Sharp Rise in Commodity Prices like Oil and Copper

Individuals Actively Invest Expecting Price Decline

[Asia Economy Reporter Minji Lee] As expectations grow for economic activity to recover following the COVID-19 pandemic, raw material prices are showing a sharp upward trend. Market concerns about inflation are driving up raw material prices, but individual investors are betting that a downturn may come as asset prices have risen rapidly.

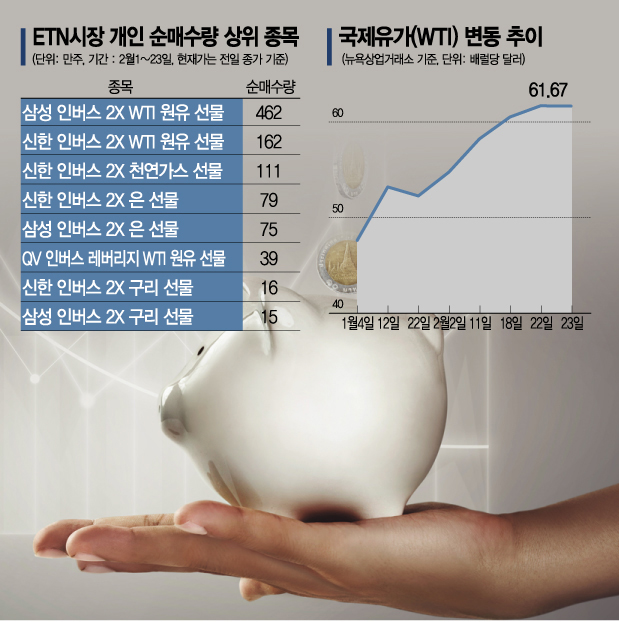

◆Raw materials surge...individuals betting on a decline= According to the Korea Exchange on the 24th, among exchange-traded notes (ETNs) with active raw material product trading up to the previous day this month, the most actively traded product by individuals was the ‘Samsung Inverse 2X WTI Crude Oil Futures ETN.’ In terms of net purchase volume, it was the highest at 4,628,504 shares (3.3 billion KRW). The rapid approach of international oil prices to the ‘60-dollar’ mark led individuals to anticipate a price decline and engage in trading accordingly.

During the same period, all of the top 10 most actively traded products were ‘inverse’ type products that invest expecting a price decline in underlying assets such as international oil prices, silver, and copper. Most were ‘double inverse’ products that seek twice the profit corresponding to the decline in the underlying asset. While concerns about inflation are increasing and demand to hedge (risk diversification) supports price rises, individual investors continue to bet on a decline.

Contrary to individual forecasts, international oil prices and industrial metals have recently surged. This is due to growing expectations for economic recovery as major countries implemented large-scale stimulus measures to curb the spread of COVID-19 and vaccination programs began. On the 23rd (local time), West Texas Intermediate (WTI) for April delivery traded at $61.67 per barrel on the New York Mercantile Exchange. At the beginning of this month, prices hovered around $52 per barrel, and some opinions suggested it would be difficult to surpass $60 per barrel, but the outlook reversed in less than a month. The unusual cold wave in Texas, USA, which temporarily halted oil production facilities, also contributed to the temporary price increase.

Copper, used as a leading indicator of economic activity, recorded a closing price of $9,158 per ton on the London Metal Exchange (LME) on the 23rd (local time), marking the highest level since the COVID-19 outbreak. Surpassing $9,000 per ton, it reached the highest price in nine years (since 2012). Recently, demand has surged significantly due to increased infrastructure investment centered on China.

◆Oil and raw material price forecasts revised upward= In the securities industry, price targets for international oil and raw materials have already been raised above previous estimates. This is based on the judgment that demand for raw materials will increase not only in supply but also across major and emerging countries.

Samsung Securities has raised its international oil price forecast to $50?65. Researcher Jonghyun Jin of Samsung Securities explained, "Demand recovery for oil is progressing faster than expected, especially in emerging Asia where COVID-19 related lockdowns are less severe," adding, "From the second half of the year, trend-based economic recovery centered on developed countries will begin, supporting oil demand recovery." Although OPEC+ (an alliance of 13 OPEC member countries and 10 major oil-producing countries including Russia) production control will be key due to Saudi Arabia’s production increase plans, it is expected that the pace of production increase will be moderated, so oil prices are unlikely to deviate significantly from the $60 per barrel level."

There are also forecasts that copper prices could rise to the all-time high level of $10,500 per ton. Researcher Byungjin Hwang of NH Investment & Securities said, "With high expectations for stockpiling by China, the largest consumer, inventories at the Shanghai Futures Exchange are below 200,000 tons compared to last year," adding, "Considering the decline in smelting fees and the potential for demand growth centered on renewable energy in developed countries, prices could soar to historic highs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.