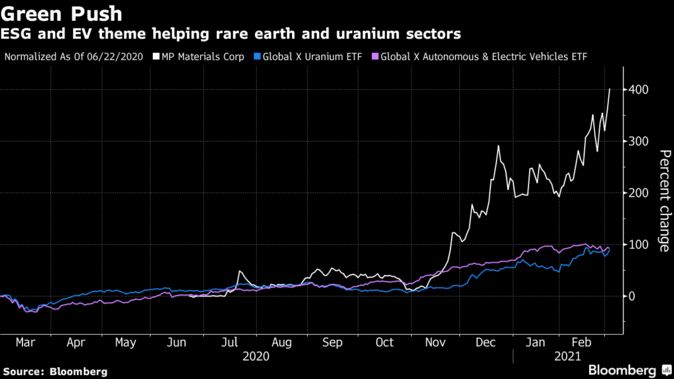

[Asia Economy Reporter Yujin Cho] Rare earth and uranium-related stocks are soaring in the U.S. stock market. This is interpreted as a result of investment sentiment being boosted by so-called 'ESG' investments focusing on environmental, social responsibility, and governance attributes, as well as expectations for the expansion of the electric vehicle market.

ESG and electric vehicle themes are fueling a surge in rare earth and uranium-related stocks. (Source: Bloomberg News)

ESG and electric vehicle themes are fueling a surge in rare earth and uranium-related stocks. (Source: Bloomberg News)

Bloomberg reported on the 3rd (local time) that the beneficiaries of electric vehicle and eco-friendly policy themes are shifting from lithium battery-related stocks to rare earth-related stocks. The stock price of MP Materials, the only rare earth company in the U.S., has risen more than fourfold in the past four months since President Biden's election.

MP Materials' stock closed at $45.82, a 289% (about 4 times) surge compared to the closing price of $11.79 on November 6 last year, just before President Biden's election victory.

The company entered the New York Stock Exchange last July through a merger with a Special Purpose Acquisition Company (SPAC) and attracted attention in the capital market by raising $554 million through its initial public offering (IPO).

The financial investment industry is raising its expectations for MP Materials. Morgan Stanley recently raised its target price for MP Materials to $57, which is 24% higher than the closing price of $45.82 on that day.

Morgan Stanley analyst Carlos de Alba explained, "Global automakers have declared that they will convert their entire vehicle lineups to electric vehicles, and as the share of wind power in power supply infrastructure increases, demand for related equipment is surging, which is boosting investment sentiment toward rare earth companies."

Rare earth elements are essential minerals used in various advanced technology fields, including electric vehicle and smartphone batteries, wind turbines, and missile guidance systems. China accounts for more than 80% of global production. The U.S. imports about 80% of its usage from China.

Recently, China announced export restrictions on rare earths, raising the possibility of a rare earth dispute between the U.S. and China, which also contributed to the stock price surge.

Uranium Exchange-Traded Funds (ETFs) are also on the rise. As uranium gains attention as a resource needed during the energy transition to renewable energy, the 'Global X Uranium ETF,' which holds uranium-related stocks worldwide, has risen 23% this year.

GJL Research analyst Gordon Johnson said, "Since the Fukushima nuclear accident in Japan in 2011, uranium supply and demand have been the tightest," adding, "As major countries increase the share of eco-friendly energy, investment funds focusing on uranium as a resource needed during the energy transition are increasing."

Uranium companies' stock prices began to surge from the end of last year. The U.S. House and Senate proposed a Department of Defense annual budget designating uranium, lithium, and other minerals important to national security, increasing the scale of strategic reserves to $150 million by September this year, which also boosted investor sentiment.

As of early this month, the long-term uranium contract price was concluded at $38.43, up 13.8% compared to the third quarter of last year, continuing the price increase trend.

Uranium mining companies Energy Fuels and Neo Performance Materials announced a partnership to jointly produce rare earths, after which their stock prices surged 50% and 35%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.