Increasing Burden of Non-Financial Social Value Items

Market-Type Public Enterprises Face 'Double Burden' of Financial Authority Disclosure Obligations

Quasi-Governmental Agencies and High-Order Volume Institutions Require 'IR Management Capability'

[Sejong=Asia Economy Reporter Moon Chaeseok] As the government plans to expand Environmental, Social, and Governance (ESG) disclosures for public institutions, the burden on these organizations is expected to increase. Measures such as support for workplace daycare centers and family care leave or sabbaticals may pose challenges, especially for small-scale public institutions. Public institutions are already facing low trust due to land speculation allegations involving Korea Land and Housing Corporation (LH), and now they are also required to comply with disclosure obligations.

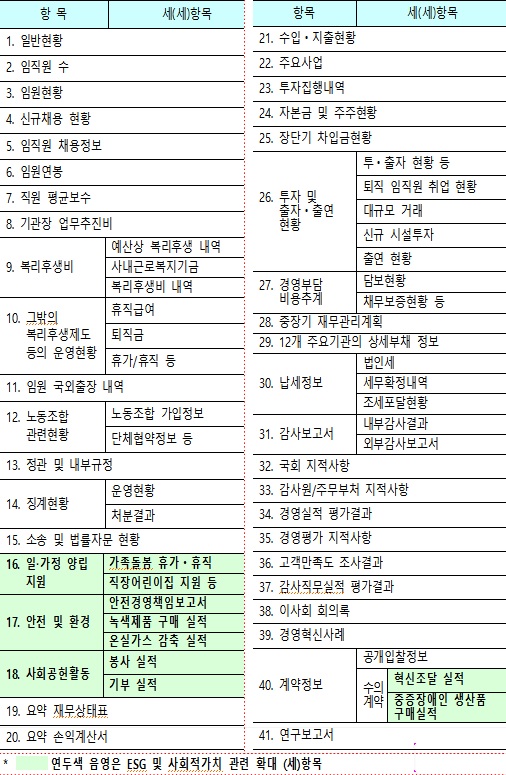

The Ministry of Economy and Finance announced on the 4th that it will expand ESG disclosure items for public institutions and apply them to the public institution management evaluation starting this July. New disclosure items include support for workplace daycare centers, family care leave and sabbaticals, safety management responsibility reports, green product purchase performance, volunteer and donation records, and information on negotiated contracts. A ministry official explained, "Implementing social value in public institutions is part of the national agenda, and there are also legislative proposals requesting the inclusion of social value items in disclosures."

Public institutions say that while they have been implementing national agenda items for some time, the introduction of disclosure obligations could create additional barriers. Some market-type public enterprises must comply simultaneously with obligations imposed by both financial authorities and the Ministry of Economy and Finance. They must disclose governance reports, which are mandatory for companies listed on KOSPI with assets exceeding 2 trillion won starting this year, along with the new items, to the financial market at once. Semi-governmental agencies, which previously had relatively fewer ESG disclosure obligations, and public institutions with large volumes of orders may face the burden of expanding their financial and investor relations (IR) departments.

An official from a public institution said, "We understand the authorities’ position that public institutions must fulfill their responsibilities to encourage diffusion to private organizations," but added, "For public institutions, this adds another layer of burden." He noted, "Especially for public institutions with large order volumes, disclosing negotiated contract innovation procurement performance could be burdensome," and predicted, "They will bear a similar burden to private KOSDAQ-listed companies that lack sufficient IR departments and must rely on proxy disclosure systems."

Another public institution official expressed concern, saying, "Due to the LH scandal, public institutions’ trust has plummeted, and we feel like we are walking on thin ice." He added, "In such circumstances, demands for non-financial factors will increase both internally and externally, and if the obligation to disclose social value is not fulfilled, the repercussions could be severe."

ESG experts in the financial investment industry say it is necessary to review whether the new disclosure items truly help strengthen institutional management. While adding evaluation criteria is the Ministry of Economy and Finance’s prerogative, to label something as 'ESG,' it must align with the original purpose of introducing ESG domestically. ESG was introduced to reform owner (major shareholder)-centric governance, prevent their arbitrary actions, increase environmental and social investments, and enhance credibility in financial markets. In other words, the true role of ESG indicators is to guide companies in reducing management risks.

Shin Jinyoung, director of the Corporate Governance Research Institute, emphasized, "Some public institution management evaluation items such as support for workplace daycare centers and green product purchases are ambiguous in terms of whether they should be called ESG." He added, "Especially for market-type public enterprises listed on the securities market, such as Korea Electric Power Corporation and Korea Gas Corporation, it is necessary to actively adopt and standardize ESG criteria used in the private sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)