Increased Demand for Digital Finance in Banking Sector Drives Active Outsourcing of Platforms and Services

[Asia Economy Reporter Park Sun-mi] Despite fierce competition in digital finance, banks largely rely on outsourcing for building smart banking applications (apps) and MyData services. Given the nature of banks lacking in-house IT development capabilities, dependence on fintech companies with technical expertise is inevitable. However, since a few fintech firms dominate the market, it has become difficult to expect significant differences between banks’ MyData service platforms, following the trend seen with smart banking apps.

According to the financial sector on the 24th, major domestic banks are in the process of selecting service providers or conducting audits after selection to build MyData service platforms, which are still in the early stages of market entry. KB Kookmin Bank announced a request for proposals to build a MyData service platform aiming to launch the service before August, and plans to select a provider by receiving applications until the 2nd of next month.

Applicant companies must submit proposals that include all necessary hardware and software for platform construction, development work details and construction plans, differentiated requirements and opening plans compared to competitors, quality management plans, and measures for fault response, recovery, and security. The bank then selects a provider through evaluation. Separately, KB Kookmin Bank is also accepting proposals until today to select an external advisory firm for building the ‘Number One Corporate Finance Platform.’

Other banks are in similar situations. Industrial Bank of Korea (IBK), preparing to apply for preliminary approval for the MyData business next month, is currently building the MyData service ‘Personal Financial Management (PFM) service’ targeting an August launch. This project was also awarded to a fintech company providing a finance-dedicated platform through an Original Equipment Manufacturer (OEM) bidding process.

IBK plans to select an auditor to oversee the fintech company responsible for service construction by the 8th of next month. The issue is that orders are concentrated on a few fintech companies, raising the possibility that banks’ MyData services will unfold similarly across banks, just like smart banking apps.

Many Domestic Banks Partner with Fingertip...

Building Services Reflecting Bank-Specific Requirements via OEM Method

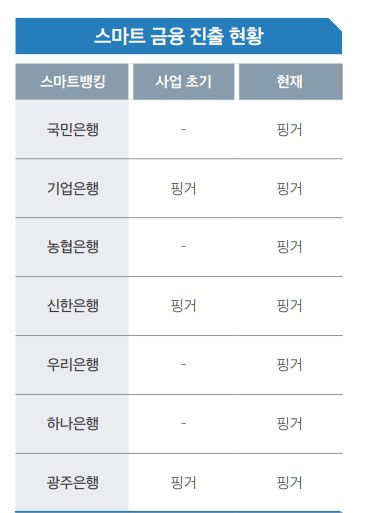

Currently, many smart banking apps in the domestic banking sector have been developed by the fintech company ‘Fingertip.’ Holding the largest number of smart banking references in the financial sector, Fingertip’s operating profit margin surged from 3.3% in 2017 to 9.1% in 2019 due to increased demand for digital finance from banks. As of the third quarter of last year, cumulative performance showed sales of 42.3 billion KRW and operating profit of 2.8 billion KRW, increasing by 13.1% and 25.8% year-on-year, respectively.

A Fingertip representative explained, "You can say that we developed most of the banks’ smart banking apps. We create them according to the banks’ requirements, but recently, with the introduction of the MyData business, the market scope has expanded."

A bank official said, "The reason why there hasn’t been much differentiation in smart finance between banks is that the IT system formats are similar and the banking tasks are fixed, leaving little room for differentiation. Even with the MyData platform, although initially implemented in different formats, since the system developers are limited, there is a possibility that platforms will become similar through comparison and improvement among banks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.