"Don't Fear Interest Rates... It's Just Excessive Concern" Analysis

Portfolio Adjustment Needed Toward Cyclical Stocks Rather Than Growth Stocks

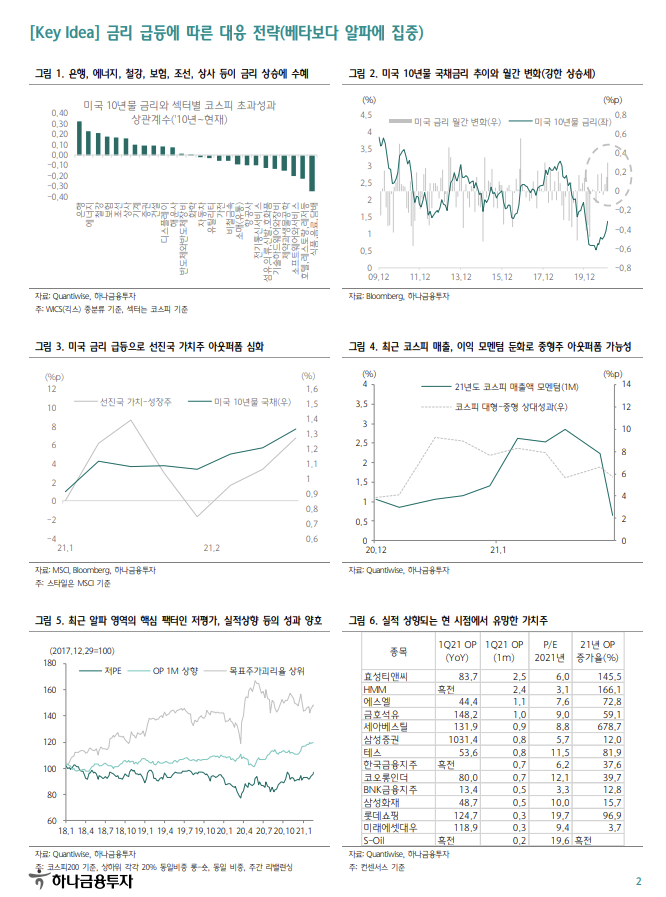

Reflation-Related Stocks Promising "Focus on Undervalued Earnings Upgrade Stocks"

On the 24th, when the KOSPI index showed a flat trend in the early session, the KOSPI was displayed on the electronic board at the Hana Bank dealing room in Euljiro, Seoul. Photo by Moon Honam munonam@

On the 24th, when the KOSPI index showed a flat trend in the early session, the KOSPI was displayed on the electronic board at the Hana Bank dealing room in Euljiro, Seoul. Photo by Moon Honam munonam@

[Asia Economy Reporter Lee Seon-ae] The domestic stock market continues to trade within a range as it is hindered by the rise in the U.S. 10-year Treasury yield. While the prevailing view is that the bull market will not be broken, a correction phase is inevitable for the time being due to high sensitivity to interest rates. As observations emerge that the global economy has entered a reflation phase (a stage where the economy escapes deflation but monetary expansion does not cause severe inflation), the domestic stock market is likely to join the reflation trade, making investment strategies targeting beneficiary sectors and stocks effective.

On the 24th, the KOSPI index opened at 3,075.58, up 0.49 points (0.02%) from the previous day, but soon turned downward, continuing the range-bound market and showing a slowdown in upward momentum. The previous session closed at 3,070.09, down 9.66 points (0.31%). Notably, growth stocks that had led the market all fell simultaneously, while cyclical stocks rose. Battery-related stocks such as LG Chem (-3.38%) and Samsung SDI (-3.92%), and biotech stocks like Celltrion (-4.36%) and Samsung Biologics (-2.56%) showed weakness, whereas Hyundai Heavy Industries Holdings (+7.29%) and Lotte Chemical (+7.95%) showed strength. This was a direct result of the rise in the U.S. 10-year Treasury yield.

The Korean stock market reacts more sensitively to U.S. Treasury yields than to domestic government bond yields because of the interplay with foreign investor flows. Although rising interest rates exert downward pressure on the stock market, the upward trend is expected to remain intact as the economic recovery trend continues, according to the general consensus in the securities industry.

Park Sang-hyun, a researcher at Hi Investment & Securities, said, "Concerns about rising interest rates are emerging, but since 1990, there has been only one instance where stock prices fell during a phase of rising U.S. 10-year Treasury yields when looking at stock prices and economic indicators. Given the strong economic stimulus and expanded vaccine distribution, there is a high possibility of a strong rebound in the global economy, including the U.S. Although interest rates may rise faster than expected, solid economic fundamentals are expected to absorb much of the shock from rising rates."

Lee Jae-sun, a researcher at Hana Financial Investment, also said, "The rise in long-term yields reflects the global economic recovery cycle and is not something to fear. Considering that during the rate tantrums in June 2013 and December 2015, KOSPI operating profit estimates and foreign buying recovered within about four months, there is a high possibility of improved foreign investor-driven demand going forward."

Lee Sang-min, a researcher at Kakao Pay Securities, said, "The market's focus is on interest rates and inflation, but I believe inflation will not damage the market, and the current rise in interest rates is a natural flow due to economic recovery." He added, "While the rise in interest rates may pose some disadvantages to growth stocks with high valuations, it is more likely to act as a narrowing of the gap between value stocks and growth stocks."

The securities industry unanimously agreed that during the range-bound market, it is necessary to adjust portfolios toward cyclical stocks rather than growth stocks. Seo Jeong-hoon, a researcher at Samsung Securities, said, "If additional U.S. stimulus measures are certain and the trend of rising commodity prices remains firm, the domestic stock market is likely to join the reflation trade by increasing the proportion of cyclical stocks rather than technology or growth stocks."

KB Securities also suggested reflation-related stocks as an investment strategy. Lee Eun-taek, a researcher at KB Securities, advised, "If short-term tightening is a concern, defensive stocks (telecommunications, utilities) are a better choice, but since that is not the case now, reflation-related stocks (rotating within software) seem to be a better choice." Recommended stocks included S-Oil, Lotte Chemical, Daehan Petrochemical, Poongsan, and POSCO.

Hana Financial Investment analyzed that since 2010, observing the sensitivity of U.S. interest rates and domestic sector stock prices, sectors such as banks, energy (refining), steel, insurance, shipbuilding, trading companies, machinery, securities, construction, display, shipping, semiconductors, and chemicals have outperformed the market during periods of rising interest rates. Lee Kyung-soo, a researcher at Hana Financial Investment, said, "Since interest rates have moved sharply for the time being, rotation flows into inflation beneficiary sectors and stocks are also likely to proceed strongly. Considering that stocks with strong earnings momentum have significantly outperformed, stocks that show undervaluation while earnings are upgraded are promising." Recommended stocks included Hyosung TNC, HMM, SL, Kumho Petrochemical, SeAH Besteel, Samsung Securities, TES, Korea Financial Group, Kolon Industries, BNK Financial Group, Samsung Fire & Marine Insurance, Lotte Shopping, Mirae Asset Daewoo, S-Oil, Doosan Infracore, SM, Hana Materials, Handsome, Yeonwoo, Wonik QnC, F&F, and Incross.

Shinhan Financial Investment also emphasized the need to adopt an 'earnings market' investment strategy. Park Seok-jung, a researcher at Shinhan Financial Investment, said, "Rather than being trapped by the fear that the stock market is entering a major 'correction phase' due to rising interest rates, I want to emphasize the need for a change in investment strategy as we enter an 'earnings market.' We are currently approaching the peak of the earnings market, and typically, during periods when corporate earnings improve alongside rising interest rates and prices, an increased allocation to cyclical stocks should be recommended." However, he noted that growth stocks still lead the contribution to earnings growth this year. Park said, "It is essential to distinguish between growth stocks. Expanding the allocation to semiconductors, eco-friendly energy, media, and entertainment sectors that drive earnings growth is effective, and among cyclical stocks, I prefer themes expanded beyond traditional categories such as travel, leisure, banking, insurance, energy, and industrials."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.