Different Credit Ratings by Banks Despite Same Credit Score

"Credit Ratings Provided by Credit Rating Agencies Are for Reference Only"

[Asia Economy Reporter Park Sun-mi] Office worker Kim Geumyung (pseudonym), who received a personal credit score of 842 points from a credit rating company (CB), began comparing loan interest rates by bank to obtain a credit loan. At Bank A, a credit score of 940 points was required to qualify for credit grades 1 to 2 and secure a loan with an interest rate in the 2% range, but at Bank B, a score of 842 points was sufficient to qualify for grades 1 to 2. Mr. Kim chose Bank B, where he could get a loan with an interest rate in the 2% range despite the lower score.

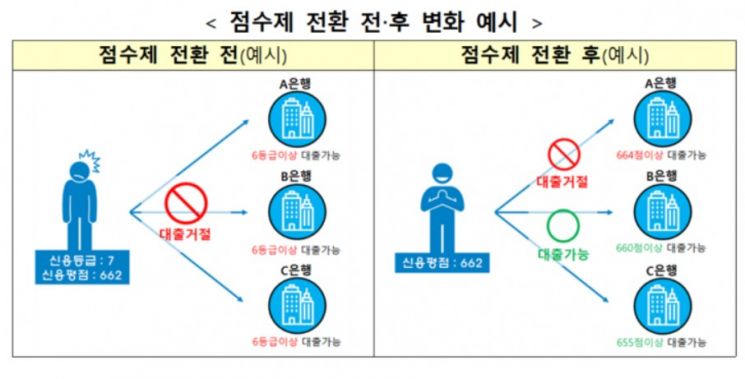

Starting this year, personal credit evaluations are conducted based on ‘scores’ rather than ‘grades,’ but it has been revealed that there are significant differences in how banks reflect evaluation scores. In the process of banks assigning their own credit grades, even with the same creditworthiness, differences in score application methods lead to large grade disparities, requiring consumers to carefully compare.

According to the ‘Interest Rate Status by Credit Grade for General Credit Loans’ disclosure by the Korea Federation of Banks on the 26th, each bank’s classification of internal credit grades based on personal credit scores provided by credit rating agencies differs. The average credit score of customers classified as internal credit grades 1 to 2 at KB Kookmin Bank is 940 points, whereas the average credit score for grades 1 to 2 customers at Woori Bank is 842 points. This means that customers classified as grades 3 to 4 at Kookmin Bank could be included in grades 1 to 2 at Woori Bank. Since loan interest rates vary by bank grade, the difference in grades is a significant consideration for consumers.

The Korea Federation of Banks, considering the change this year from the existing grade system to a score system ranging from 1 to 1000 points provided by credit rating agencies, provides both personal credit scores and bank-specific credit grades in the credit loan interest rate comparison disclosure. From the consumer’s perspective, this allows them to anticipate how their personal credit score is applied to each bank’s credit grade, helping them choose a bank.

Different Credit Grade Evaluation Methods by Bank

Credit Scores Are for Reference Only

Even for the same credit grades 1 to 2, the credit scores applied by each bank vary because banks do not solely reflect the personal credit scores provided by credit rating agencies when classifying their own credit grades, but also apply different factors according to each bank’s strategy.

Each bank applies different important factors when assessing a customer’s creditworthiness, so even with a somewhat lower credit score, a customer can be included in a higher grade. Before the introduction of the score system, only credit grades from 1 to 10 existed, and loans were uniformly rejected based on the grade. The credit grade system was pointed out as a cause of the loan ‘threshold effect.’

Woori Bank stated that rather than immediately adjusting the approximately 100-point difference in the average personal credit score of customers classified as credit grades 1 to 2 compared to other banks, it will observe the situation further before making a decision. A Woori Bank representative said, "Through the Korea Federation of Banks’ disclosure, it has become possible to compare personal credit score levels by credit grade ranges for each bank, but since the cutoff criteria for credit grades differ by bank, differences can certainly exist. If the difference becomes large, we will conduct an internal review, but since it is still the early stage of implementation, we plan to observe the situation before making a judgment."

An official from another bank advised, "While credit scores are an important criterion in loan screening, the credit scores provided by credit rating agencies are not an absolute factor but rather a reference level when internally dividing credit grades. From the consumer’s perspective, it is important to understand that credit scores are not an absolute standard that determines loan interest rates, and careful comparison by bank is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.