"Implementation Imminent but Detailed Rules Unsettled"…Financial Sector Confused, Authorities Lukewarm

Confusion Expected Due to Differences from Existing Policies and Practices…Lack of Guidelines and Training Time

Experts Warn "Could Fuel More Disputes…Clear and Effective Regulation Needed"

[Asia Economy Reporter Kwangho Lee] With only two weeks left until the enforcement of the Financial Consumer Protection Act (FCPA), the financial sector is on high alert due to ambiguous guidelines. Although financial companies are fully engaged in preparations, anticipating that the FCPA will be the biggest variable affecting management this year, concerns are rising that initial chaos is inevitable because the legal framework remains insufficient. Experts emphasize that the FCPA could increase disputes between financial companies and consumers, urging financial authorities to establish clearer standards.

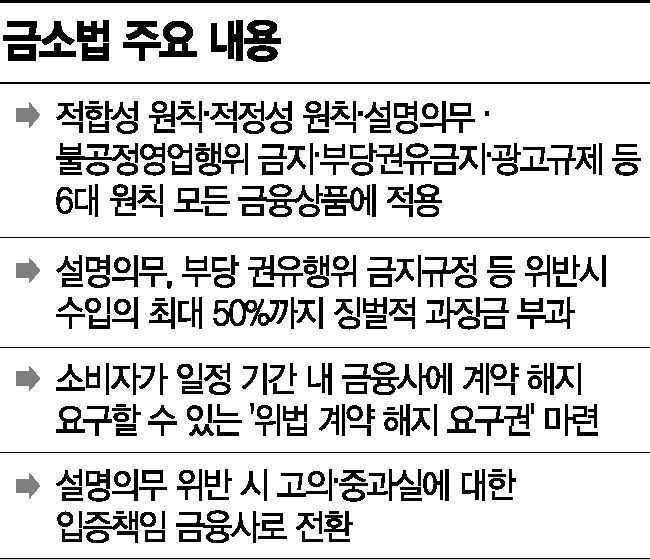

According to financial authorities and the financial sector on the 8th, the FCPA, which strengthens six major sales regulations for financial companies, will take effect from the 25th. Accordingly, financial companies must consider consumers’ assets and investment experience when selling financial products. If the sale is deemed inappropriate, they must inform the customer of the facts and explain each clause of the terms and conditions, requiring the recording of the sales process. Punitive fines will be imposed for violations.

Insufficient Preparation Time for Extensive Content

Ahead of the FCPA enforcement, financial companies have taken measures such as strengthening employee training and expanding the scope of sales recordings to prevent incomplete sales and avoid liability, but they are already expressing difficulties. This is due to not having received the Q&A manual yet and the vast content of the FCPA, resulting in an absolute shortage of preparation time.

A senior executive at a major commercial bank said, "The content related to the FCPA is too extensive," adding, "It will take a considerable amount of time for frontline employees to adapt to a completely different work environment, departing from previous work policies or practices, so initial confusion is inevitable."

Another bank official stated, "Because the scope is so broad, we are simultaneously operating task forces (TFs) between departments, conducting employee training, and building related IT systems," adding, "After enforcement, we plan to operate an emergency response system across the entire bank. We will continue to make adjustments based on actual enforcement cases."

Growing Dissatisfaction with Financial Authorities’ Tepid Response

Dissatisfaction is also growing over the financial authorities’ lukewarm response. In fact, the Financial Services Commission announced the enforcement decree for legislative notice on October 28 last year, collected industry opinions until December 8, and announced major changes on January 18. The supervisory regulations were administratively notified on December 24 last year, but the enforcement rules are still not finalized. The request for review by the Ministry of Government Legislation was only made on the 4th.

Delays in appointing a financial authority official to oversee the FCPA at the most critical time for communication with financial companies have also drawn criticism. After Lee Myung-soon, director of the Financial Consumer Bureau and the FCPA overseer, moved to become a standing member of the Securities and Futures Commission, the position remained vacant for over ten days. Park Kwang, the Planning and Coordination Officer, was appointed as the successor only on the 4th.

How the Six Principles Are Followed Will Be Key

Experts view that how financial companies specifically comply with the six principles will be crucial. Professor Kim Dae-jong of Sejong University’s Department of Business Administration said, "Legislation should clearly and distinctly establish violations and penalties, but the FCPA has shortcomings," adding, "As financial products become increasingly diverse and the law is broadly applied, financial companies are likely to be concerned about an increase in disputes."

Jo Yeon-haeng, chairman of the Financial Consumer Federation, criticized, "Effective consumer rights systems and mechanisms should have been included, but they were omitted during the legislative review process," adding, "Most obligations such as suitability principles and explanation duties are declarative." From the consumer’s perspective, unclear standards may result in inadequate protection under the FCPA.

There were also opinions that the policy should be a 'win-win' that allows financial companies to smoothly sell financial products while consumers receive substantial protection. Professor Lee Jeong-hee of Chung-Ang University’s Department of Economics emphasized, "The six principles were applied during the Lime and Optimus sales, but they ultimately led to financial accidents," adding, "Strengthening regulations indiscriminately under the pretext of protecting consumers does not help much."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)