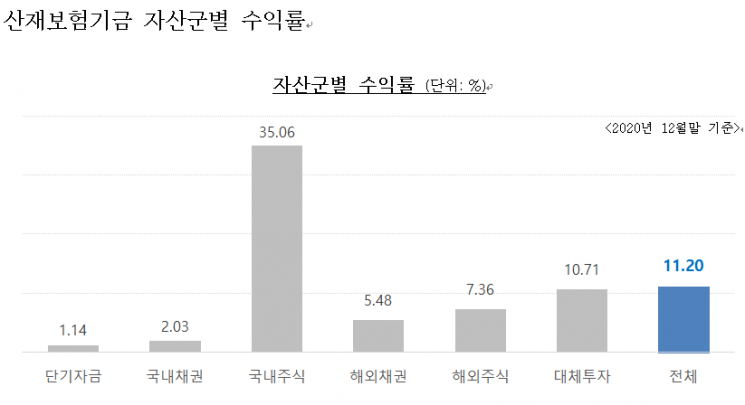

[Asia Economy Reporter Minji Lee] Samsung Asset Management announced on the 23rd that the 2020 investment return of the Industrial Accident Compensation Insurance Fund, with assets under management of approximately KRW 22 trillion, achieved 11.20%. This performance exceeded the benchmark return (BM) by 0.92% and the target return by 7.73%, with strong results in domestic and international equities and alternative investments significantly contributing to the achievement of the target.

The Industrial Accident Compensation Insurance and Prevention Fund (Industrial Accident Insurance Fund) is a fund established to secure resources for compensating workers for occupational injuries and related insurance projects, managed by the Ministry of Employment and Labor.

Samsung Asset Management stated, “Despite the extreme volatility in financial markets caused by the global spread of COVID-19 and the resulting economic recession last year, it is remarkable that we simultaneously achieved both risk management and exceeding the target return in the fund management sector, where stable operation is absolutely crucial.”

This achievement was driven by a customized asset allocation strategy considering the characteristics of the fund. The Ministry of Employment and Labor and Samsung Asset Management continuously diversified sources of returns by incorporating global asset classes and expanding alternative investments in the portfolio, and significantly increased returns by promptly responding to rapidly changing market conditions through active tactical asset allocation and style allocation strategies.

Additionally, the close collaboration system between the Ministry of Employment and Labor and the lead asset manager had a positive impact. Under the supervision of the Ministry of Employment and Labor, committees for ‘Asset Management,’ ‘Risk Management,’ and ‘Performance Evaluation’ were operated, establishing a decision-making system linking the ‘Committee ? Ministry of Employment and Labor ? Lead Asset Manager,’ which led to systematic and efficient management.

Samsung Asset Management’s OCIO operation expertise also enhanced the efficiency of fund management. Samsung Asset Management has been selected as the lead asset manager for the Pension Fund Investment Pool five consecutive times, in addition to managing the Industrial Accident Insurance Fund, and provides OCIO services to private funds (Seoul National University Development Fund, Ewha Womans University Fund), earning a reputation as a leader in the domestic OCIO market.

Cho Seong-seop, Head of the Industrial Accident Insurance Fund Business Division at Samsung Asset Management, said, “This year’s asset management direction aims to establish a sustainable management system to ensure the smooth execution of the Industrial Accident Insurance Fund’s purpose as a social safety net, continue portfolio diversification, and expand the proportion of global asset classes and alternative assets. Through this mid- to long-term asset management direction, we will make every effort to generate stable and sustainable returns.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)