'Recent Financial Environment Changes and Capital Companies' Response Tasks' Report

[Asia Economy Reporter Ki Ha-young] In the post-COVID-19 era, capital companies need to improve their business practices to be consumer-centered and provide various digital services linked to real assets, according to advice given.

On the 1st, according to the Credit Finance Association, Lee Gyu-bok, Senior Research Fellow at the Korea Institute of Finance, recently stated in the Credit Finance Association's publication "Post-COVID-19 Era, Challenges and Development Directions for Credit Finance Companies" under the theme "Recent Changes in the Financial Environment and Tasks for Capital Companies."

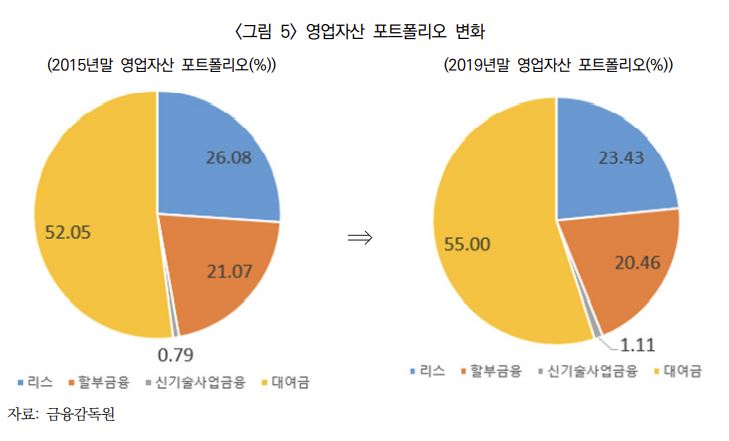

Senior Research Fellow Lee diagnosed the current situation of the capital industry, saying, "In an environment of low interest rates, low growth trends, and rapidly developing digital finance, competition within and between industries is intensifying, making it highly likely that the trend of consolidation and polarization within the financial industry will expand."

He added, "In this changing financial environment, capital companies need to improve their business practices for financial services to individuals and corporations to be consumer-centered, and secure stable growth opportunities through the expansion and advancement of digital financial services."

He said, "If capital companies move away from the traditional supplier-oriented business practices and form consumer-centered business practices such as the enactment of the Financial Consumer Protection Act, they can secure trust-based relationships with customers," adding, "Through this, it is expected that a stable profit base can be secured."

He also mentioned that capital companies providing financial services linked to real assets can enhance transaction efficiency by more precisely evaluating the residual value of real assets through big data analysis.

Senior Research Fellow Lee advised, "With the expansion of digital finance and the prolonged COVID-19 situation, online non-face-to-face sales platforms will become more active," and added, "Since capital companies can combine or link platforms for the sale or purchase of real assets in addition to financial products, it is necessary to prepare various online service provision plans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)