BOK 'Funds for Crisis Preparedness'... Concerns Over Public Tax Burden if Reserve Funds Are Insufficient

Ruling Party Strongly Pressures, Saying "It Is Not Right to Prepare Only for a Non-Existent Financial Crisis"

[Asia Economy Reporter Kim Eunbyeol] As political circles, led by the ruling party, propose reducing the Bank of Korea's (BOK) reserve funds to use for COVID-19 support, the BOK finds itself in a difficult position. Although it is true that the BOK's net income has recently increased, allowing some leeway in reserve funds, these reserves are literally 'money set aside for crisis situations.' When a crisis hits and the central bank incurs losses, the accumulated reserve funds cover the shortfall. However, if the reserves are insufficient and deficits continue, not only will the BOK's external credibility decline, but the public's tax burden could also increase. In particular, the BOK is concerned about its limited capacity to respond to sudden foreign exchange and financial market crises.

According to the BOK on the 24th, the BOK's net income for 2020 was approximately KRW 7.4 trillion after tax, an increase of about KRW 2.1 trillion compared to 2019. The low interest rate environment last year and increased gains from foreign securities trading contributed to the growth in net income.

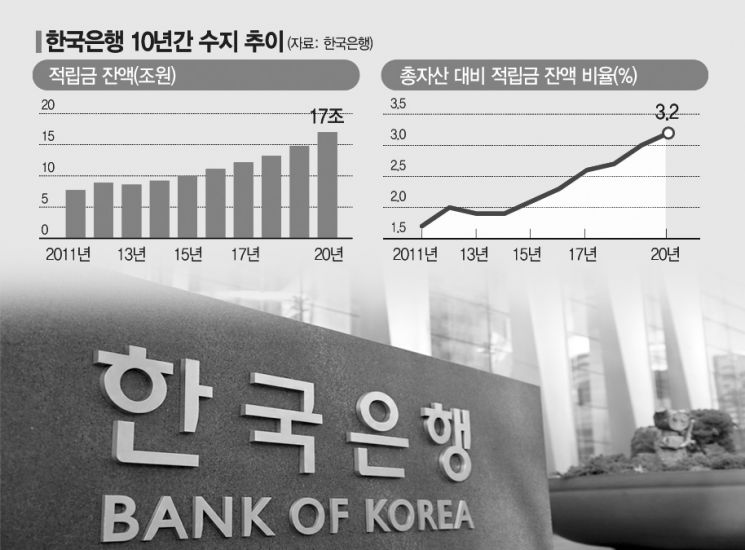

Under the Bank of Korea Act, the BOK is required to allocate 30% of its net income to statutory reserve funds. If about 30% (KRW 2.2 trillion) of last year's KRW 7.4 trillion is set aside, the cumulative reserve funds will total KRW 17 trillion. This accounts for about 3.2% of the BOK's total assets. Although the ratio of reserve funds to total assets has steadily increased from about 1.7% in 2011, the BOK's internal assessment considers around 5% of total assets to be an appropriate level. As a small open economy, Korea experiences significant exchange rate fluctuations, and with foreign exchange reserves at a record high of USD 440 billion, losses can vary greatly depending on exchange rates. In such cases, the BOK's deficit could reach several trillion won. In fact, economies with similar structures such as Hong Kong (21%), Australia (16%), and Taiwan (7%) also maintain high reserve fund ratios relative to total assets.

However, ruling party lawmakers are pressuring the BOK, arguing that "it is not right for the BOK to accumulate reserve funds in preparation for a financial crisis that does not exist." During a recent work report, Go Eung-jin, a member of the Democratic Party of Korea, criticized Governor Lee Ju-yeol, saying, "Stability is important, but I want to raise the question of whether the reserve fund ratio really needs to be increased to 5%." Lawmaker Go suggested, "Since the BOK's net income has significantly increased, it might be possible to consider temporarily reducing the reserve funds for about three years." He personally believes that "if the BOK reserves only about 10% of total assets, it would be sufficient, and doing so could reduce the public tax burden by more than KRW 1 trillion."

Yang Kyung-sook, also from the Democratic Party, raised her voice, saying, "Honestly, there is no immediate risk of a fiscal or financial crisis, is there? I think lowering the reserve fund ratio until the COVID-19 situation subsides would strengthen the BOK's role and earn recognition." In response, Governor Lee stated, "In the past, when reserve funds were depleted, the BOK's credibility and monetary policy were constrained, which is why the ratio was increased." He added, "If the international financial market is shaken and large-scale deficits occur, the public's tax burden will actually increase." After the financial crisis, in 2011, the BOK raised the statutory reserve fund ratio from 10% to 30% of net income.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.