Reflation Phase Favorable for Emerging Market Stocks

Dollar Weakness and Capital Flow Conditions Needed for Further Gains

On the 5th, dealers are working in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI index opened at 3036.16, down 7.33 points (0.24%) from the previous trading day, showing a downward trend. The won-dollar exchange rate opened at 1132.0 won, up 6.9 won. Photo by Moon Honam munonam@

On the 5th, dealers are working in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI index opened at 3036.16, down 7.33 points (0.24%) from the previous trading day, showing a downward trend. The won-dollar exchange rate opened at 1132.0 won, up 6.9 won. Photo by Moon Honam munonam@

[Asia Economy Reporter Minwoo Lee] Amid growing concerns about rising inflation and interest rates spreading worldwide, emerging market stocks showed somewhat favorable price trends. However, with the dollar's weakness being limited, the capacity for capital movement to emerging markets is not large, leading to analyses that it is insufficient for a sustained bullish trend.

On the 6th, KTB Investment & Securities analyzed that the current reflation environment (a state moving away from deflation but not reaching severe inflation) is favorable for emerging market stocks.

First, Hanjin Kim, a researcher at KTB Investment & Securities, analyzed that rising inflation and interest rates have a dual impact on the overall global stock market and regional stock price differentiation. Advanced markets, centered on growth stocks, may experience a full-scale correction due to the burden of rising interest rates, negatively affecting the global stock market as a whole. On the other hand, positive effects such as confidence gained from inflation and global economic expansion, capital movement spread, or dollar weakness and risk asset preference are also possible. The current stock market is described as a mixture of these two aspects.

Therefore, market reactions are expected to vary depending on the nature and speed of future inflation and interest rate increases. If interest rate rises are more influenced by asset inflation due to monetary expansion rather than economic factors, the global stock market is expected to continue showing sluggish responses. Even high-quality interest rate increases due to economic expansion can burden the stock market if the pace is too fast. Researcher Kim diagnosed, "The recent burden expressed by the global stock market regarding inflation and interest rate increases is because both factors are at play."

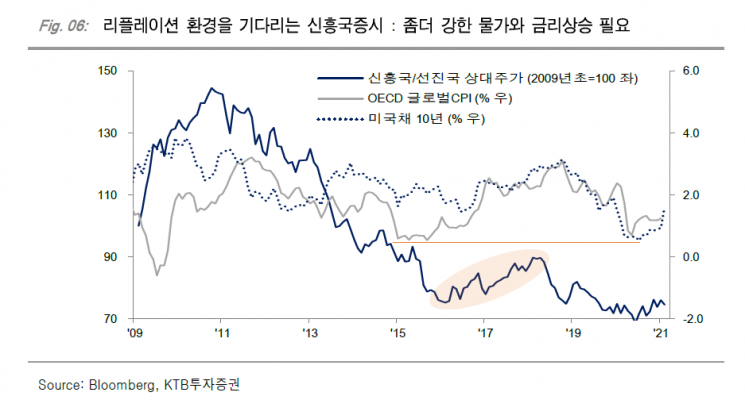

Meanwhile, this year, the global reflation situation has led to a clear reversal in emerging market stocks and prices of materials and industrial goods. Researcher Kim explained, "Especially since global inflation has returned to 2015 levels and interest rates are rising, this supports the strong reversal in emerging market stock prices," adding, "The relative strength fatigue of emerging and developed market stocks that appeared since last year is being supported by reflation."

He viewed that the fundamental environment is still favorable for emerging markets this month. Since deflation is expected to continue in the Eurozone (19 countries using the euro) in March, the euro is unlikely to strengthen significantly, nor is the dollar expected to reverse to a strong bullish trend. Therefore, from an exchange rate perspective, there is no reason for emerging market stocks to be at a disadvantage compared to developed markets.

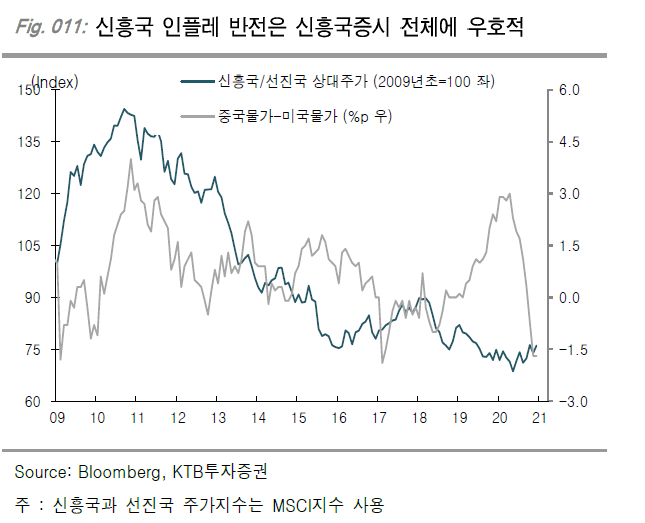

Additionally, China's economic momentum is expected to be better than that of the U.S. this month. Although the unusually sharp rise in oil prices affects producer prices and the underlying effect dominates, meaning inflation does not reflect normal economic conditions, key economic indicators such as consumption are also showing strength, suggesting that emerging market stocks are not relatively weak.

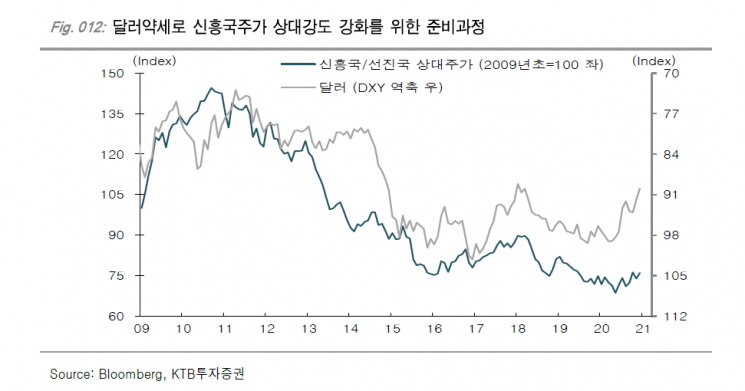

However, he added a caveat that conditions are necessary for emerging market stocks to not only hold steady but continue rising. The concerns about stock price stagnation due to rising interest rates must be dispelled, and dollar weakness (avoidance of safe-haven currency) due to inflation must accompany it. Researcher Kim stated, "If the relative economic gap between the U.S., Eurozone, emerging markets, and developed markets does not widen further, the extent of dollar weakness will not be significant, and the capacity for capital movement to emerging markets will also be limited," adding, "While it is true that sectors typical of emerging markets are not disadvantaged, the conditions are not sufficient to create a clearer and independent trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.