Do Gyu-sang, Vice Chairman of the Financial Services Commission, Holds Meeting on March 3 to Review Corporate Finance Status and Risk Factors

Financial Authorities Extend Maturity and Interest Payment Deferral Measures for SME and Small Business Loans

[Asia Economy Reporter Park Sun-mi] As small and medium-sized enterprises (SMEs) that increased their loan sizes in response to COVID-19 continue to express management instability, financial authorities are accelerating efforts to review the status and risks of corporate finance, alongside the banking sector's steps to align with these policy efforts.

According to financial authorities and the financial sector on the 2nd, Do Gyu-sang, Vice Chairman of the Financial Services Commission, will hold a meeting on the morning of the 3rd to review the status and risk factors of corporate finance and take measures to understand and respond to the situation of companies struggling due to the spread of COVID-19. The convening of this meeting by Vice Chairman Do coincides with the timing of loan maturity extensions and soft landing measures for small business owners and SMEs, and is being held amid concerns about economic uncertainty despite the expansion of SME loan volumes.

The banking sector is also taking various gestures to support small business owners and SMEs in line with the policy direction of the financial authorities. Woori Bank recently signed an agreement with Naver Financial, the financial subsidiary of Naver, to actively cooperate in developing digital convergence products combining finance and platform technology for small business support and providing platform financial services. KB Financial has significantly expanded its SME financial support products, and Hana Bank is focusing on efforts to expand support through collaboration with guarantee institutions.

A financial sector official explained, "With household loans restricted by regulatory measures and small business owners and SMEs still facing difficulties despite COVID-19 financial support, everyone is releasing related support measures to participate in the government's innovative SME promotion policy."

SME Loans Continue to Expand... "Concerns Over the Felt Impact of COVID-19 and Uncertainty Are Growing"

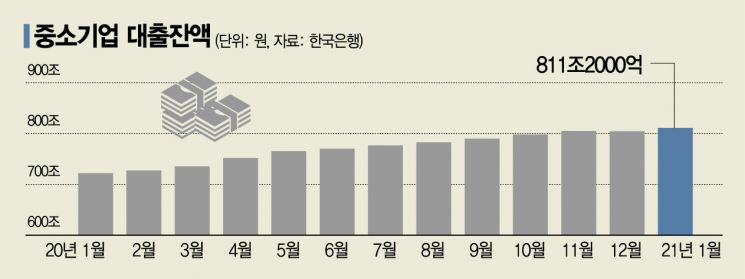

According to the Bank of Korea, as of the end of January, the outstanding SME loans amounted to 811.2 trillion won, an increase of 6.6% compared to the previous month. This is 1.2 percentage points higher than the 5.4% growth rate recorded in January last year.

The market expects the scale of SME loans to continue increasing for the time being. Although the number of small business owners and SMEs managing COVID-19 damages through loans has increased, concerns about the felt impact of COVID-19 and uncertainty remain high. The banking sector's focus on corporate finance to secure profitability amid tightened household loan regulations by financial authorities is also contributing to the expansion of SME loans.

Experts point out that comprehensive support measures considering SMEs' response strategies and policy demands need to be urgently prepared. This is because the perceived business conditions of SMEs and small business owners continue to deteriorate despite expanded COVID-19 support.

In fact, according to the Korea Federation of SMEs, the SBHI (Small Business Health Index), which shows the business performance of SMEs, recorded 65.9 in January, down 0.1 points from the previous month, and the BSI (Business Sentiment Index) for small business owners also dropped 15.8 points to 35.8. A survey conducted by the Korea Institute for Industrial Economics & Trade on 808 small export companies showed that about 91% of respondents reported a decrease in exports.

Most small export companies expect COVID-19 to continue for more than a year. This indicates a high risk of export market exit and employment reduction, especially among small-scale, vulnerable, and less competitive export companies. Song Young-chul, a research fellow at the Korea Institute for Industrial Economics & Trade, advised, "While preparing for the prolonged COVID-19 situation, it is necessary to find ways to effectively lead a clear export recovery for our SMEs in the future."

Financial Authorities Extend SME and Small Business Loan Maturity Extensions and Interest Payment Deferrals

Meanwhile, the financial authorities announced on the same day that they will extend the loan maturity extension and interest payment deferral measures for SMEs and small business owners by an additional six months until September this year. Even after the financial support program ends, a 'soft landing plan' has been prepared to reduce borrowers' burdens by allowing them to repay principal and interest over a long period. In reality, this is a '6 months + α' support that provides not only until the end of September but also the repayment period.

Kwon Dae-young, Director of the Financial Industry Bureau at the Financial Services Commission, explained, "Considering the impact of COVID-19 on the real economy and the opinions of the industrial and financial sectors comprehensively, we decided to extend the previous measures by six months until September. We also specified a 'soft landing plan for repayment-deferral loans' to prevent borrowers' repayment burdens from concentrating at the end of the deferral period."

As of the end of January, the total loan maturity extensions across all financial sectors amounted to 121 trillion won (371,000 cases), principal repayment deferrals to 9 trillion won (57,000 cases), and interest payment deferrals to 163.7 billion won (13,000 cases). Policy financial institutions such as the Korea Development Bank, Export-Import Bank of Korea, Industrial Bank of Korea, Korea Credit Guarantee Fund, and Korea Technology Finance Corporation will also implement loan maturity extensions and interest payment deferrals upon application for loans and guarantees of SMEs and small business owners maturing in September.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.