[Asia Economy Reporter Yujin Cho] The U.S. Congressional Budget Office (CBO) has warned that the national debt will double the size of the Gross Domestic Product (GDP) within 30 years.

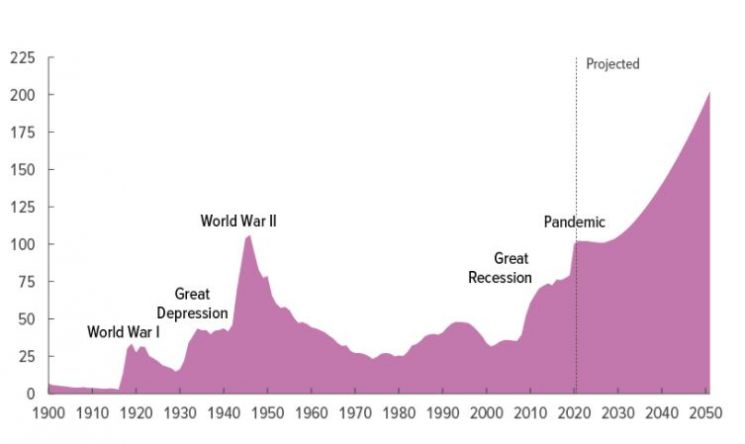

In its 2021 Long-Term Budget Outlook released on the 4th (local time), the CBO forecasted that "by the end of this year, the national debt will reach 102% of GDP," adding, "This will exceed 107% in 2031, reaching a historic high, and by 2051 it will reach 202%, double the level of this year."

The CBO viewed the debt increase trend by stating, "The fiscal deficit has remained below 4% of GDP for several years but will sharply increase after 2031 due to borrowing burdens growing faster than tax revenues and expanded spending on public health and other areas."

It continued, "The increasing fiscal deficit will push the national debt to historically high levels," diagnosing that "the national debt exceeding 100% of GDP is the first time since World War II and historically represents an excessively high debt level."

This estimate does not reflect President Joe Biden's $1.9 trillion (approximately 2,140 trillion won) COVID-19 relief package.

Due to the COVID-19 impact, as the government rapidly expands fiscal spending and economic activity contracts, tax revenues have decreased, causing the government's fiscal deficit to surge rapidly.

The CBO analyzed that by 2051, the U.S. fiscal deficit will reach about 13% of GDP.

The CBO also expressed concern that "the increase in debt will raise the risks of fiscal crisis and inflation."

Over the next 30 years, the U.S. economic growth rate is projected to be about 1.8% annually. This is an improvement from the 1.6% forecast made in September last year. The CBO said the upward revision in growth rate "means the impact of COVID-19 is less severe than expected."

From 1951 to 2020, the U.S. economic growth rate averaged about 3.1% annually.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.