Korea Insurance Research Institute Report "Whole Life Insurance Guaranteed Fees 4.0~8.5%"

[Asia Economy Reporter Oh Hyung-gil] The fees charged by insurance companies to policyholders to guarantee the payment of insurance surrender refunds vary by company, with some charging more than twice as much as others.

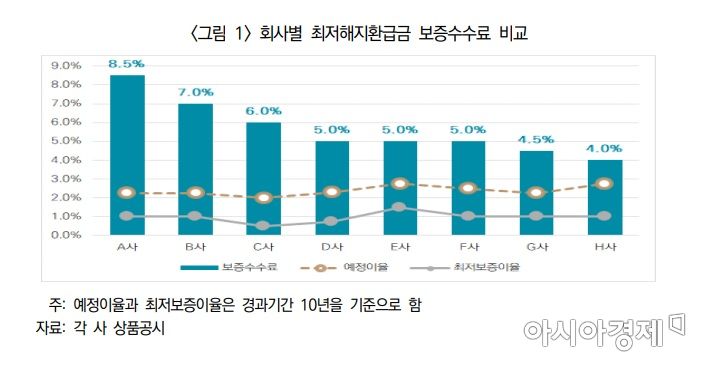

According to a report titled "Status and Implications of General Account Guarantee Reserves" recently released by the Korea Insurance Research Institute on the 3rd, the lowest surrender refund guarantee fees for whole life insurance products sold by eight major life insurance companies were found to be up to 8.5% of the premium (operating premium).

The insurance company charging the lowest guarantee fee relative to the premium payment amount charges only 4.0%, less than half of the highest rate.

The lowest surrender refund guarantee fee refers to the fee charged in exchange for guaranteeing the policyholder a surrender refund calculated using the guaranteed interest rate (expected interest rate) promised by the insurer at the time of contract, even if the interest rate applied to the accumulated premium of interest-linked protection insurance (the announced interest rate) falls short of the expected interest rate in an ultra-low interest rate environment.

Insurance companies collect the lowest surrender refund guarantee fees to build guarantee reserves. If financial market conditions such as interest rates improve and the guarantee reserves are ultimately not used, they revert to the insurer's profit.

From the policyholder's perspective, the guarantee fee is essentially the cost to properly receive the surrender refund. If the guarantee fee rate deducted from the premium payment is higher than that of other companies, assuming other additional costs are similar, the accumulated premium will decrease.

Since guarantee fees are set by each insurance company based on their respective risks and assumptions, there are differences between companies, with the highest rate exceeding twice the lowest rate, showing a significant gap.

The annual guarantee fee of Company A, which has the highest guarantee fee rate, exceeds the total monthly premium amount. Large life insurers with significant scale and brand power tend to have higher guarantee fees, while small and medium-sized life insurers tend to have relatively lower fees.

No Geon-yeop, a research fellow at the Korea Insurance Research Institute, said, "When comparing products with the same coverage amount, the expected interest rate and guarantee fee can be important criteria for consumers to compare insurance premium burdens," adding, "Although guarantee fees are disclosed along with expected interest rates in the Insurance Association's public disclosure room, it is not easy for general consumers to find and compare them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.