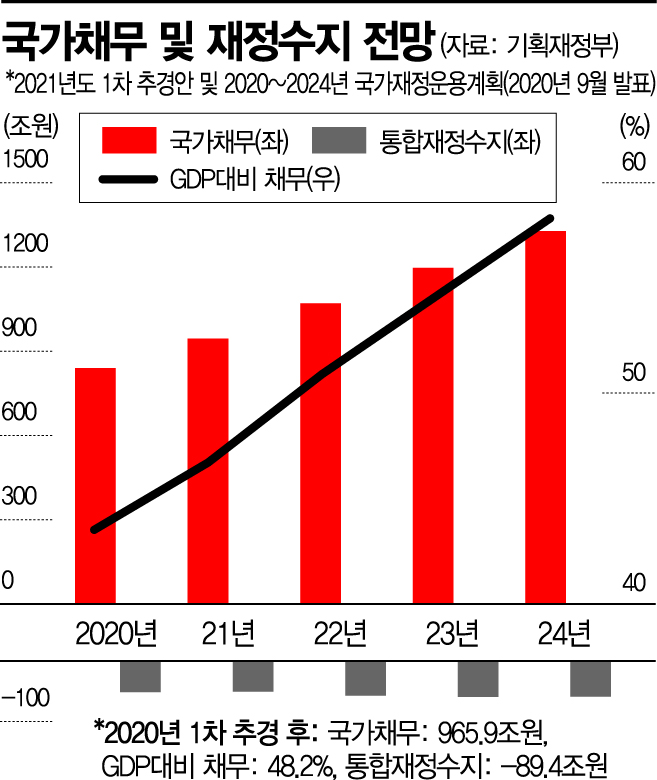

[Asia Economy Reporter Kim Eunbyeol] With the formation of the first supplementary budget (추경) bill this year, the national debt is set to increase by nearly 120 trillion won compared to last year. By 2024, the national debt is expected to increase by more than 125 trillion won annually, and the national debt-to-GDP ratio is projected to approach 60% in 2024.

According to the "Fiscal Total Effect and Management Plan of the National Fiscal Operation Plan" data submitted by the Ministry of Economy and Finance to the National Assembly along with the supplementary budget bill on the 7th, the national debt will rise to 965.9 trillion won with this year's supplementary budget. This is an increase of 119 trillion won from the 846.9 trillion won national debt based on last year's 4th supplementary budget. The national debt has already increased by nearly 120 trillion won due to the first quarter "Cherry Blossom Supplementary Budget," and if additional supplementary budgets are formed this year to respond to the COVID-19 crisis, the increase in national debt is expected to be even greater.

Furthermore, even after next year, when the COVID-19 crisis is expected to somewhat subside, the national debt is forecasted to continue increasing by about 120 to 130 trillion won annually. The Ministry of Economy and Finance projects next year's national debt to be 1,091.2 trillion won, an increase of 125.3 trillion won from this year. It estimates 1,217.1 trillion won in 2023, up 125.9 trillion won from the previous year, and 1,347.8 trillion won in 2024, up 130.7 trillion won from the previous year. If more than 34.1 trillion won in debt is incurred this year through additional supplementary budgets, the "era of 1,000 trillion won national debt" could arrive within this year.

The national debt-to-GDP ratio from 2021 to 2024 has also risen compared to initial projections. This year's national debt ratio is 48.2%, and it will surpass 50% next year, reaching 52.3%. It is expected to be 56.1% in 2023 and 59.7% in 2024, approaching 60%.

The national debt ratio of 60%, which has become an "implicit standard" for fiscal soundness, will materialize in three years. Earlier, the government announced a plan to introduce fiscal rules last year, stating that the national debt ratio would be managed within 60%, and the integrated fiscal balance would be maintained within -3% of GDP.

The national debt ratio first entered the 20% range in 2004 (22.4%), reached the 30% range in 2011 (30.3%), and surpassed 40% for the first time last year (43.9%). It reached the 50% range in 2022 (52.3%). It took nine years to move from the 30% to the 40% range, but only three years to move from the 40% to the 50% range. Since surpassing 60% is likely after 2025, it is expected that it may take only three years to move from the 50% to the 60% range.

Experts express concern that the current pace of debt increase could lead to a downgrade of the national credit rating, emphasizing the need for appropriate pace control and discussions on the introduction of fiscal rules.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.