Cumulative Operating Yield 6.27%

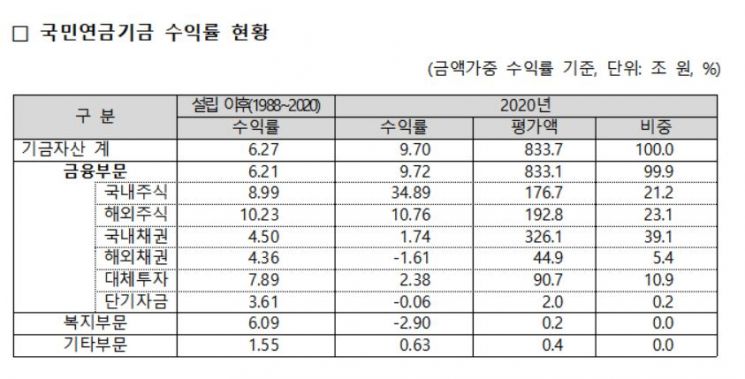

[Asia Economy Reporter Kim Ji-hee] The National Pension Service Fund Management Headquarters announced on the 25th that as of the end of last year, the National Pension Fund reserves increased by 97.1 trillion KRW compared to the end of the previous year, reaching 833.7 trillion KRW. Since the establishment of the National Pension Fund in 1988, the average annual cumulative rate of return has been 6.27%.

In particular, despite the COVID-19 pandemic, the overall annual fund return last year was 9.70%, with earnings of 72.1 trillion KRW. This amount is equivalent to twice the annual operating profit of Samsung Electronics, one of the top domestic listed companies by market capitalization.

Specifically, the National Pension recorded a 9.72% return in the financial sector alone last year. All asset classes, including domestic stocks (34.89%), overseas stocks (10.76%), and domestic and foreign bonds, outperformed their benchmark (BM) returns. Amid significant declines in domestic and international stock markets due to the impact of COVID-19, the Fund Management Headquarters quickly implemented tactical asset allocation adjustments, which led to the overall increase in fund returns.

In bonds, not only did asset valuation gains increase due to the global low-interest-rate environment, but favorable performance was also achieved thanks to sector and stock selection effects aligned with benchmark changes. However, for overseas investment assets, foreign currency translation losses occurred due to the depreciation of the KRW against the USD, resulting in a lower KRW-based operating return compared to the foreign currency-denominated return.

Regarding alternative investments, despite significant constraints in discovering new investment destinations, approximately 23 trillion KRW worth of new commitments were made overseas. This outcome is attributed to actively pursuing the expansion of investment scale, discovery of new investment targets, and diversification of detailed strategies and investment regions through joint investments and strengthened strategic partnerships with major overseas institutional investors such as the Dutch pension fund (APG) and Allianz.

Meanwhile, the final performance evaluation of the National Pension Fund management will be confirmed by the Fund Management Committee at the end of June after review by the Risk Management and Performance Compensation Expert Committee.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.