by Assemblymen Jo Jeong-sik and Jeong Tae-ho, this bill initially focused on profit distribution between large and small businesses, but recently the ruling party expanded the scope to include platform companies, putting fintech firms on alert.

The amendment to the Act on Support for Financial Life of the Underprivileged, which includes securing resources for the underprivileged financial fund by receiving annual contributions of 200 billion KRW from banks and insurance companies, failed to pass the Political Affairs Committee during the February extraordinary session. The core is to expand the funding sources for underprivileged financial loans such as 'Sunshine Loans' to include banks, insurance companies, and credit finance companies for continuous contributions, but criticism has arisen that this imposes welfare funding burdens on private financial companies, leading to sharp disagreements between the ruling and opposition parties.

A financial sector official said, "Because the bills under review have a significant impact on the financial market, financial companies' attention is focused on the National Assembly," adding, "There are concerns about the backlash from pushing through populist bills or regulations that are out of touch with reality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.