[Asia Economy Reporter Oh Hyung-gil] Last year, domestic banks' profitability declined as they set aside provisions due to the impact of the COVID-19 pandemic.

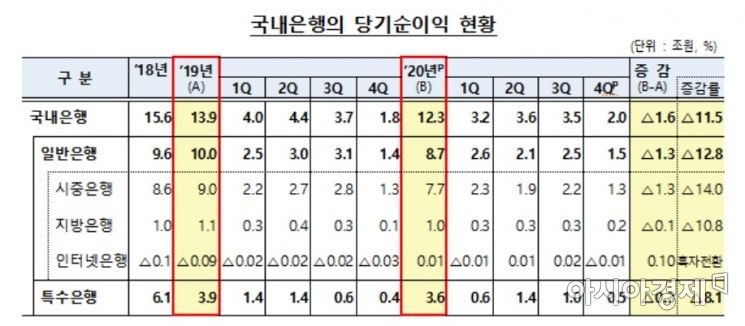

According to the 2020 domestic banks' business performance (preliminary) announced by the Financial Supervisory Service on the 8th, the net income of domestic banks last year was 12.3 trillion won, a decrease of 11.5% or 1.6 trillion won compared to the previous year.

The return on assets (ROA) of domestic banks was 0.42%, and the return on equity (ROE) was 5.63%, down 0.10 percentage points and 1.09 percentage points respectively from the previous year.

Interest income increased by 500 billion won (1.2%) from the previous year to 41.2 trillion won.

Although the net interest margin in the fourth quarter of last year hit a record low of 1.38%, resulting in an annual figure of 1.41%, operating assets such as loan receivables increased.

Non-interest income rose by 800 billion won to 7.3 trillion won. Gains related to securities increased by about 400 billion won due to falling interest rates, and foreign exchange and derivative-related gains also increased by 400 billion won due to exchange rate volatility.

Selling and administrative expenses rose 1.9% from 23.7 trillion won the previous year to 24.1 trillion won. While labor costs increased, material costs remained at a similar level to the previous year.

Reflecting the impact of COVID-19, provisions were expanded, causing credit costs to surge 88.7% from 3.7 trillion won the previous year to 7 trillion won.

Corporate tax expenses decreased by 13.5% from the previous year to 4.2 trillion won due to the decline in net income.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)