[Asia Economy Reporter Suyeon Woo] Recently, as the global semiconductor supply shortage intensifies, the dominance of South Korea and Taiwan's semiconductor industries is being reexamined worldwide. With the global dependence on semiconductors produced by the two countries deepening, voices calling for supply chain restructuring centered on the United States are also emerging.

On the 4th, Bloomberg reported an article titled "The Semiconductor Power of South Korea and Taiwan Shakes the US and China," focusing on the market influence of the two countries' semiconductor industries.

Bloomberg explained that as key industries requiring semiconductors for the 4th Industrial Revolution?such as 5G mobile communications, artificial intelligence (AI), and autonomous driving?develop, the industrial importance of semiconductors will further expand. It also reported that the recent semiconductor supply shortage has halted production lines of major global companies' automobiles, confirming the world's economic dependence on South Korea and Taiwan.

According to a report published in September by Boston Consulting Group and the Semiconductor Industry Association of the United States, Taiwan and South Korea ranked first and second in global semiconductor production capacity, accounting for 21.7% and 20.9%, respectively. China accounted for 14.7%, and the United States for 11.6%.

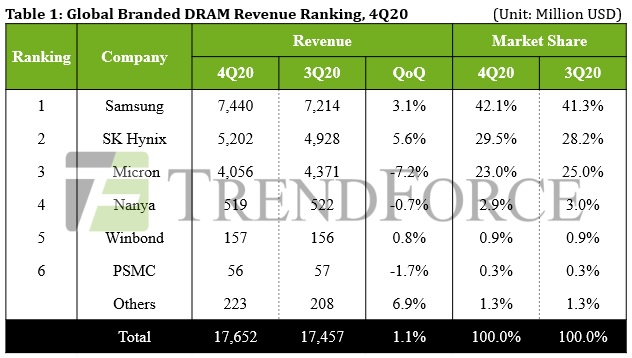

In particular, in the memory semiconductor sector, Samsung Electronics and SK Hynix's market share exceeded 70%. According to market research firm TrendForce, in the global DRAM market in the fourth quarter of last year, Samsung Electronics and SK Hynix's sales-based market share reached 71.6%.

Samsung Electronics recorded sales of $7.44 billion, a 3.1% increase from the previous quarter, capturing a 42.1% market share, while SK Hynix posted sales of $5.02 billion, up 5.6%, with a 29.5% market share.

Although the average selling price (ASP) of DRAM for Samsung Electronics and SK Hynix declined quarter-on-quarter, the shipment volume per bit increased, offsetting the sales decrease caused by the price drop. Taiwan's Micron, ranked third in the industry, saw its market share fall by 2% quarter-on-quarter due to a factory power outage at the end of last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.