[Asia Economy Reporter Ji Yeon-jin] As the number of 5th generation mobile communication (5G) subscribers has recently surged sharply, telecom stocks are gaining attention again. Expectations for investment recovery in 5G have grown this year, and with dividends also expanding, there is hope that stock prices will rise. Telecom stocks had long been overlooked despite high expectations as beneficiaries of the COVID-19 untact trend and the 5G rally.

According to the securities industry on the 23rd, the net increase in 5G subscribers among the three major domestic telecom companies plummeted to 290,000 in January last year but rose to 800,000 in August of the same year, followed by net increases of 950,000 and 920,000 in November and December, respectively. At the end of last year, the number of domestic 5G subscribers was 11.85 million, and it is expected to increase by 15 million this year to reach 27 million.

This year, it is forecasted that 5G subscribers will increase by 1 million per month in the first half and by 1.5 million per month from the second half. This is because most new mobile phone devices are 5G-enabled, and if 5G devices supporting the 28GHz band are released, the expectation for 5G commercialization will increase the preference for purchasing 5G phones. The increase in 5G subscribers can lead to a rise in the average revenue per user (ARPU) for telecom companies. It is expected that telecom companies' revenue will increase as subscribers of low-cost 3G and 4G plans move to 5G.

In particular, the full-scale entry into the 5G era enhances the attractiveness of telecom stocks because the revenue that telecom companies can newly generate is limitless. The government has eased regulations by preparing guidelines that recognize exceptions for 5G core technologies applied to some convergence services such as autonomous vehicles, and 5G is emerging as a key infrastructure for IoT in the market. Not only telecom companies but also network equipment manufacturers, device and IT component companies, and automobile and machine tool companies are adopting 5G SA (Standalone Mode), which evolves into IoT. At this year's Consumer Electronics Show (CES) in the U.S., IoT, smart cities, and digital healthcare based on 5G technology were prominently featured. Analyst Kim Heung-sik of Hana Investment & Securities said, "There are still many investors who do not recognize telecom stocks as 5G-related stocks, but with the increase in mobile phone revenue, telecom stocks will eventually recover the returns on 5G investments, leading to stock price increases."

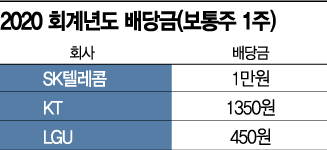

Dividend expansion is also cited as a factor encouraging investment in telecom stocks. SK Telecom's dividend last year was 10,000 won (including an interim dividend of 1,000 won), unchanged from the previous year, but KT and LG Uplus increased theirs by 22% and 13%, respectively. Thanks to this dividend expansion effect, KT's closing price on the 22nd rose 9.45% compared to the beginning of the year. SK Telecom and LG Uplus rose by 4.64% and 3.38%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)