Powell, US Fed Chair, Reaffirms US Economic Stimulus Policy

Asian Stocks Fluctuate Amid Concerns Over Liquidity Withdrawal by People's Bank of China

Need to Boost Consumption and Decrease Supply-Side Liquidity... "Liquidity Withdrawal Scale Will Be Small"

[Asia Economy Reporter Minwoo Lee] There is an analysis suggesting the need to be cautious about increased stock market volatility due to liquidity withdrawal by the People's Bank of China. Although U.S. inflation and the risk of early tightening have disappeared following remarks by Jerome Powell, Chairman of the U.S. Federal Reserve (FED), the risk of tightening remains in China, where economic recovery and normalization of monetary policy could occur earlier than in the U.S. However, since the scale of China's COVID-19 response stimulus was weaker than during the global financial crisis and the direction of economic stimulus policies has not changed, the scale of liquidity withdrawal is expected to be smaller than before.

On the 28th, IBK Securities identified concerns over liquidity withdrawal by the People's Bank of China as the key factor behind recent fluctuations in the domestic stock market. Previously, the KOSPI fell 2.45% on the 24th compared to the previous day, breaking below the 3000 mark for the first time since January 7 this year. The next day, it rebounded 3.5% to reach 3099.69. Then on the 26th, it dropped again by 2.80% in a single day, closing as low as 2988.28 during intraday trading. This period coincided with Powell’s remarks on future policy directions before the U.S. Congress. He stated that the inflation concerns feared by the market were temporary due to base effects and that the current accommodative policy stance would be maintained until employment and other economic indicators recover to the Fed’s target levels. Although there was little difference in his speeches over two days, the domestic stock market showed the opposite trend.

This Week’s KOSPI Fluctuations Influenced More by the People's Bank of China than the U.S. Federal Reserve

Nevertheless, the reason for the reversal in stock market direction is attributed to tightening issues in China and Hong Kong. Soeun Ahn, a researcher at IBK Investment & Securities, explained, "Powell’s dovish remarks eased concerns about U.S. inflation and early Fed tightening, but tightening concerns continued in China (and Hong Kong). It is also realistically likely that China will begin monetary policy normalization earlier than the U.S. after recovering from the COVID-19 shock." Although the People's Bank of China officially stated that it is not switching to tightening like the Fed, the market remains cautious because liquidity withdrawal by the People's Bank has been confirmed, unlike the Fed.

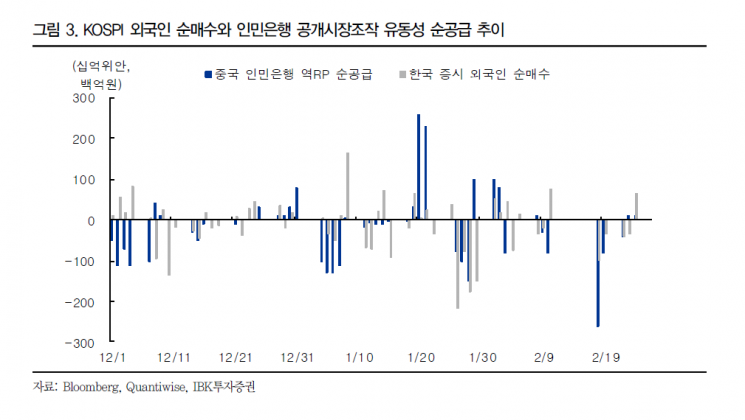

In fact, since last month, a high correlation has been observed between foreign capital inflows and outflows in the domestic stock market and the net liquidity supply through open market operations by the People's Bank of China. Researcher Ahn analyzed, "During the period when the People's Bank withdrew funds around the Chinese Lunar New Year holiday, foreign capital sharply exited the domestic stock market. Since the domestic export ratio dependent on Chinese demand has increased, the impact of demand contraction due to China’s tightening policies on the domestic economy and corporate profits has also grown."

Similar foreign capital flow trends appeared in other Asian countries highly dependent on China. In Vietnam, foreign net selling accelerated following concerns over China’s tightening. Conversely, in India, which has relatively lower dependence on China, foreign capital inflows continued regardless of China’s tightening. However, in India’s case, factors such as the easing of foreign stock regulations may have also played a role.

China’s Economic Recovery Still in Progress: "Liquidity Withdrawal Scale Will Be Smaller Than Before"

However, there is a forecast that although liquidity withdrawal by the People's Bank of China may increase volatility in the domestic stock market, it will not break the upward trend of the market. This is because the scale of liquidity withdrawal is likely to be small even if the People's Bank continues withdrawing liquidity.

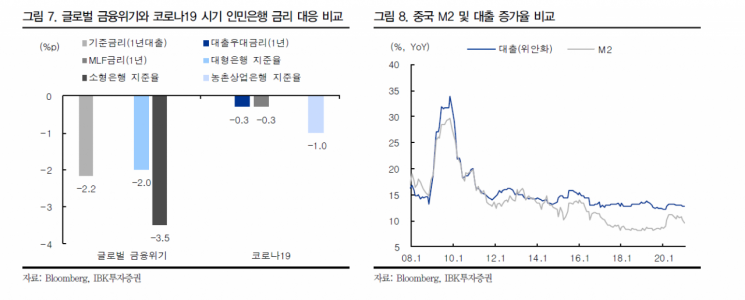

First, the scale of stimulus measures promoted by the People's Bank since last year in response to COVID-19 was not large. During the global financial crisis, large-scale stimulus caused asset price bubbles, so this time the People's Bank’s liquidity supply was selective and cautious. Policy interest rates were lowered for specific banks or support targets, and the rate cuts were not significant. The increase in market liquidity and loans was minimal. Since the scale of interest rate cuts or liquidity supply was not large, the amount to be withdrawn is also expected to be small.

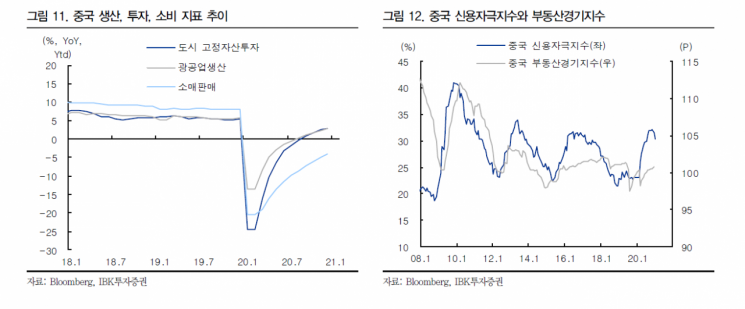

China’s economy has not overheated enough to warrant aggressive tightening. The period when the People's Bank seriously tightened through interest rate hikes in the past was when both consumer and producer prices rose more than 5% year-on-year. Researcher Ahn explained, "Although inflation rates have started to rise due to a rebound in raw material prices, demand-side inflationary pressure is still weak as it has just emerged from negative territory. Fixed investment and industrial production indicators have quickly recovered due to government policy implementation, direct spending, and resumption of production facilities, but retail sales, which depend heavily on the private sector, have yet to turn to an increasing trend compared to pre-COVID-19 levels."

Therefore, it is expected that China will not change its policy direction of economic stimulus. This stance is also anticipated to be reaffirmed at the upcoming Two Sessions (National People's Congress and Chinese People's Political Consultative Conference) scheduled for the 4th of next month. The announcement of consumption stimulation policies at local sessions ahead of the national Two Sessions supports this. Researcher Ahn diagnosed, "Recent liquidity supply adjustments by the People's Bank can also be seen as measures to stabilize household housing, which forms the basis of consumption. This is because real estate prices in some regions have recovered faster than household incomes to pre-COVID-19 levels, causing prices to rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.