Lee Ju-yeol, Governor of the Bank of Korea, Attends National Assembly Planning and Finance Committee Meeting

"Bitcoin Has No Intrinsic Value... Will Show High Price Volatility"

Yellen, U.S. Treasury Secretary: "Bitcoin Is an Extremely Inefficient Means for Transactions"

"Highly Speculative Asset with Extremely High Volatility"

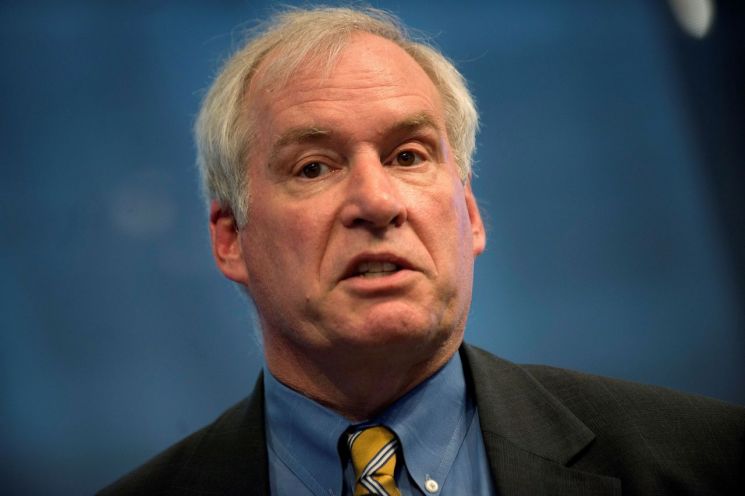

Bank of Korea Governor Lee Ju-yeol is responding to questions at the Strategy and Finance Committee plenary session held at the National Assembly on the 23rd.

Bank of Korea Governor Lee Ju-yeol is responding to questions at the Strategy and Finance Committee plenary session held at the National Assembly on the 23rd. [Image source=Yonhap News]

[Asia Economy Reporter Eunbyeol Kim] Lee Ju-yeol, Governor of the Bank of Korea, stated on the 23rd that "crypto assets (virtual currencies) inherently have no intrinsic value" and "their price volatility will remain high in the future." This aligns with the uncomfortable views expressed by U.S. Treasury Secretary Janet Yellen and senior officials of the U.S. Federal Reserve (Fed) regarding the rapid surge in Bitcoin prices.

On the 23rd, during the plenary session of the National Assembly's Planning and Finance Committee, in response to a question from Yang Hyang-ja, a member of the Democratic Party of Korea, asking "Is the rise in virtual currencies such as Bitcoin temporary?" Lee said, "The rapid rise in Bitcoin prices was influenced by a combination of factors including its use as an inflation hedge, Tesla CEO Elon Musk's acceptance of Bitcoin as a payment method and large-scale purchases, and the launch of Bitcoin trading brokerage services by some financial institutions."

He added, "It is difficult to comment on the value level of Bitcoin assets themselves, but they are assets that inherently have no intrinsic value," and "They are expected to exhibit high price volatility."

Bitcoin, the leading virtual currency, surpassed $50,000 per coin for the first time ever on the 16th, and its market capitalization exceeded $1 trillion (approximately 1,100 trillion KRW). In domestic trading, it exceeded 65 million KRW per coin on the 20th. The price surged after CEO Musk announced the acceptance of Bitcoin as a payment method and made large purchases, and global financial institutions also contributed to the price surge by buying large amounts of Bitcoin. Following the rapid price increase, CEO Musk posted messages on social media stating that the price was excessively high, which led to an intraday price drop of as much as 17%.

Regarding this, on the 22nd (local time), U.S. Treasury Secretary Yellen said at the New York Times (NYT) hosted 'DealBook Conference' that "she does not believe Bitcoin will be widely used as a transaction mechanism." She added, "There is concern that it is often used for illegal finance," and pointed out, "Bitcoin is an extremely inefficient means for conducting transactions, and the amount of energy consumed in the transaction process is unbelievable."

She also emphasized, "I think people need to know that Bitcoin is a highly speculative asset and extremely volatile." The Bank of Korea also holds the view that Bitcoin cannot be considered currency. To have legal status as currency, it must be issued by the central bank, i.e., the Bank of Korea.

On the 19th, Eric Rosengren, President of the Boston Federal Reserve Bank, also said in an interview with the NYT, "Personally, I am amazed that Bitcoin prices continue to rise as they do now," and "This continued rally will eventually have to end." Rosengren said, "There is no evidence anywhere in the world that Bitcoin can be used for a long time," and "Eventually, central banks of each country will present alternative options that can replace Bitcoin."

He argued that if central bank digital currencies (CBDCs) are issued by countries, digital currencies with legal status will be issued one after another, and there will be little reason to use Bitcoin for payments except in the underground economy. Rosengren added, "Because of this, Bitcoin prices will face downward pressure over time," and revealed that the Boston Fed is also studying the possibility of issuing digital currency in the U.S.

Eric Rosengren, President of the Federal Reserve Bank of Boston, USA [Image source=Reuters Yonhap News]

Eric Rosengren, President of the Federal Reserve Bank of Boston, USA [Image source=Reuters Yonhap News]

On the same day, Secretary Yellen also expressed the opinion that "it is reasonable for central banks to directly issue digital currency" as an alternative to Bitcoin, indicating that the U.S. could issue a CBDC. This marks a step forward from Fed Chair Jerome Powell's previously cautious stance on CBDC issuance.

The Bank of Korea has been preparing since last year by starting CBDC research and establishing a dedicated organization. The Bank of Korea plans to complete external consulting on CBDC by next month and begin pilot testing in the second half of the year. The Bank of Korea will complete consulting related to CBDC by the end of next month and build a pilot system within the year. In the second half, it will test whether the payment system works properly when using CBDC in a virtual environment. It will also review the impact of usage and the transmission of monetary policy effects.

Governor Lee said in a business report, "The review of CBDC design and technology is almost complete," and "Testing in a virtual environment is scheduled to be conducted within this year, proceeding as planned." However, he added, "There does not seem to be a great need to issue it in a short time, but since new payment methods are emerging and the payment environment is rapidly changing, we are preparing quickly."

The Bank of Korea has settled on issuing a CBDC using a distributed ledger method based on blockchain technology. Distributed ledger technology stores ledgers in multiple locations using blockchain technology, which has the advantage of increased anonymity. To be attractive as digital currency, it is preferable to have characteristics similar to cash, but if the central bank centrally manages all transactions, information accumulates in one place and anonymity decreases. For this reason, most central banks except China prefer issuing distributed ledger CBDCs.

Initially, central banks worldwide, including the Bank of Korea, did not feel concerned despite the growing scale of virtual asset investments like Bitcoin. The turning point for central banks' urgency came in 2019 when Facebook launched the virtual asset 'Libra.' Unlike existing virtual assets such as Bitcoin, Libra is a 'stablecoin' that can be exchanged at a fixed rate with fiat currency issued by central banks. For example, 1 Libra can be exchanged for 1 dollar. This threatens the central banks' exclusive right to issue currency. This is why central banks accelerated CBDC research. The significant decline in cash usage such as banknotes and coins due to COVID-19 also accelerated CBDC research.

The Bank of Korea is also promoting the establishment of financial sector standards for decentralized identifiers (Decentralized Identifier, DID) to activate digital identity verification that can safely and easily confirm identity during non-face-to-face (untact) financial transactions. A Bank of Korea official said, "We will closely examine the impact of CBDC issuance on monetary policy, financial stability, and issuance operations, and actively participate in related international discussions," adding, "We will also analyze how the spread of private virtual assets affects payment and settlement and seek countermeasures."

◇Terminology Explanation

◆Central Bank Digital Currency (CBDC) = A digital form of fiat currency issued by a central bank. It can be stored in electronic wallets such as smartphones and held similarly to actual banknotes or coins.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)